Critical Metals Corp (NASDAQ:CRML) shares are slightly up on Friday as the company faces pressure following a recent business update. Here’s what investors need to know.

- Critical Metals stock is trending lower. Why is CRML stock retreating?

Are Geopolitical Factors Fueling The Surge?

Critical Metals this week held a business update where it disclosed entering four non-binding term sheets for the offtake of its rare earth concentrates, allocating 100% of the planned production from its Tanbreez project.

Additionally, the company announced a joint venture with a Saudi Arabian industrial conglomerate, aimed at creating a processing facility specifically for the U.S. military-industrial sector.

The company also revealed plans to construct a pilot plant in Greenland, with operations expected to begin by May 2026. This news follows a significant rally in the stock, which was up approximately 20% earlier in the week, driven by geopolitical developments and positive internal updates.

Why Greenland’s Tanbreez Deal Could Re-Rate CRML Stock

For investors, Critical Metals is now tied to one of Greenland’s strategic rare-earth assets just as the island moves to the center of U.S.–EU geopolitics. The new Greenland framework that defused threatened EU tariffs lowers odds of trade barriers on rare-earth exports, making long-dated offtake contracts easier to finance.

CRML’s four term sheets effectively pre-sell 100% of planned Tanbreez output, a deposit with high-value heavy rare earths used in defense and EV magnets. That revenue visibility can support project debt, reduce the company’s cost of capital and draw in additional strategic partners alongside its Saudi processing JV.

If Greenland maintains stable, West-aligned policy, investors could begin valuing CRML less as a speculative explorer and more as an emerging link in a government-backed minerals supply chain, with each step toward binding offtake and project funding acting as a potential re-rating catalyst.

Is CRML Stock Set For A Breakout?

The stock is currently trading 45.9% above its 20-day simple moving average (SMA) and 74.2% above its 100-day SMA, demonstrating strong short-term momentum. Over the past 12 months, shares have increased 147.07% and are currently positioned closer to their 52-week highs than lows.

The RSI is at 68.80, which is considered neutral territory, indicating that the stock is not yet overbought. Meanwhile, MACD is above its signal line, suggesting bullish momentum.

The combination of neutral RSI and bullish MACD suggests mixed momentum.

- Key Resistance: $18.00

- Key Support: $16.50

Benzinga Edge Rankings

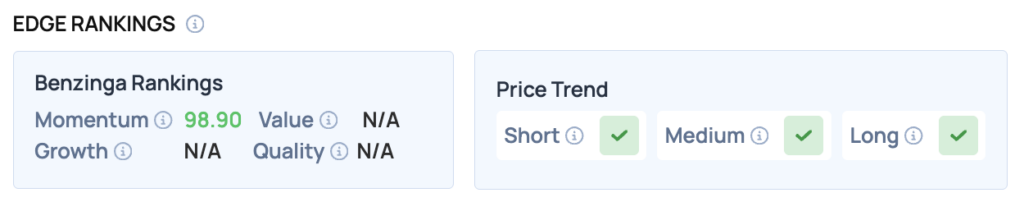

Below is the Benzinga Edge scorecard for Critical Metals, highlighting its strengths and weaknesses compared to the broader market:

- Momentum: Bullish (Score: 98.9) — Stock is outperforming the broader market.

The Verdict: Critical Metals’ Benzinga Edge signal reveals a classic ‘High-Flyer’ setup. While the Momentum (98.9) confirms the strong trend, the lack of Value and Quality scores warns that the stock is priced for perfection—investors should ride the trend but use tight stop-losses.

CRML Stock Pulls Back Friday

CRML Price Action: Critical Metals shares were up 2.17% at $18.86 at the time of publication on Friday, according to Benzinga Pro data.

Image: Shutterstock

Recent Comments