Columbia Banking System Inc (NASDAQ:COLB) reported upbeat earnings for the fourth quarter on Thursday.

The company posted quarterly earnings of 82 cents per share which beat the analyst consensus estimate of 71 cents per share. The company reported quarterly sales of $717.000 million which beat the analyst consensus estimate of $696.191 million.

“Our fourth quarter performance marked a strong end to a tremendous year for Columbia, reflecting continued momentum across our businesses and our commitment to consistent, repeatable results,” said Clint Stein, President and CEO. “Our operating performance was supported by disciplined balance sheet management, new and expanding customer relationships, and the first full-quarter contribution from Pacific Premier. We remain on track for a seamless systems conversion later this quarter, which will enable us to fully realize deal-related cost savings and achieve a clean expense run rate by the third quarter. Investments made throughout 2025 strengthened our western footprint and enhanced our long-term earnings power, and we entered 2026 with healthy pipelines, solid capital generation, and a clear path to continued operational improvement, all in support of long-term value creation and ongoing capital return to our shareholders.”

Columbia Banking System shares fell 1.8% to trade at $29.12 on Friday.

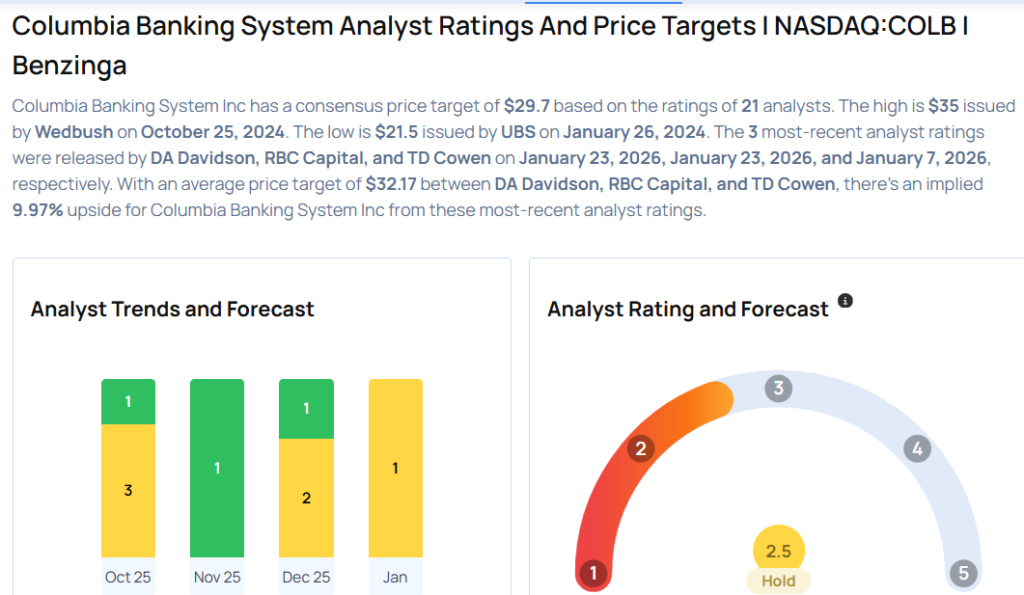

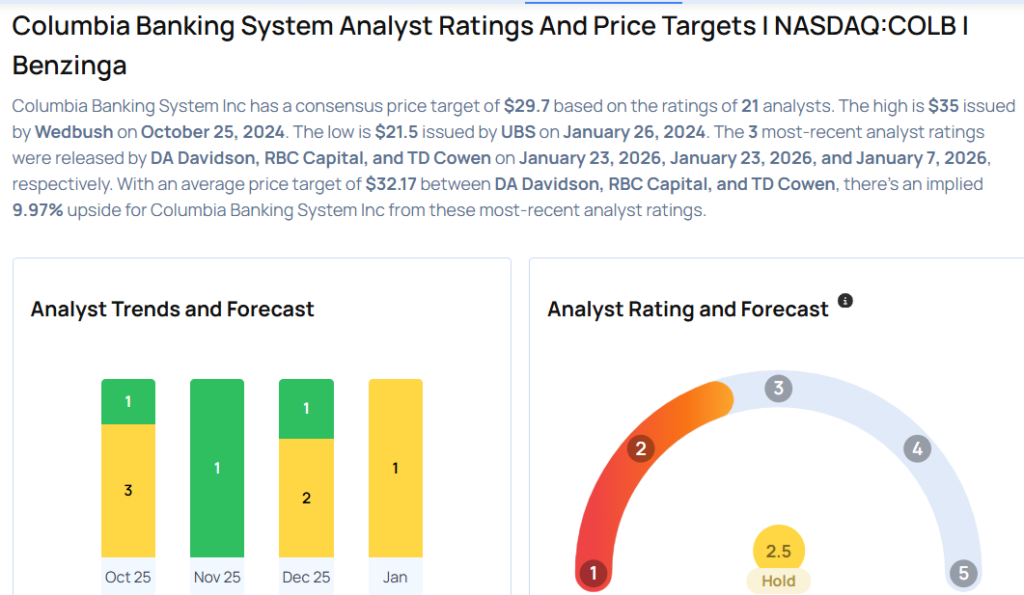

These analysts made changes to their price targets on Columbia Banking System following earnings announcement.

- RBC Capital analyst Jon G. Arfstrom maintained Columbia Banking System with a Sector Perform and raised the price target from $30 to $32.

- DA Davidson analyst Jeff Rulis maintained the stock with a Neutral and raised the price target from $30 to $32.5.

Considering buying COLB stock? Here’s what analysts think:

Photo via Shutterstock

Recent Comments