The Iranian protests against the country’s Islamist regime have erupted into the deadliest anti-government unrest since 1979, exposing a widening split between Europe and the US over how to respond.

Europe’s dependence on oil imports has constrained its policy to impose harsher penalties against Iran, leaving Brussels with fewer policy levers than Washington. The Trump administration has considered Iran as part of a bigger geopolitical competition that aims to weaken China’s influence by choking off its access to Iranian oil.

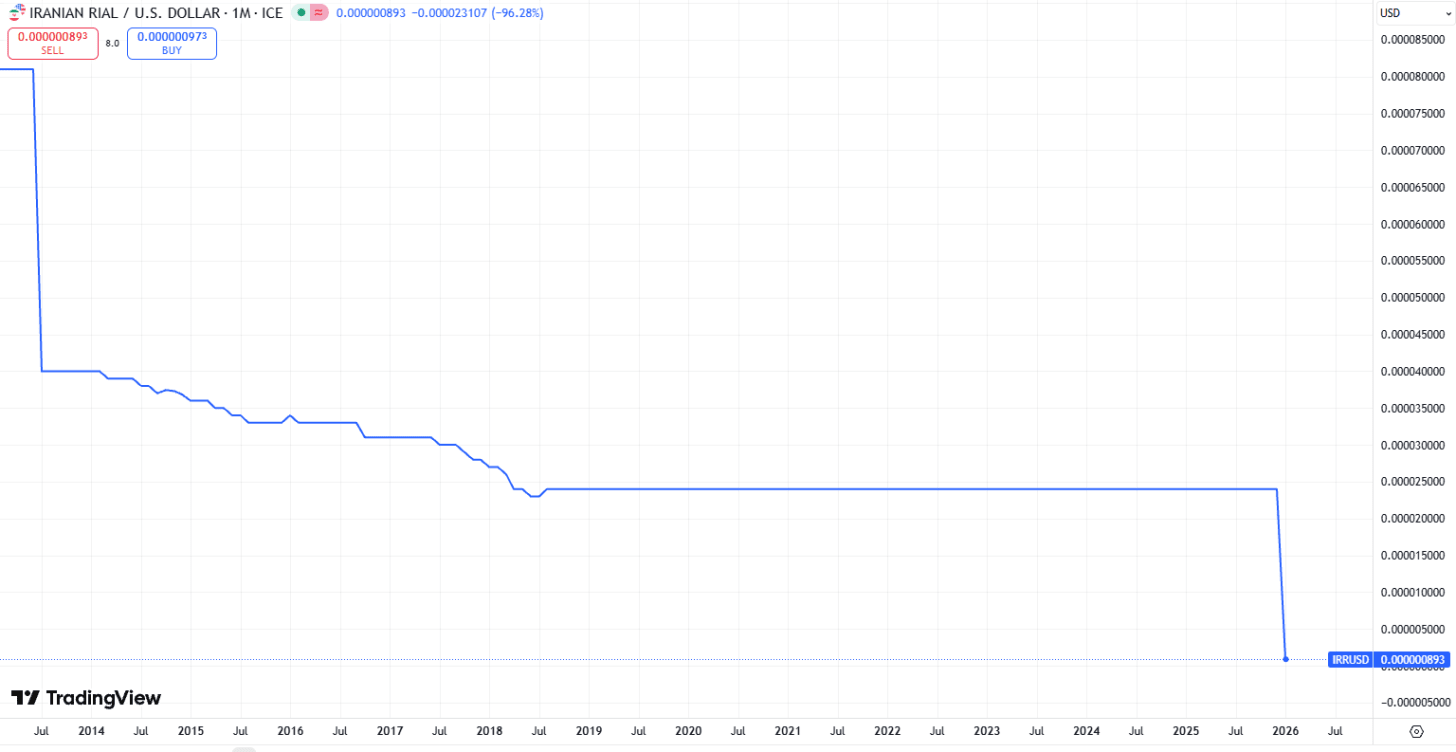

Iranian leader Ayatollah Ali Khamenei’s government launched a deadly crackdown against the protesters who took to the streets after the Iranian rial plummeted by more than 96% against the dollar in the last month. The unrest has become the biggest threat to the Islamic Republic since it seized power in 1979.

The government has killed more than 12,000 individuals since December 28, when the protests started, according to CBS News. Iranian officials say only 5,000 deaths have been verified, Reuters said on January 19.

The Iranian government has said that protesters, whom it labeled ‘rioters, organizers and leaders of anti‑security movements,’ would be targeted ‘without leniency.’

