Natural gas prices are heading toward a historic weekly surge as expectations for blockbuster heating demand collide with an exceptional cold wave gripping much of the U.S. in the latter part of the week.

- UNG ETF has rallied sharply this week. Check live prices here.

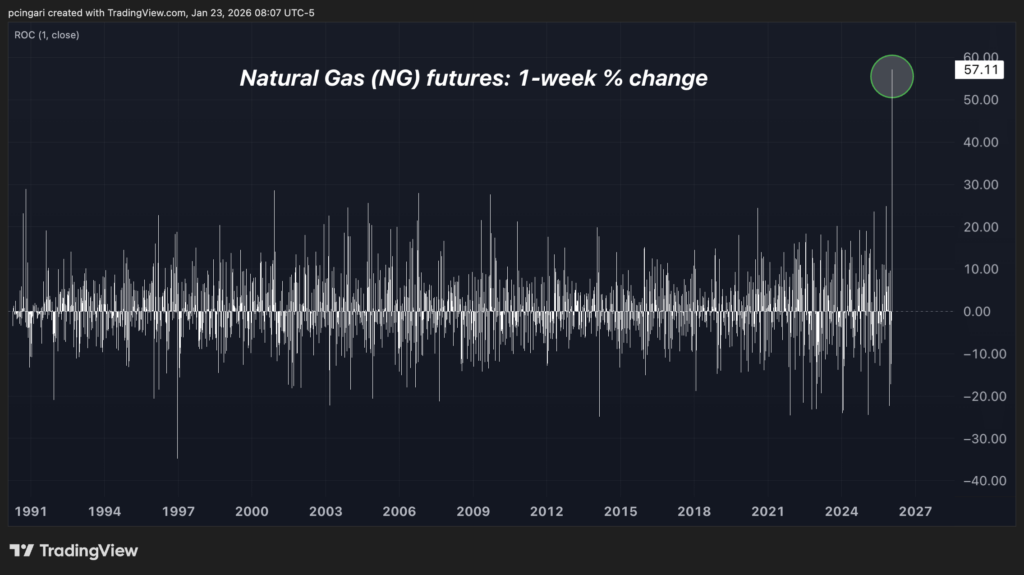

Futures at the Henry Hub facility surged past $5 per MMBtu on Friday, putting prices up roughly 60% for the week — the largest weekly gain on record since natural gas began trading in 1990. The move comes as forecasters warn that dangerously cold air, heavy snow and crippling ice could strain energy systems nationwide.

“Record cold wave expected to hit 40 States. Rarely seen anything like it before,” President Donald Trump said Friday. While campaigning for the 2024 presidential election, Trump pledged to cut U.S. energy prices in half within a year if elected.

The National Weather Service issued a series of warnings highlighting the severity of the unfolding storm. Forecasts call for heavy snow across the Central and Southern Plains into the Ohio Valley, with snowfall totals exceeding 12 inches across parts of the Mid-Atlantic and Northeast.

“Catastrophic ice accumulation” is expected from the Southern Plains through the Southeast, raising the risk of long-duration power outages and dangerous travel conditions.

Chart: Natural Gas Futures Eye Biggest Weekly Increase On Record

In a note shared Friday, Goldman Sachs commodity analyst Samantha Dart outlined two major balance risks now driving the market.

The first is near-term deliverability risk, as production outages from freeze-offs could emerge precisely as heating demand peaks, potentially leaving the system temporarily short of gas.

Adding to near-term concerns, Wood Mackenzie estimates production disruptions could peak near 15 billion cubic feet per day on Jan. 26 due to freeze-offs.

That tightening could be exacerbated by roughly 16 Bcf/d of incremental heating demand on the coldest day of the forecast, compared with expectations from just a week earlier.

“We estimate that near-term deliverability risks are meaningful, even taking into account mitigating factors like gas-to-coal switching and the re-sale of gas by liquefaction facilities back to the grid,” Dart wrote.

The second is a storage-path risk, where elevated winter demand draws inventories lower, increasing vulnerability to tightening shocks heading into the 2026–27 winter.

“We think this would ultimately be a temporary physical imbalance, likely to be reflected in very high cash prices during the tightening shock,” the expert added.

Looking beyond the immediate storm, Goldman said storage risks could require natural gas prices to remain in the $3.50 to $4.00 per MMBtu range to curb power-sector demand and incentivize additional supply.

Natural Gas Intelligence recently noted that while the latest Energy Information Administration’s storage report showed a relatively lean draw, traders appeared more focused on the potential for record-setting withdrawals in the weeks ahead as the extreme cold expands across the nation.

Natural Gas Stocks Rally

Equities tied to U.S. natural gas production are on track for robust weekly gains as prices surge. Antero Resources (NYSE:AR) is up roughly 9% on the week, while EQT Corporation has climbed about 10.5%.

Within midstream players shares of ONEOK Inc. (NYSE:OKE) and Kinder Morgan Inc (NYSE:KMI) are both up 6%.

Image: Shutterstock

Recent Comments