As of Jan. 20, 2026, three stocks in the health care sector could be flashing a real warning to investors who value momentum as a key criteria in their trading decisions.

The RSI is a momentum indicator, which compares a stock’s strength on days when prices go up to its strength on days when prices go down. When compared to a stock’s price action, it can give traders a better sense of how a stock may perform in the short term. An asset is typically considered overbought when the RSI is above 70, according to Benzinga Pro.

Here’s the latest list of major overbought players in this sector.

Venus Concept Inc (NASDAQ:VERO)

- Madryn Asset Management disclosed a 91% stake in the medical aesthetic technology company. In an SEC filing on Friday, Madryn Asset Management said the deal is for investment purposes. The company’s stock gained around 426% over the past five days and has a 52-week high of $14.50.

- RSI Value: 95.9

- VERO Price Action: Shares of Venus Concept gained 451.8% to close at $7.89 on Friday.

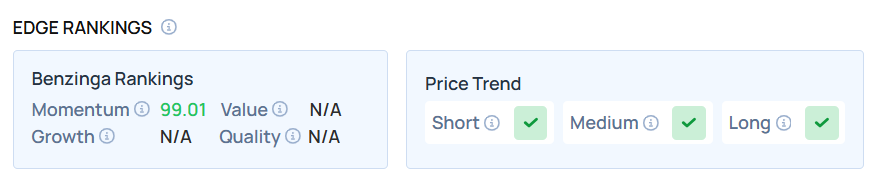

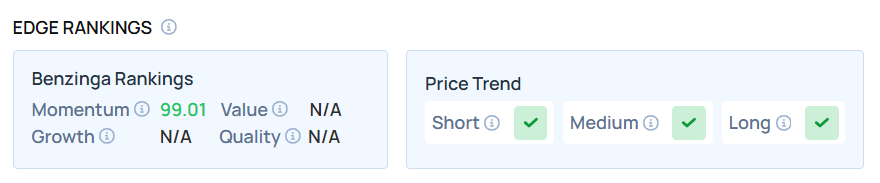

- Edge Stock Ratings: 99.01 Momentum score.

Immunitybio Inc (NASDAQ:IBRX)

- ImmunityBio stock has surged more than 100% year to date after the upbeat fourth-quarter preliminary results and trial data. The company on Friday said enrollment exceeded internal expectations in its randomized registrational trial in BCG-naïve non-muscle-invasive bladder cancer (NMIBC), QUILT-2.005. The company’s stock gained around 136% over the past five days and has a 52-week high of $5.58.

- RSI Value: 95.4

- IBRX Price Action: Shares of Immunitybio rose 39.8% to close at $5.52 on Friday.

Learn more about BZ Edge Rankings—click to see scores for other stocks in the sector and see how they compare.

Photo via Shutterstock

Recent Comments