GE Aerospace (NYSE:GE) will release earnings for the fourth quarter before the opening bell on Thursday, Jan. 22.

Analysts expect the company to report fourth-quarter earnings of $1.43 per share. That’s up from $1.32 per share in the year-ago period. The consensus estimate for GE Aerospace’s quarterly revenue is $11.21 billion (it reported $9.88 billion last year), according to Benzinga Pro.

On Jan. 13, GE Aerospace announced that Delta Air Lines (NYSE:DAL) has selected GEnx engines to power 30 new Boeing 787-10s with options for 30 more aircraft. The agreement also includes spare engines and long-term services support.

Shares of GE Aerospace rose 2% to close at $318.50 on Wednesday.

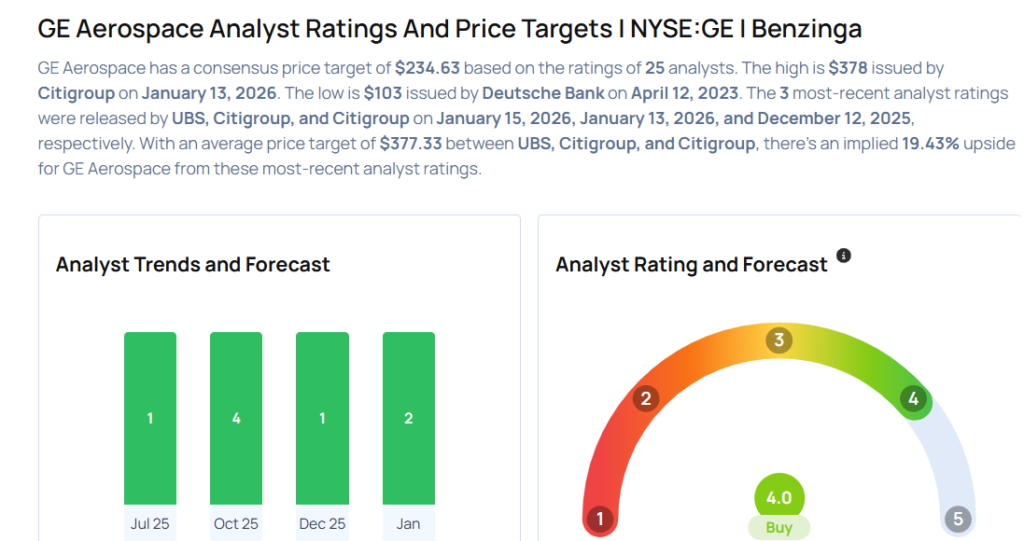

Benzinga readers can access the latest analyst ratings on the Analyst Stock Ratings page. Readers can sort by stock ticker, company name, analyst firm, rating change or other variables.

Let’s have a look at how Benzinga’s most-accurate analysts have rated the company in the recent period.

- UBS analyst Gavin Parsons maintained a Buy rating and raised the price target from $366 to $368 on Jan. 15, 2026. This analyst has an accuracy rate of 75%.

- Citigroup analyst John Godyn maintained a Buy rating and cut the price target from $386 to $378 on Jan. 13, 2026. This analyst has an accuracy rate of 67%.

- Susquehanna analyst Charles Minervino initiated coverage on the stock with a Positive rating and a price target of $386 on Dec. 12, 2025. This analyst has an accuracy rate of 74%.

- B of A Securities analyst Ronald Epstein maintained a Buy rating and raised the price target from $310 to $365 on Oct. 27, 2025. This analyst has an accuracy rate of 72%.

- JP Morgan analyst Seth Seifman maintained an Overweight rating and raised the price target from $275 to $325 on Oct. 27, 2025. This analyst has an accuracy rate of 86%

Considering buying GEV stock? Here’s what analysts think:

Photo via Shutterstock

Recent Comments