Escalation in Iranian Unrest Could Have Global Implications

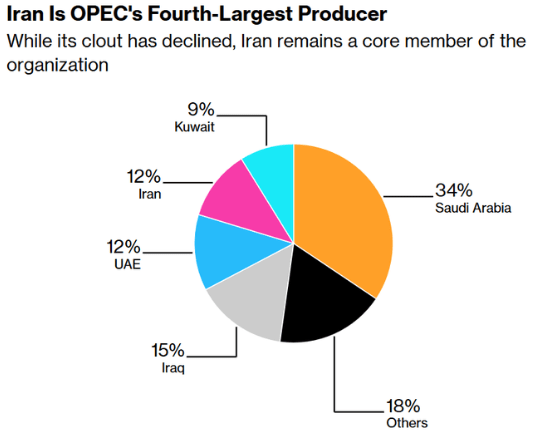

An escalation in unrest in Iran, which produces about 3.3 million barrels of oil per day, could have global energy implications. Iran provides about 1.3 million barrels a day to Chinese refineries. It ranks fourth among OPEC members, behind Saudi Arabia, Iraq, and the United Arab Emirates.

Disruptions to oil shipments through the Strait of Hormuz—where roughly 20% of global oil supplies transit from Saudi Arabia, Iraq, the United Arab Emirates, and Qatar—could affect global markets. BloombergNEF estimates that Brent crude could reach $71 per barrel in the second quarter and $91 per barrel by year‑end if flows were halted.

“Iran’s familiar tactics, such as closing the Strait of Hormuz, banking on its trade with China, and threatening nuclear escalation, are still on the table,” MENA Research Director at Rystad Energy, Aditya Saraswat, said on January 22.

Tehran has threatened to close the strategic waterway multiple times since the Iran–Iraq War in the 1980s.

EU Reliance on Oil Imports Curbs Iran Response

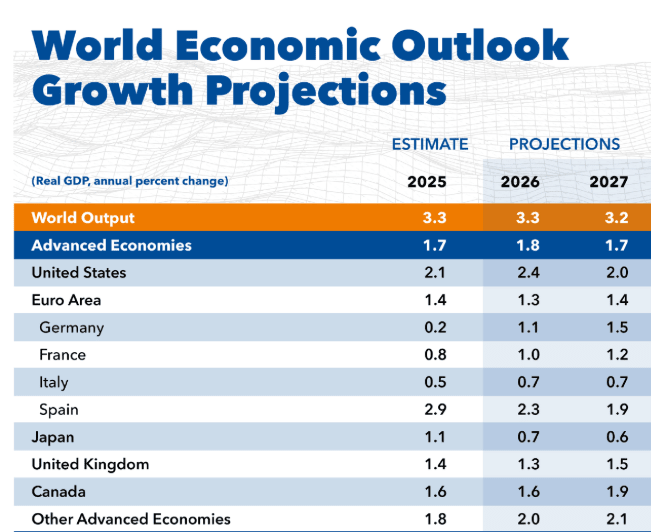

For the European Union (EU), with over 30% of its total LNG transiting the Strait of Hormuz, an escalation of tensions in the region could curb economic expansion. The 27‑member bloc is already struggling with weak growth.

The International Monetary Fund forecasted in January that the Euro Area’s GDP will expand by an estimated 1.4% in 2025. Germany, Europe’s biggest economy, grew by a meager 0.2%, compared with 4.3% annualized US growth in the third quarter.

These economic constraints have pushed Brussels toward a narrower, more symbolic response. The EU has proposed sanctions against Iran’s interior minister and 14 other senior officials for their role in a violent crackdown.

The European Parliament urged Brussels on Thursday to designate the Islamic Revolutionary Guard Corps (IRGC) as a terrorist organization. EU leadership summoned Iranian representatives on January 13 to account for the mass bloodshed.

Human Rights Watch verified on January 8 the involvement of the IRGC in the killings and violence against demonstrators. But internal EU divisions have stalled the effort, with several Member States resisting a formal designation.

EU Refuses to Designate IRGC as Terrorist Organization

French Foreign Minister Jean-Noël Barrot said on January 13 that there could be “no impunity for those who turn their guns on peaceful protesters.” The British Foreign Secretary Yvette Cooper told parliament she called on Iran’s ambassador to “answer for the horrific reports that we are hearing.”

European officials have so far refused to designate the IRGC as a terrorist organization. British Business Secretary Peter Kyle, on January 12, concluded the designation wasn’t “appropriate,” and France’s UN Ambassador, Jerome Bonnafont, said sanctions were the bloc’s principal response.

