Procter & Gamble Company (NYSE:PG) posted mixed quarterly results on Thursday.

The company reported second-quarter adjusted earnings per share of $1.88, beating the analyst consensus estimate of $1.86. Quarterly sales of $22.208 billion missed the Street view of $22.282 billion.

Procter & Gamble CFO Andre Schulten said the company expects sales to rebound over the next six months after what he described as the “softest quarter of the year,” Bloomberg reported.

Procter & Gamble reaffirmed its fiscal 2026 adjusted EPS guidance of $6.83 to $7.09, compared with the $6.97 consensus estimate, and maintained its fiscal 2026 sales outlook of $85.127 billion to $88.498 billion, versus the $86.823 billion estimate. The company cut its fiscal 2026 GAAP earnings forecast, lowering its EPS outlook to $6.58 to $6.90 from a prior range of $6.71 to $7.09, below the $6.91 consensus estimate.

Procter & Gamble shares gained 0.9% to trade at $150.16 on Friday.

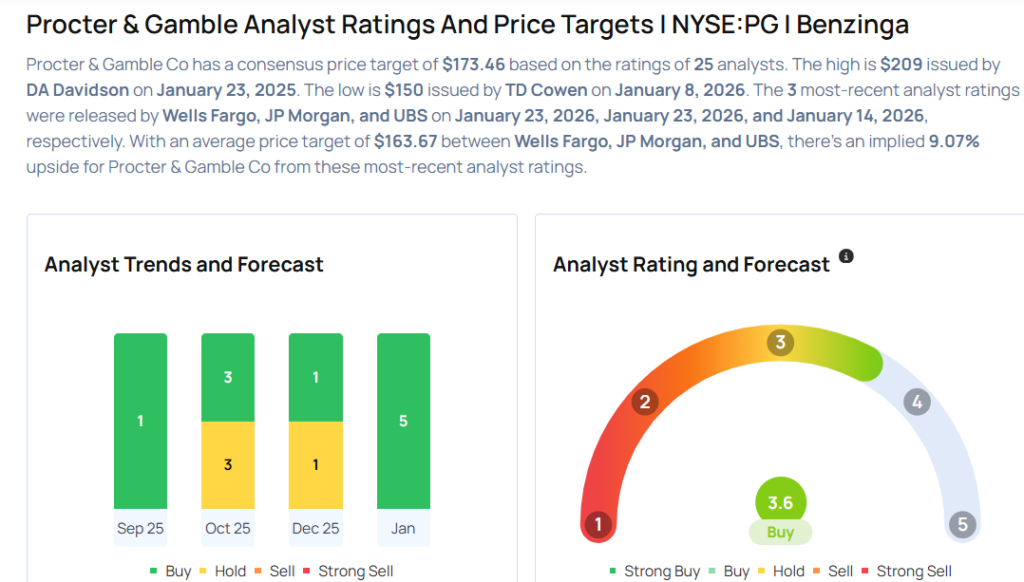

These analysts made changes to their price targets on Procter & Gamble following earnings announcement.

- JP Morgan analyst Andrea Teixeira upgraded Procter & Gamble from Neutral to Overweight and raised the price target from $157 to $165.

- Wells Fargo analyst Chris Carey maintained Procter & Gamble with an Overweight rating and raised the price target from $158 to $165.

Considering buying PG stock? Here’s what analysts think:

Photo via Shutterstock

Recent Comments