Mobileye Global Inc. (NASDAQ:MBLY) reported in-lien earnings for its fiscal fourth-quarter on Thursday.

The firm reported a 9% year-on-year decline in quarterly revenue to $446.000 million, beating the analyst consensus estimate of $432.329 million.

EyeQ volumes declined 11% in the quarter due to demand-supply imbalances, leading to tighter-than-normal inventory levels at its Tier 1 customers exiting 2025. Adjusted EPS of 6 cents was in line with the analyst consensus estimate.

Mobileye CEO Prof. Amnon Shashua said the company aims to lead in Physical AI across both autonomous vehicles and humanoid robotics, and said the automotive roadmap positions the company to benefit from growing demand for cost-efficient, single-ECU hands-free systems in high-volume vehicles, as well as self-driving technology for commercial robotaxi services.

Mobileye expects fiscal 2026 revenue of $1.90 billion-$1.98 billion versus the $1.881 billion analyst consensus estimate.

Mobileye shares fell 5.4% to trade at $9.94 on Friday.

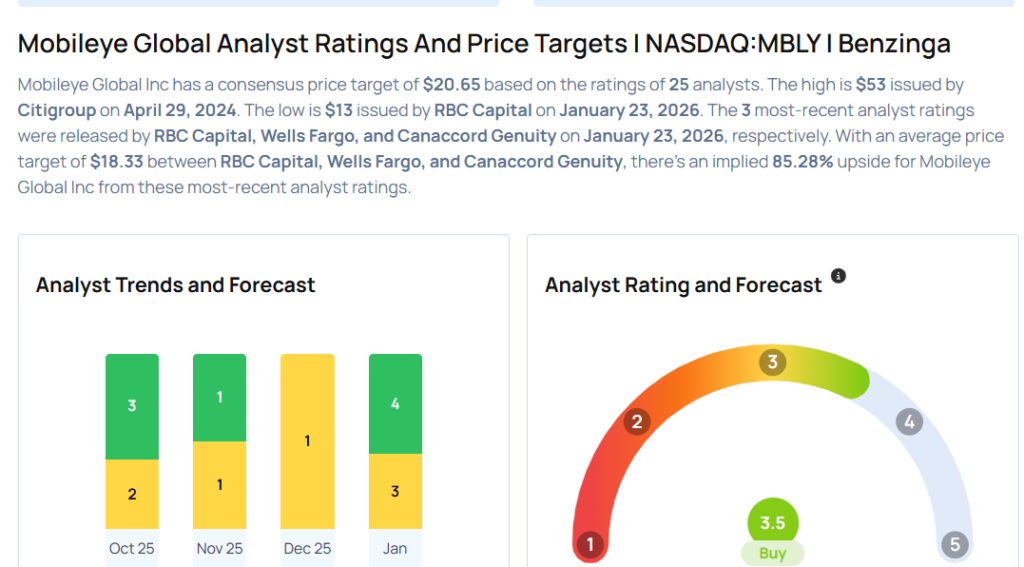

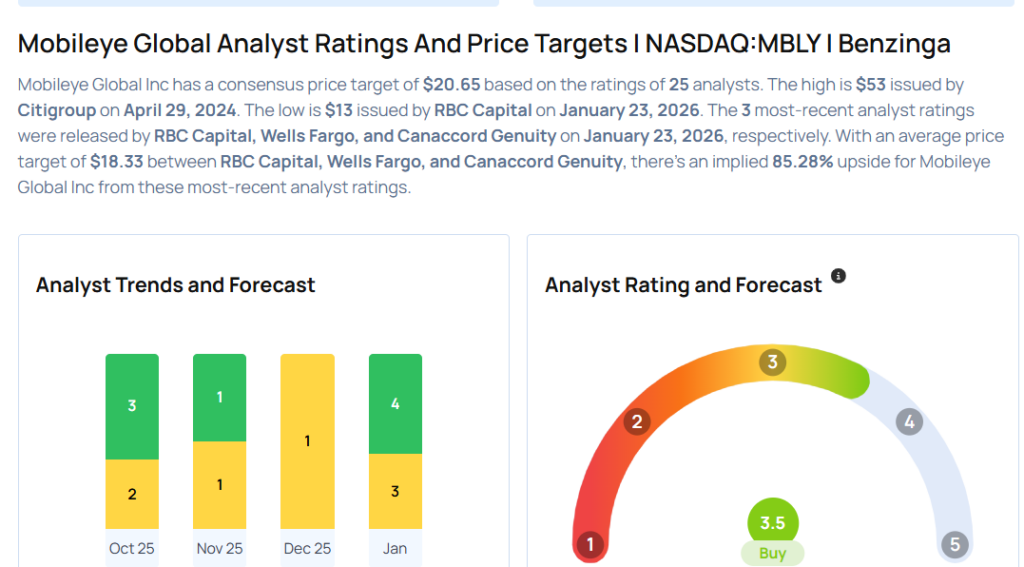

These analysts made changes to their price targets on Mobileye following earnings announcement.

- Needham analyst N. Quinn Bolton maintained Mobileye Global with a Buy and lowered the price target from $18 to $16.

- Canaccord Genuity analyst George Gianarikas maintained the stock with a Buy and lowered the price target from $30 to $24.

- RBC Capital analyst Tom Narayan maintained Mobileye Global with a Sector Perform and lowered the price target from $14 to $13.

Considering buying MBLY stock? Here’s what analysts think:

Photo via Shutterstock

Recent Comments