U.S. stock futures rose on Friday following Thursday’s positive close. Futures of major benchmark indices were higher.

On Thursday, chip stocks were standout performers after Taiwan Semiconductor Manufacturing Co. (NYSE:TSM) posted a record quarter. Financials also rallied, as Goldman Sachs Group Inc. (NYSE:GS) rose over 4% on strong fourth-quarter profits and Morgan Stanley (NYSE:MS) jumped nearly 6% on upbeat results.

Meanwhile, the 10-year Treasury bond yielded 4.17%, and the two-year bond was at 3.56%. The CME Group’s FedWatch tool‘s projections show markets pricing a 95% likelihood of the Federal Reserve leaving the current interest rates unchanged in January.

| Index | Performance (+/-) |

| Dow Jones | 0.11% |

| S&P 500 | 0.28% |

| Nasdaq 100 | 0.47% |

| Russell 2000 | 0.38% |

The SPDR S&P 500 ETF Trust (NYSE:SPY) and Invesco QQQ Trust ETF (NASDAQ:QQQ), which track the S&P 500 index and Nasdaq 100 index, respectively, were higher in premarket on Friday. The SPY was up 0.30% at $694.33, while the QQQ advanced 0.51% to $624.93.

Stocks In Focus

Chevron

- Chevron Corp. (NYSE:CVX) was 0.51% higher in premarket on Friday as the company, along with its partners have reached a final investment decision to expand the Leviathan reservoir’s production capacity, aiming to deliver approximately 21 billion cubic meters of natural gas annually to Israel, Egypt, and Jordan by the end of the decade.

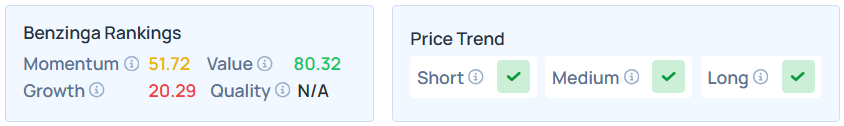

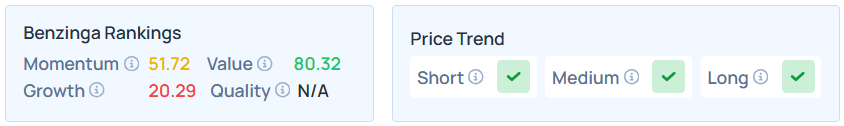

- Benzinga’s Edge Stock Rankings shows that CVX maintains a stronger price trend over the short, medium, and long term, with a solid value ranking.

Paysafe

- Paysafe Ltd. (NYSE:PSFE) gained 2.20% after it announced a strategic partnership with payments orchestration platform Pay.com to serve as a recommended card acquirer and integrate its Skrill, Neteller, and Paysafecard solutions, aiming to optimize transaction approval rates and checkout flexibility for global merchants.

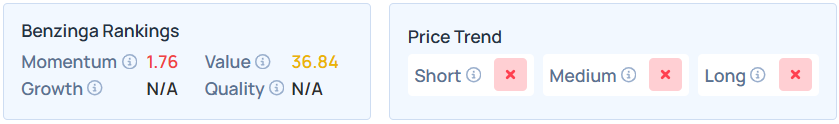

- Benzinga’s Edge Stock Rankings indicate that PSFE maintains a weaker price trend over short, medium, and long term, with a moderate value ranking.

J.B. Hunt Transport Services

- J.B. Hunt Transport Services Inc. (NASDAQ:JBHT) dropped 4.19% after reporting mixed financial results for the fourth quarter. Its fourth-quarter revenue of $3.097 billion was slightly below estimates of $3.099 billion.