“The EU and European nations — purely symbolically — called Iranian ambassadors,” Janatan Sayeh, research analyst and Iran specialist at the Foundation for Defense of Democracies (FDD), wrote on January 16. “Absent meaningful consequences for the Islamic Republic, summons and tongue lashings have fallen flat, protecting no one and deterring nothing.”

Even one of its closest allies, Ukrainian President Volodymyr Zelenskyy, criticized the Europeans.

“In Europe, there were Christmas and New Year celebrations, the seasonal holidays,” Zelenskyy said during his speech at the World Economic Forum in Davos, Switzerland, this week. “By the time politicians came back to work and began forming a position, the Ayatollah had already killed thousands. Europe offers nothing and does not want to enter this issue as a supporter of the Iranian people and the democracy they need.”

Trump Has Different Iranian Objectives

Washington has taken a much harder line than the EU, with the US importing less than 10% of its oil from the Persian Gulf. Trump threatened military action if “Iran violently kills peaceful protesters, which is their custom.”

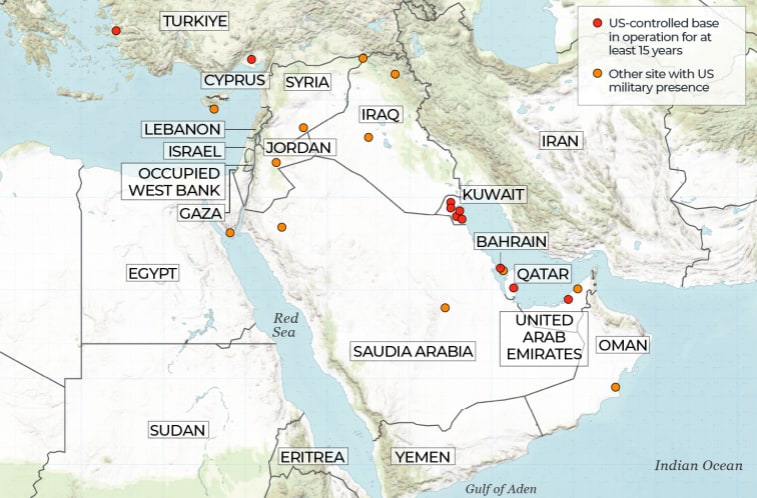

The Pentagon has rushed Boeing Co.-made (NYSE:BA) F-15E Strike Eagles to the Middle East to reinforce its airpower. The U.S. military has also dispatched an aircraft carrier, the USS Abraham Lincoln.

But the US approach is driven by more than Iran — it is rooted in Washington’s strategy to constrain China’s energy security. China purchased more than 80% of Iran’s oil exports in 2025.

“Xi Jinping now has the additional worry that, if Ayatollah Ali Khamenei is toppled in Iran, his country will lose unfettered access to cheap oil from that country as well,” China expert and President of the Population Research Institute, Steven W. Mosher, wrote on January 17. “The effective result would be an American chokehold on the energy that China’s industry — and its military — needs to operate,” he wrote.

US Aims to Weaken China’s Geopolitical Influence

A collapse of the Ayatollah’s regime would be a “geopolitical disaster for Beijing,” Mosher said. It would open the door for the US to finally carry out its “long‑delayed pivot to Asia,” with additional forces reinforcing America’s existing presence in South Korea, Japan, and the Philippines. Such a shift would further complicate “China’s strategic planning for, say, a future invasion of Taiwan,” he said.

The US’s actions in Venezuela have undercut Beijing’s projected image as a capable counter to Washington’s military might on the world’s stage. China was also the top buyer of Venezuelan oil and supplier of military equipment to the regime in Caracas.

“Nicolás Maduro was China’s most important partner in Latin America,” FDD senior director of government relations, Connor Pfeiffer, wrote on January 16. “His capture is a clear message to the hemisphere that when the chips are down, Beijing is unwilling and unable to offer more than diplomatic protest in the face of serious U.S. pushback.”

The widening split underscores how energy security and great‑power rivalry are reshaping Western policy toward Iran — and how Tehran’s unrest is reverberating far beyond its borders.

Disclaimer:

Any opinions expressed in this article are not to be considered investment advice and are solely those of the authors. European Capital Insights is not responsible for any financial decisions made based on the contents of this article. Readers may use this article for information and educational purposes only.

Benzinga Disclaimer: This article is from an unpaid external contributor. It does not represent Benzinga’s reporting and has not been edited for content or accuracy.

Recent Comments