The US has identified critical mineral security as a national priority. That shift is reshaping transatlantic relations and underscoring Europe’s dependence on foreign suppliers.

The Trump administration has argued that Greenland’s natural resources, along with its strategic location, make it vital to US economic interests. Trump’s attention on the Danish territory is part of a larger US strategy to diversify from Chinese-dominated rare earth elements (REE) and critical mineral supply chains.

For the European Union, the shift presents a dual challenge. It underscores the bloc’s need to strengthen its defense capabilities after decades of reliance on Washington. It highlights Europe’s acute vulnerability to disruptions in rare earth elements (REEs) and critical minerals essential for clean energy, semiconductors, and defense manufacturing.

“The US and the EU are competing with China to access Greenland’s rare earths as they attempt to diversify away from Beijing’s dominance of the global critical minerals supply chain,” Patrick Schröder, Senior Research Fellow at Chatham House, wrote in October. “Greenland is home to largely untapped deposits of critical minerals.”

These warnings underscore Europe’s deepening supply chain crisis.

EU Faces Supply Chain Vulnerabilities

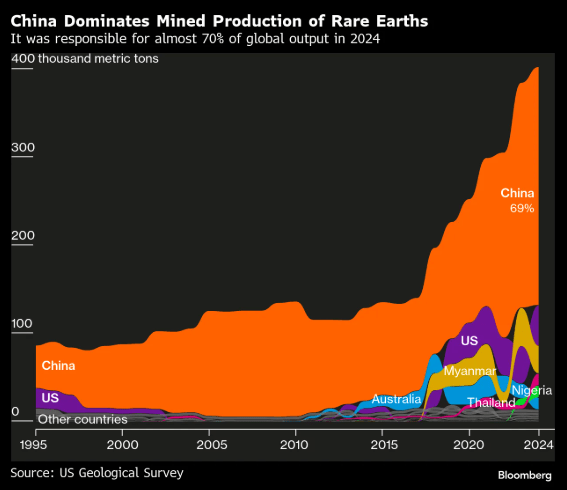

The World Economic Forum (WEF), which is hosting its annual forum in Davos this week, has warned of the EU’s supply chain vulnerabilities. China produces about 95% of the world’s rare-earth oxides and supplies 70% of Europe’s imports.

“The EU has virtually no domestic rare-earth production,” Hamed Ghiaie, Professor of Economics and Public Policy (HDR), ESCP Business School, and Filippo Gorelli, Analyst at Nexans, wrote for WEF in October. “It sources 98% of its rare-earth magnet demand from Chinese suppliers. Similar dependencies exist for magnesium, gallium, and germanium — metals vital for semiconductors and defense technologies.”

Greenland has emerged as a strategic asset for European industries. Without secure access to REEs and critical minerals, Europe risks falling behind in AI development, defense manufacturing, and its net‑zero transition.

In a better political environment, Europe could have cooperated more closely with the US on REE supply chains.

Relations have soured. Trump posted an image of himself on social media planting a US flag in the Arctic territory. He threatened tariffs of 10% on European countries if they didn’t concede to his demands. Europe has plans to retaliate. They have not announced a formal policy.

Antimony Has An Oversized Defense Role

Antimony, a critical mineral whose strategic importance has surged, has become the latest flashpoint in the global scramble for critical minerals. Greenland is home to high‑grade antimony deposits, with Perth‑based GreenX Metals (LSE: GRX) reporting significant mineralization in 2024 at its Eleonore North project.

Antimony is used in flame retardants, lead‑acid batteries, alloys, and defense technologies. Its defense applications are critical: armor‑piercing ammunition, night‑vision equipment, and hardened lead alloys.

“Antimony is one of those raw materials that historically have been completely unknown to the public,” CEO of United States Antimony Corp., Gary C. Evans, said in the company’s third-quarter 2025 earnings call. “For the military and industrial sectors, this mineral is absolutely essential. Antimony alloys play a significant role in making ammunition production that is extremely difficult to replace.”

The EU’s Critical Raw Materials Act (CRMA) has designated antimony (Sb) as critical and strategic. Canada, the US, the UK, and Australia have put it on critical minerals lists. The International Institute for Strategic Studies has highlighted antimony’s role in European defense resilience.

China Uses Antimony As Geopolitical Weapon

Currently, China, Russia, and Tajikistan control about 90% of global mine antimony production.

With 58% of global antimony production in 2023, China has used antimony as a strategic weapon in its trade war with Washington. In December 2024, Beijing halted exports to the US of antimony, gallium, and germanium, other critical minerals, and required greater scrutiny of the end-usage of graphite items.

