On Tuesday, Cathie Wood-led Ark Invest made significant trades involving Broadcom Inc. (NASDAQ:AVGO), WeRide Inc. (NASDAQ:WRD), BYD Co. Ltd. (OTC:BYDDY), and Advanced Micro Devices Inc. (NASDAQ:AMD). These trades were executed across various Ark ETFs.

The Broadcom Trade

Ark Invest’s flagship fund, ARK Innovation ETF (BATS:ARKK), acquired 32,408 shares of Broadcom, valued at approximately $10.8 million based on the closing price of $332.60.

This move comes after Broadcom’s shares faced a downturn due to China’s directive against using foreign cybersecurity software, impacting several U.S. firms, including Broadcom-owned VMware.

The WeRide Trade

ARK Autonomous Technology & Robotics ETF (BATS:ARKQ) added 577,099 shares of WeRide, amounting to about $4.9 million at the closing price of $8.48.

WeRide, a Chinese robotaxi company, has been expanding its autonomous fleet, now boasting over 1,000 vehicles and driverless operations in cities like Beijing and Guangzhou. This aligns with Ark’s interest in innovative transportation solutions, as WeRide continues to integrate its services with platforms like Tencent’s WeChat.

The BYD Trade

ARKQ purchased 205,748 shares of BYD, valued at around $2.53 million at the closing price of $12.31.

BYD recently surpassed Tesla in electric vehicle sales, selling 2.26 million EVs globally in 2025. However, the company faces challenges related to profitability and international expansion.

The AMD Trade

ARK Space & Defense Innovation ETF (BATS:ARKX) acquired 3,165 shares of AMD, worth approximately $734,026 at the closing price of $231.92.

AMD is focusing on integrating AI into mainstream PCs and leveraging data center strengths for future growth. Analysts highlight AMD’s efforts to make AI capabilities more accessible, which could drive the company’s next growth phase.

Other Key Trades:

- Kratos Defense and Security Solutions Inc. (KTOS) – Sold 61,632 shares by ARKK, 35,813 shares via ARKX and 74,426 shares by ARKQ.

- Trimble Inc. – Bought 28,241 shares by ARKX.

- Deere & Co – Bought 2,540 shares by ARKQ.

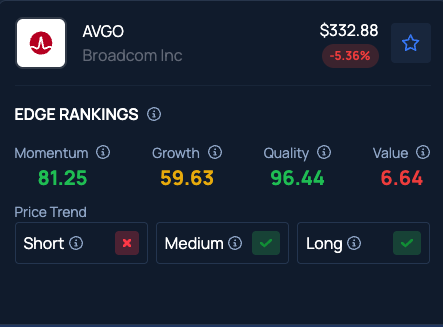

Benzinga Edge Stock Rankings show Broadcom stock has a Value in the 6th percentile and checks out on the Medium and Long Price Trends.

Photo: ChrisStock82 / Shutterstock

This story was generated using Benzinga Neuro and edited by Shivdeep Dhaliwal

Recent Comments