High Roller Technologies Inc. (NYSEAMERICAN: ROLR) surged 45.18% to $11.44 in after-hours trading on Wednesday following the closing of its registered direct offering.

Company Prices 1.9M Share Offering

After the market closed on Wednesday, the Las Vegas-based online gaming operator announced it had closed the sale of 1.89 million common shares at $13.21 per share, generating about $25 million in gross proceeds before fees

New York-based boutique investment bank ThinkEquity acted as the sole placement agent for the offering.

According to the company, the shares were sold under an effective shelf registration statement filed with the Securities and Exchange Commission on Nov. 12 and declared effective Dec. 2, 2025.

High Roller Technologies said it plans to use the proceeds for sales and marketing, geographic expansion, product development and diversification, and working capital.

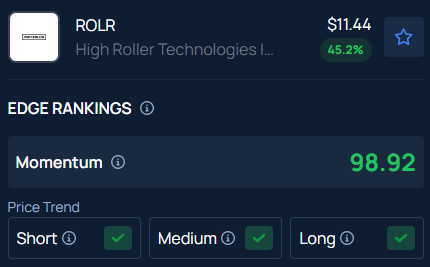

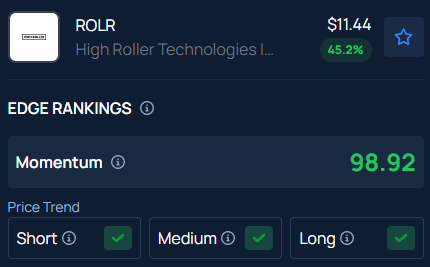

Trading Metrics, Technical Analysis

The company’s Relative Strength Index (RSI) is 52.68.

High Roller Technologies has a market capitalization of $66.96 million, with its stock trading in a 52-week range of $1.16 to $33.68.

Over the past 12 months, ROLR has risen 75.5%, highlighting a strong upward trend and signaling potential strength for long-term investors.

According to Benzinga Pro data, the stock closed at $7.88 on Wednesday, down 35.62%.

This suggests the stock is trading at 20.7% of its 52-week range, placing it nearer to its lows than its highs.

With momentum in the 98th percentile, Benzinga’s Edge Stock Rankings show that ROLR has a positive price trend across all time frames.

Photo: mukul126 / Shutterstock

Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors.

Recent Comments