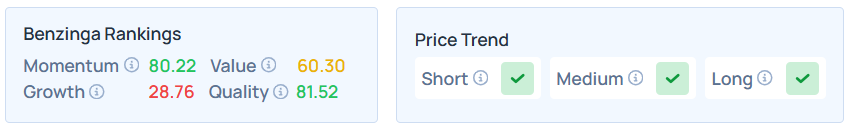

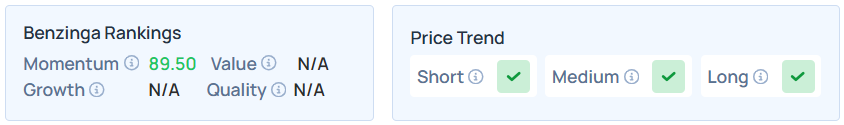

- It maintains a stronger price trend over the short, medium, and long term with a poor growth ranking, as per Benzinga’s Edge Stock Rankings.

QXO

- QXO Inc. (NYSE:QXO) declined 4.08% after it announced a $750 million common stock offering and reported preliminary fourth-quarter net sales of $2.19 billion.

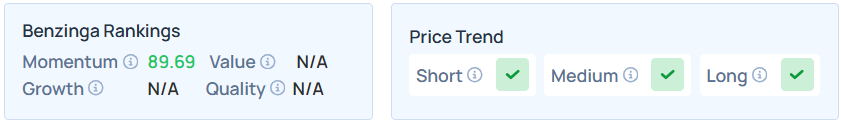

- QXO maintains a stronger price trend over the short, medium, and long terms, as per Benzinga’s Edge Stock Rankings.

ImmunityBio

- ImmunityBio Inc. (NASDAQ:IBRX) shares surged 21.01% after jumping over 30% on Thursday. It announced preliminary net product revenue for Anktiva reached approximately $113 million for fiscal 2025, reflecting a remarkable 700% increase year-over-year.

- IBRX maintains a stronger price trend over the short, medium, and long terms, as per Benzinga’s Edge Stock Rankings.

Cues From Last Session

Utilities, industrials, and real estate stocks recorded the biggest gains on Thursday, while energy and health care shares bucked the trend to close lower.

| Index | Performance (+/-) | Value |

| Dow Jones | 0.60% | 49,442.44 |

| S&P 500 | 0.26% | 6,944.47 |

| Nasdaq Composite | 0.25% | 23,530.02 |

| Russell 2000 | 0.86% | 2,674.56 |

Insights From Analysts

Jennifer Timmerman, Investment Strategy Analyst at Wells Fargo Investment Institute, maintains a bullish outlook for 2026, asserting that the U.S. economy has entered the new year on “firm footing”.

She highlights that despite persistent geopolitical headlines, the “U.S. economy’s resilience appears undeniable,” supported by a robust 4.3% GDP growth rate in late 2025.

Timmerman notes that while “manufacturing remains weak,” strength in services and consumer spending suggests most economic indicators are flashing “green” for broadening growth. She anticipates that positive forces—including Federal Reserve rate cuts, tax cuts, and AI-driven productivity—will drive broader equity-market sector participation.

Although she cautions that “it’s unlikely the market will enjoy smooth sailing throughout 2026,” she advises investors to focus on long-term themes rather than daily noise. Ultimately, Timmerman concludes that the current environment represents an “all systems go” signal for investors.

Upcoming Economic Data

Here’s what investors will be keeping an eye on Friday.

- December’s industrial production and capacity utilization data will be released by 9:15 a.m., Richmond Fed President Tom Barkin will speak at 11:00 a.m., and Federal Reserve Vice Chair Philip Jefferson will speak at 3:30 p.m. ET.

Commodities, Gold, Crypto, And Global Equity Markets

Crude oil futures were trading higher in the early New York session by 1.01% to hover around $59.79 per barrel.

Gold Spot US Dollar fell 0.31% to hover around $4,601.79 per ounce. Its last record high stood at $4,643.06 per ounce. The U.S. Dollar Index spot was 0.04% lower at the 99.2780 level.

Meanwhile, Bitcoin (CRYPTO: BTC) was trading 1.46% lower at $95,562.46 per coin.

Asian markets closed mixed on Friday, as China’s CSI 300, Japan’s Nikkei 225, and Hong Kong’s Hang Seng indices fell. While India’s Nifty 50, Australia’s ASX 200, and South Korea’s Kospi indices rose. European markets were mixed in early trade.

Photo: Shutterstock

Recent Comments