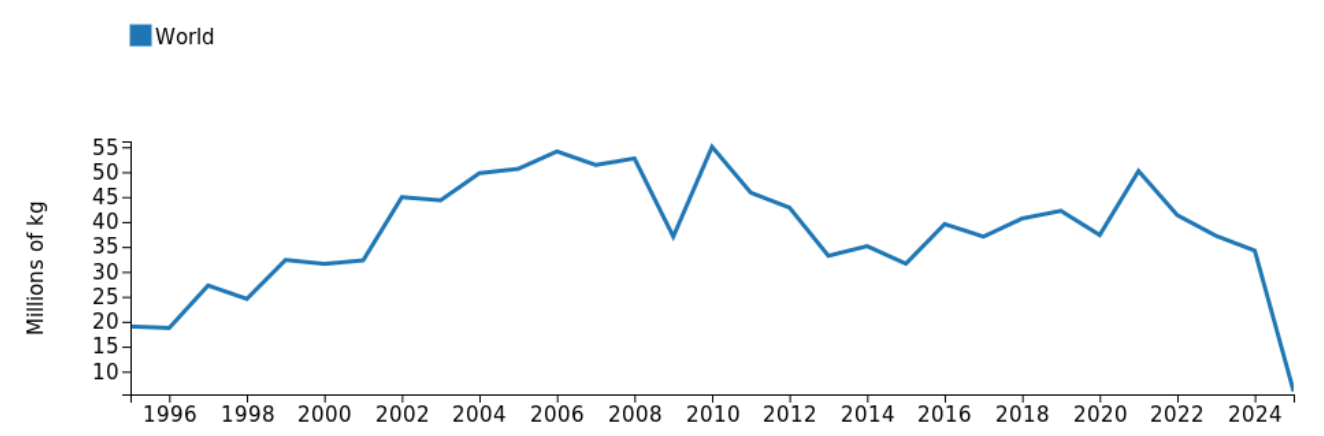

China slashed its 2025 antimony oxide export by over 80% to just 6,000 tons from 34,200 tons in 2024. China suspended its export ban on antimony, gallium, and germanium to the US until November 2026. Beijing made the decision after a meeting between Trump and President Xi Jinping.

China halted antimony shipments to the EU in October 2024, despite expectations that the restrictions targeted the US alone. European antimony prices surged 437% between 2023 and 2025, worsening shortages for munitions, hardening, and infrared optics.

Europe’s Small Number of Sb Miners

Europe has a handful of antimony miners who can help meet demand, as it grows to $0.65 billion by 2035 from $0.32 billion in 2024, according to the Market Research Future (MRFR). Germany, Europe’s largest economy, has the biggest market for antimony, driven by its strong industrial base and high demand for flame retardants.

Small caps have stepped efforts to increase supplies.

Military Metals Corp. (OTCQB:MILIF) is developing Slovakia’s Trojarová project, with 2026 drills targeting high-grade antimony-gold resources. DPM (ASX: DPM) acquired Adriatic Metals and has been producing 24,000 MT of reserves in antimony concentrates since 2023, supporting EU self-sufficiency efforts under the Critical Raw Materials Act.

Tajikistan, the world’s second‑largest producer, could meet some European demand. Laos and Cambodia began exporting 10–15 MT per month to Europe in 2025. The two Southeast Asian suppliers face political instability, making them unreliable long‑term partners.

Europe Remains Reliant on Foreign Suppliers

The EU’s push to secure critical minerals has struggled with regulatory hurdles, environmental constraints, and slow permitting. The US has accelerated its own strategy.

“The US has done a complete 180 in the last 12 months, and again made mining a priority area for our national development,” David Copley, the White House’s minerals and supply chain coordinator, said at a mining event on Wednesday in Saudi Arabia. “Minerals are the elemental building blocks of everything we need to re-industrialize our country. Over the next few years, the US government will deploy hundreds of billions of dollars of capital into the mining sector between debt and equity.”

On Thursday, a bipartisan group of US lawmakers introduced a bill to create a $2.5 billion stockpile of critical minerals to encourage domestic mining and refining. The US bought stakes in Lithium Americas Corp. (NYSE:LAC) and MP Materials Corp. (NYSE:MP) last year.

“Geopolitical factors are expected to remain a key driver of the antimony market through 2026,” Xiaoying Du and Nico Zhang wrote for Fastmarkets in their market outlook report. “Export controls, environmental regulations, defense priorities and trade relationships are expected to play decisive roles in determining how antimony moves through the global supply chain.”

Disclaimer:

Any opinions expressed in this article are not to be considered investment advice and are solely those of the authors. European Capital Insights is not responsible for any financial decisions made based on the contents of this article. Readers may use this article for information and educational purposes only.

Benzinga Disclaimer: This article is from an unpaid external contributor. It does not represent Benzinga’s reporting and has not been edited for content or accuracy.

Recent Comments