Halliburton Company (NYSE:HAL) will release earnings for the fourth quarter before the opening bell on Wednesday, Jan. 21.

Analysts expect the Houston, Texas-based company to report fourth-quarter earnings of 55 cents per share. That’s down from 70 cents per share in the year-ago period. The consensus estimate for Halliburton’s quarterly revenue is $5.41 billion (it reported $5.61 billion last year), according to Benzinga Pro.

The company has beaten analyst estimates for revenue in three straight quarters, but only in four of the last 10 quarters overall.

Shares of Halliburton fell 1.6% to close at $32.06 on Tuesday.

Benzinga readers can access the latest analyst ratings on the Analyst Stock Ratings page. Readers can sort by stock ticker, company name, analyst firm, rating change or other variables.

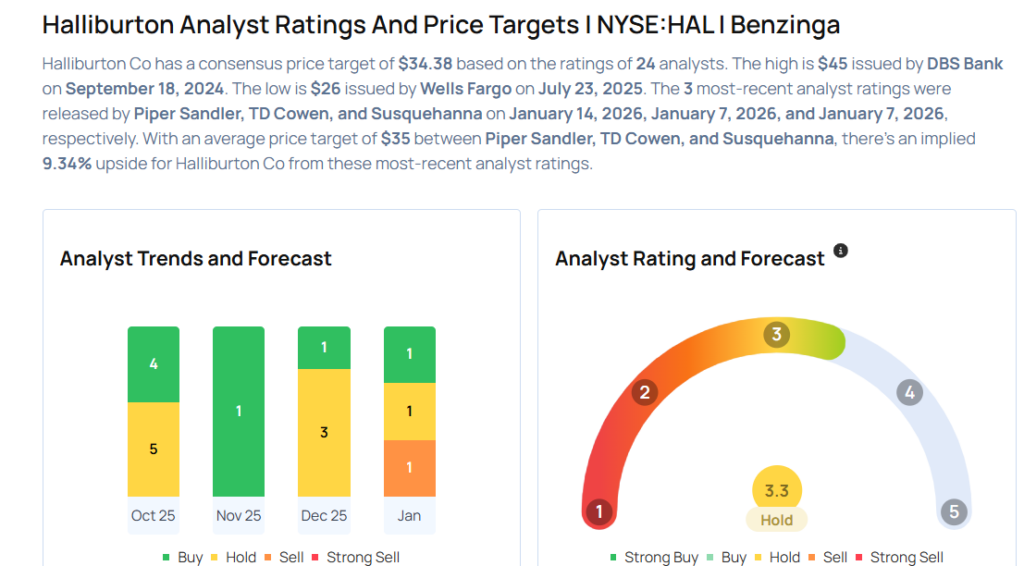

Let’s have a look at how Benzinga’s most-accurate analysts have rated the company in the recent period.

- Piper Sandler analyst Derek Podhaizer maintained a Neutral rating and raised the price target from $29 to $30 on Jan. 14, 2026. This analyst has an accuracy rate of 72%.

- TD Cowen analyst Marc Bianchi maintained a Buy rating and raised the price target from $38 to $39 on Jan. 7, 2026. This analyst has an accuracy rate of 63%.

- Susquehanna analyst Charles Minervino maintained a Positive rating and increased the price target from $29 to $36 on Jan. 7, 2026. This analyst has an accuracy rate of 74%.

- Evercore ISI Group analyst James West downgraded the stock from Outperform to In-Line and raised the price target from $28 to $35 on Jan. 6, 2026. This analyst has an accuracy rate of 73%.

- Barclays analyst David Anderson maintained an Equal-Weight rating and raised the price target from $25 to $30 on Dec. 17, 2025. This analyst has an accuracy rate of 69%

Considering buying HAL stock? Here’s what analysts think:

Photo via Shutterstock

Recent Comments