Tariffs pause, Risk returns – Is Netflix A Buy here?

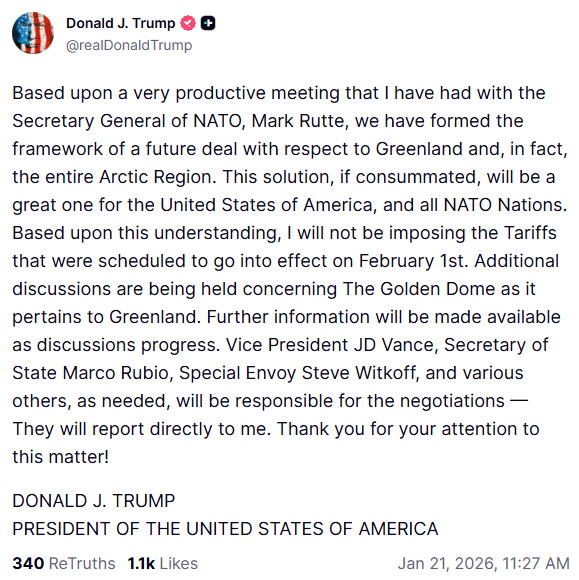

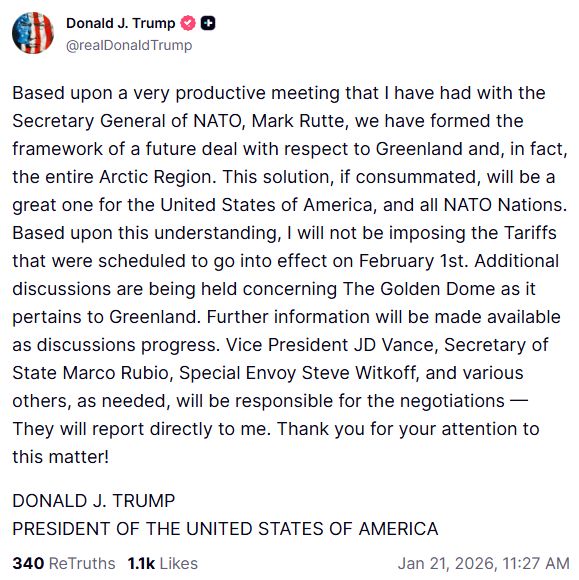

NATO and The Taco Call-Off

Comments around a developing framework involving Greenland, NATO, and President Trump shifted the macro tone. The market focus was not geopolitics alone, but the signal that previously scheduled European tariffs may be paused, removing a near-term overhang. That change helped drive a sharp intraday reversal and improved risk appetite.

From an economic perspective, the Arctic angle reframed Greenland as a long-term resource and supply-chain issue rather than a political flashpoint. Markets responded to the prospect of coordination and stability over escalation. In a tape driven by marginal changes, tariff relief mattered more than the headline itself.

Semiconductor Stocks Lead the Rally

Semiconductors led the rebound, with strength across GPUs, equipment, and legacy chipmakers. The move reflected improving confidence in forward growth rather than backward-looking earnings. Investors continue to reward visibility and scale in AI-related demand.

The underlying theme remains intact: AI, onshoring, and durable capex cycles. When estimates move higher, semis rerate quickly, even from elevated levels. Today’s action reinforced that chips remain the market’s preferred expression of structural growth when macro pressure eases.

Is Netflix a Buy Here?

Netflix beat on revenue and EPS but guided the next quarter slightly below expectations, keeping pressure on the stock. Revenue growth modestly reaccelerated, but margin and free cash flow softness raised valuation concerns. Technically, the stock remains below key levels, limiting near-term momentum.

The bigger question is expectations. Netflix is still priced as a premium compounder, leaving little room for mixed guidance. While the platform continues to dominate streaming and scale advertising, upside likely remains incremental without clearer margin expansion.

**

Thanks for reading! For more updates throughout the week, follow @WOLF_Financial

**

Benzinga Disclaimer: This article is from an unpaid external contributor. It does not represent Benzinga’s reporting and has not been edited for content or accuracy.

Recent Comments