AST SpaceMobile Inc (NASDAQ:ASTS) shares are down on Wednesday as the company faces a pullback following its recent strength. Here’s what investors need to know.

- AST SpaceMobile stock is feeling bearish pressure. Why is ASTS stock falling?

AST SpaceMobile Stock Pulls Back After Red-Hot Run

AST SpaceMobile shares are falling after Blue Origin earlier announced its TeraWave satellite communications network, promising up to 6 Tbps data speeds via a 5,408-satellite multi-orbit constellation.

Investors are potentially reacting to a powerful, well-funded new competitor targeting the same global, hard-to-reach connectivity markets as AST SpaceMobile, which can pressure expectations for ASTS’s future revenue and market share.

Traders may also be taking profits Wednesday afternoon following a powerful multi-month rally that recently pushed the satellite-to-smartphone play to fresh all-time highs.

The stock had surged roughly 370% over the past year, fueled by optimism around its first large BlueBird 6 satellite launch and an aggressive plan to deploy 45 to 60 satellites by the end of 2026.

Recent gains were also supported by a broad move into space and defense names and inclusion in several aerospace and mid-cap ETFs, which can amplify both upside and downside as fund flows shift.

What AST SpaceMobile Does

AST SpaceMobile is building a space-based cellular broadband network designed to connect directly to everyday 4G and 5G smartphones, without any hardware changes for users.

Its large phased-array satellites in low Earth orbit aim to extend mobile coverage to remote and underserved regions while bolstering resiliency for carriers such as AT&T, Verizon and Vodafone.

Defense Tie-In Adds New Angle For ASTS Stock

Beyond commercial connectivity, AST SpaceMobile recently secured a prime spot on the U.S. Missile Defense Agency’s SHIELD program, part of the Golden Dome initiative, positioning the company to compete for future research, prototyping and operational defense work.

With shares easing today after a sharp run-up, traders are weighing short-term volatility against ASTS’s expanding role in both commercial satellite communications and dual-use defense applications.

Unpacking The 326% Annual Surge

The stock is currently trading 10.8% above its 20-day SMA and 44.7% above its 100-day SMA, demonstrating longer-term strength. Shares have increased 326.84% over the past 12 months and are currently positioned closer to their 52-week highs than lows.

The RSI is at 66.98, which is considered neutral territory, while MACD is above its signal line, indicating bullish momentum. The combination of neutral RSI and bullish MACD suggests strong momentum.

- Key Resistance: $103.00

Revenue Surge Highlights AST SpaceMobile’s Resilience

Investors are looking ahead to the company’s next earnings report in March.

- EPS Estimate: Loss of 19 cents (Down from Loss of 18 cents YoY)

- Revenue Estimate: $39.03 million (Up from $1.92 million YoY)

Analyst Consensus & Recent Actions: The stock carries a Hold Rating with an average price target of $61.08. Recent analyst moves include:

- B. Riley Securities: Upgraded to Neutral (Raised Target to $105.00) (Jan. 13)

- Scotiabank: Upgraded to Sector Underperform (Target $45.60) (Jan. 7)

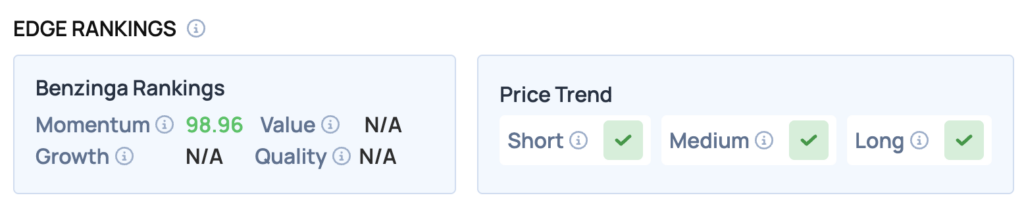

Benzinga Edge Rankings

Below is the Benzinga Edge scorecard for AST SpaceMobile, highlighting its strengths and weaknesses compared to the broader market:

- Momentum: Bullish (Score: 98.96/100) — Stock is outperforming the broader market.

The Verdict: AST SpaceMobile’s Benzinga Edge signal reveals a classic “High-Flyer” setup. While the Momentum score confirms the strong trend, investors should remain cautious given the mixed technical indicators.

Top ETF Exposure

- First Trust Indxx Aerospace & Defense ETF (NYSE:MISL): 4.27% Weight

- Defiance Connective Technologies ETF (NASDAQ:SIXG): 3.48% Weight

- Tradr 2X Long ASTS Daily ETF (NASDAQ:ASTX): 120.88% Weight

Significance: Because ASTS carries such a heavy weight in these funds, any significant inflows or outflows for these ETFs will likely force automatic buying or selling of the stock.

ASTS Shares Dive Wednesday

ASTS Price Action: AST SpaceMobile shares were down 11.28% at $99.76 at the time of publication on Wednesday, according to Benzinga Pro data.

Image: Shutterstock

Recent Comments