Pharmaceutical company Johnson & Johnson (NYSE:JNJ) is set to report its fourth-quarter results on Wednesday, facing one of the most important transitions in its modern history, as investors focus on whether the company can replace revenue from its former immunology powerhouse, Stelara.

J&J Faces Patent Cliff

For years, Stelara ranked among J&J’s largest products, generating close to $10 billion annually at its peak. That dominance is now fading as biosimilar versions enter the U.S. market following the loss of exclusivity.

During its recent third-quarter results, the company reported a 42% year-over-year decline in sales, which it attributed to “the impact of biosimilar competition,” while pointing to a collection of newer therapies, which it said can help offset this erosion.

Management highlighted that its Oncology drug Darzalex has become a multibillion-dollar franchise, while immunology medicine Tremfya and depression treatment Spravato have been highlighted as fast-growing contributors. Even its new cell therapy, Carvykti, is showing strong growth, with the company expecting $5 billion in peak sales.

Beyond pharmaceuticals, investors will also watch the MedTech division for momentum, which the company has framed as a key area of growth going forward.

Acquisitions such as Abiomed and Shockwave Medical have strengthened the company’s offerings in this segment, which is typically less vulnerable to patent cliffs than branded drugs, and are now helping it grow “through the loss of exclusivity of Stelara,” according to CEO Joaquin Duato.

The company’s CFO, Joseph Wolk, dismissed an M&A driven approach to dealing with this loss of exclusivity, saying that they will not resort to any “desperation” deals to replace this revenue, and will remain focused on a “thoughtful long-term approach” to capital deployment instead.

As a result, investors and analysts heading into the fourth quarter will be focused on the company’s 2026 guidance, particularly the expected pace of Stelara’s sales decline and how effectively the rest of the portfolio can help offset this erosion.

Stock Touches New All-Time High

Despite these concerns, shares of Johnson & Johnson touched a new all-time high of $220.11 last week, with the stock up 5.45% year-to-date, and 47.59% over the past year.

Analyst consensus remains bearish on the stock, with an average price target of $198.82, which represents a downside of 9.07% from current levels.

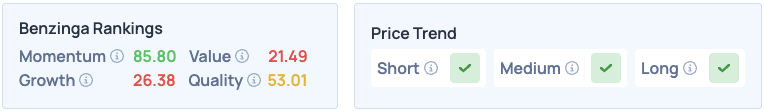

Shares of Johnson & Johnson were down 0.41% on Friday, closing at $218.66, and are down 0.70% overnight. The stock scores high on Momentum in Benzinga’s Edge Stock Rankings, with a favorable price trend in the short, medium and long terms.

Photo courtesy: Shutterstock

Recent Comments