American Rebel Holdings Inc. (NASDAQ:AREB) jumped 45.41% on Wednesday, trading at $0.63 in the after-hours session, following the announcement of a 1-for-20 reverse stock split set to take effect on Feb. 2.

Split Takes Effect February 2

The Nashville-based patriotic lifestyle brand company said the reverse stock split will take effect at 12:00 a.m. Eastern Time on Feb. 2.

The stock will continue trading under the symbol “AREB” with a new CUSIP number, 02919L802.

According to the company’s press release, American Rebel has not received a deficiency notice and does not expect to receive one concerning Nasdaq’s bid price rule.

The company stated that the reverse split is intended to improve marketability and ensure compliance with Nasdaq’s $1 minimum bid price requirement.

Round Lot Protection Included

The split includes protections for shareholders owning 100 or more shares. No current shareholder with at least 100 shares will see their holdings drop below 100 shares following the split.

The company also noted that fractional shares will be rounded up to the nearest whole number.

The reverse split will cut the company’s outstanding shares from roughly 8.7 million to about 435,359, based on Tuesday’s data.

Securities Transfer Corporation will serve as the exchange agent.

According to the company, stockholders approved the reverse split through written consent.

Trading Metrics, Technical Analysis

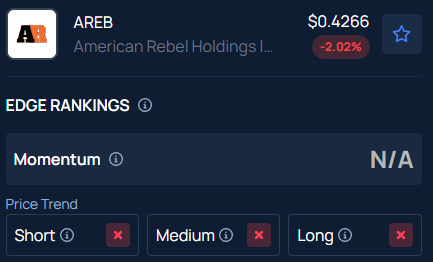

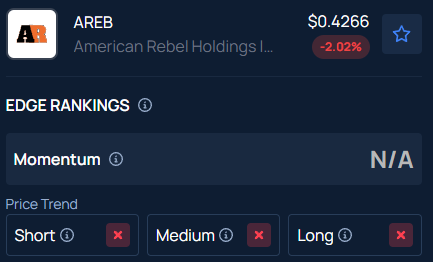

The Relative Strength Index (RSI) of American Rebel stands at 25.20.

The company has a market capitalization of $3.43 million. Over the past 12 months, American Rebel Holdings’ stock has dropped 99.95%. This steep decline highlights the significant challenges the stock has faced and underscores the importance of caution for potential investors.

The stock closed on Wednesday at $0.44, down 7.68%, according to Benzinga Pro data.

This suggests the small-cap company’s stock is currently trading extremely close to its 52-week low, reflecting weak market sentiment.

Benzinga’s Edge Stock Rankings indicate AREB stock has a negative price trend across all time frames.

Photo: Sittipong Phokawattana from Shutterstock

Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors.

Recent Comments