FuelCell Energy Inc (NASDAQ:FCEL) shares are trading higher Tuesday morning following the announcement of a strategic collaboration with Sustainable Development Capital to address the surging power demands of the global data center market. Here’s what investors need to know.

- FuelCell Energy stock is charging ahead with explosive momentum. What’s driving FCEL stock higher?

How AI Is Driving Energy Infrastructure Innovation

The partnership explores the deployment of up to 450 megawatts of FuelCell’s advanced power systems to support distributed power needs.The collaboration is driven by the rapid expansion of artificial intelligence which the companies believe is fundamentally redesigning data center power architectures.

As AI increases the need for reliable, always-on power, the partnership aims to combine FuelCell Energy’s distributed baseload technology with SDCL’s expertise in financing and operating scalable energy infrastructure.

Jason Few, CEO of FuelCell Energy, highlighted that the industry is moving toward centralized 800-volt DC power, a standard FCEL’s platforms are architecturally ready to support. Additionally, FCEL’s systems can capture waste heat for absorption chilling, potentially improving data center efficiency.

Jonathan Maxwell, CEO of SDCL, noted that FCEL’s flexible, low-emission technology is particularly attractive for data centers where resilience and sustainability must coexist.

Per the company, this strategic move positions FuelCell Energy to capitalize on the growing energy constraints facing the tech sector, sparking positive investor sentiment.

Short-Term Weakness Signals Potential Opportunity

FuelCell Energy is currently trading approximately 9.1% below its 20-day simple moving average (SMA) and 4.4% above its 100-day SMA, indicating some short-term weakness while maintaining longer-term support. Shares have increased by 0.11% over the past 12 months and are currently positioned closer to their 52-week highs than lows.

The RSI is not available, indicating a neutral momentum stance, while the MACD is also not available, suggesting a lack of clear directional momentum at this time. The combination of these indicators implies mixed signals for traders.

- Key Resistance: $10.50

- Key Support: $7.50

Revenue Estimates Indicate Strong Year-Over-Year Growth

Investors are looking ahead to the next earnings report on March 10.

- EPS Estimate: Loss of 92 cents (Up from $-1.42 YoY)

- Revenue Estimate: $47.94 million (Up from $19.00 million YoY)

Analyst Consensus & Recent Actions: The stock carries a Buy Rating with an average price target of $2789.81. Recent analyst moves include:

- Canaccord Genuity: Hold (Target $12.00) (Dec. 19, 2025)

- UBS: Neutral (Raised Target to $7.25) (Sep. 17, 2025)

- Canaccord Genuity: Hold (Target $12.00) (Sep. 15, 2025)

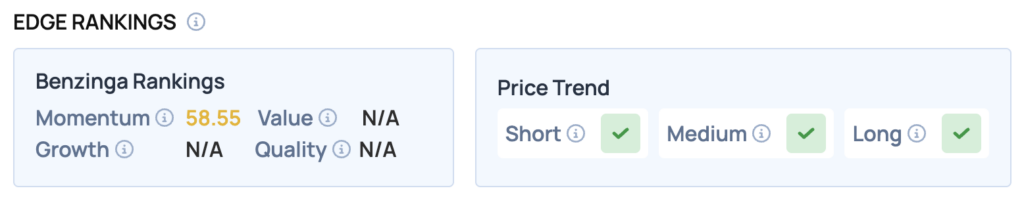

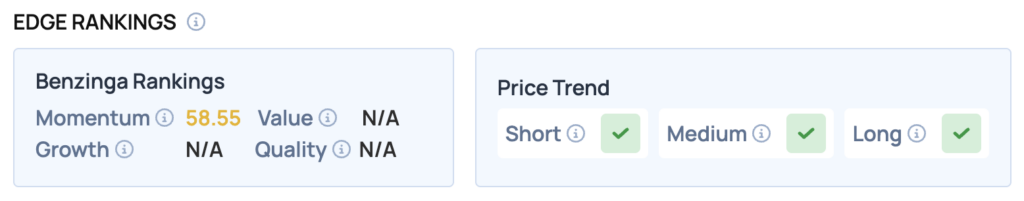

Benzinga Edge Rankings

Below is the Benzinga Edge scorecard for FuelCell Energy, highlighting its strengths and weaknesses compared to the broader market:

- Momentum: Bullish (Score: 58.55/100) — Stock is outperforming the broader market.

The Verdict: FuelCell Energy’s Benzinga Edge signal reveals a moderate momentum score, indicating some positive movement relative to the market. Investors should monitor upcoming earnings closely, as the stock’s performance may hinge on the results.

Top ETF Exposure

- Global X Hydrogen ETF (NASDAQ:HYDR): 4.49% Weight

- Defiance Next Gen H2 ETF (NYSE:HDRO): 6.56% Weight

Significance: Because FCEL carries significant weight in these funds, any significant inflows or outflows for these ETFs will likely force automatic buying or selling of the stock.

FCEL Shares Surge Tuesday

FCEL Price Action: FuelCell Energy shares were up 8.46% at $8.72 at the time of publication on Tuesday, according to Benzinga Pro data.

Image: Shutterstock

Recent Comments