Ahead of United Airlines Holdings Inc.‘s (NASDAQ:UAL) fourth-quarter earnings on Tuesday, here’s what you need to know about what’s driving the company’s news cycle.

Q4 Estimates

According to analyst estimates, UAL is expected to report an EPS of $2.93-$3.05 per share. Analyst consensus also puts United’s revenue somewhere around the $15.37-$15.44 billion mark, an almost 5% surge from its Q4 2024 revenue of $14.70 billion.

UAL Last Quarter Performance

The company reported mixed earnings results in the third quarter, beating analyst EPS estimates of $2.62 with $2.78 per share. The company also reported 6% YoY surge in Premium cabin revenue, while basic economy revenue also grew 4% YoY.

While United’s revenue grew 2.6% YoY to $15.225 billion, it still missed the analyst consensus of $15.325 billion for Q3. It also reported a share buyback of $19 million in the third quarter of 2025.

United Taps Former American Airlines Executive

The company also tapped Vasu Raja, a former American Airlines Group Inc. (NASDAQ:AAL) executive, in a reshuffling of its loyalty program leadership, according to a report by Bloomberg on Thursday. Raja’s appointment comes after American Airlines CEO Robert Isom reportedly let the former go for alienating corporate clients, the report suggests.

Starlink On United Flights

The company has also teamed up with Elon Musk-backed SpaceX‘s satellite internet service provider, Starlink, to offer in-flight Wi-Fi services on all of its mainline flights after it received approval from the Federal Aviation Administration (FAA) to begin rolling out the service.

Boeing Widebody Jet Routes

Meanwhile, the flight operator is also eyeing San Francisco as the hub for its awaited “Elevated” interior in the Boeing Co. (NYSE:BA) 787-9 Dreamliner fleet, according to a report by Simple Flying last week.

The airline has touted the Elevated as its luxurious widebody operations and will run the fleet on the San Francisco–Singapore, as well as the San Francisco–London routes, according to the report.

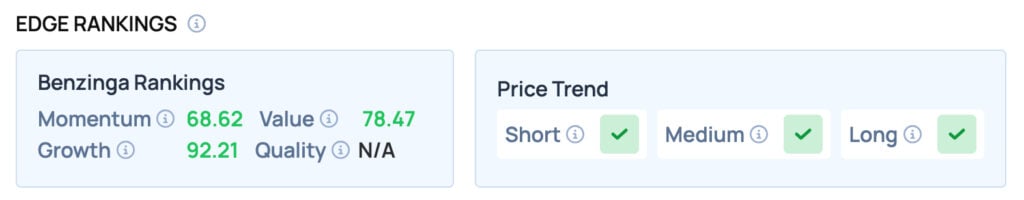

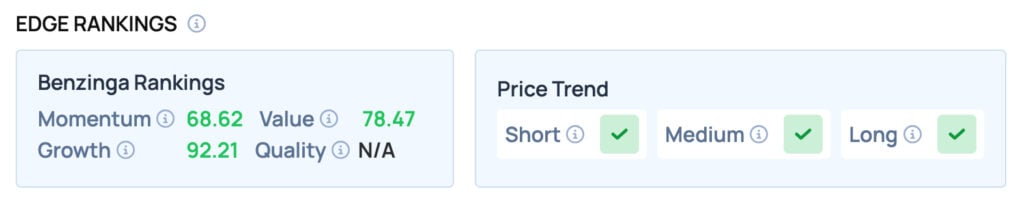

United Airlines scores well on Momentum, Value, and Growth metrics. It also offers a favorable price trend in the Short, Medium, and Long term.

Price Action: UAL gained 4.76% to $116.02 at Market close on January 15, but declined 2.22% to $113.45 during the After-hours trading on Friday.

Check out more of Benzinga’s Future Of Mobility coverage by following this link.

Photo: FiledIMAGE / Shutterstock

Recent Comments