B2Gold Corp. (NYSE:BTG) shares are amplifying their signal in an already hot sector, with the stock’s momentum ranking on Benzinga Edge jumping to the 91st percentile this week.

Momentum Score Jumps

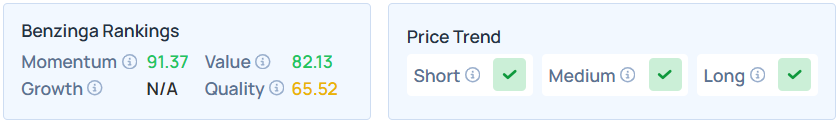

The momentum score climbed from 89.23 to 91.37, confirming that the miner is participating heavily in the “leveraged upside” analysts see across the precious metals complex.

The surge in momentum aligns with broader expert analysis suggesting that mining stocks are currently offering a compelling alternative to physical commodities.

According to a recent research note by LPL Financial, miners provide investors with leveraged exposure to accelerating gold and silver demand, along with the benefits of cash flow and earnings that physical metal ownership cannot provide.

Fundamental & Value Support

Apart from the momentum signal, B2Gold’s fundamentals appear to back the move. The stock holds a value ranking of 82.13, indicating it remains cheaper than 82% of the market despite the recent rally.

This mirrors the broader sector narrative where, despite strong performance, mining stocks continue to trade at a discount to the S&P 500.

Thomas Shipp, the Head of Equity Research at LPL Financial, notes that mining index revenues are expected to grow 30% in fiscal 2025, with earnings potentially nearly doubling, yet the group trades at roughly 14.3x forward earnings compared to the S&P 500’s 19.5x.

Technical Trends And Outlook

B2Gold’s technical profile is currently green across the board, as Benzinga’s Edge Stock Rankings shows positive trends over short, medium, and long-term timeframes.

However, the intensity of this momentum comes with a caveat. With the broader mining index trading within a “steep rising channel” and many constituents showing overbought conditions (RSI > 70), Shipp advises a tactical approach.

While the uptrend is sustained, investors looking to capture this leveraged upside might be wise to view pullbacks as entry opportunities rather than chasing the peak of the rally.

B2Gold Gains Nearly 95% In A Year

Shares of BTG have gained by 2.89% in 2026 so far. They were also higher by 34.20% over the last six months and 94.54% over the past year.

On Thursday, the stock closed 0.64% lower at $4.63 apiece, while it was up 0.43% in premarket on Friday.

Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors.

Image via Shutterstock

Recent Comments