The most oversold stocks in the consumer staples sector presents an opportunity to buy into undervalued companies.

The RSI is a momentum indicator, which compares a stock’s strength on days when prices go up to its strength on days when prices go down. When compared to a stock’s price action, it can give traders a better sense of how a stock may perform in the short term. An asset is typically considered oversold when the RSI is below 30, according to Benzinga Pro.

Here’s the latest list of major oversold players in this sector, having an RSI near or below 30.

Oddity Tech Ltd (NASDAQ:ODD)

- On Jan. 8, Keybanc analyst Scott Schoenhaus maintained ODDITY Tech with an Overweight rating and lowered the price target from $70 to $50. The company’s stock fell around 20% over the past month and has a 52-week low of $33.06.

- RSI Value: 25.3

- ODD Price Action: Shares of Oddity Tech fell 0.1% to close at $33.80 on Wednesday.

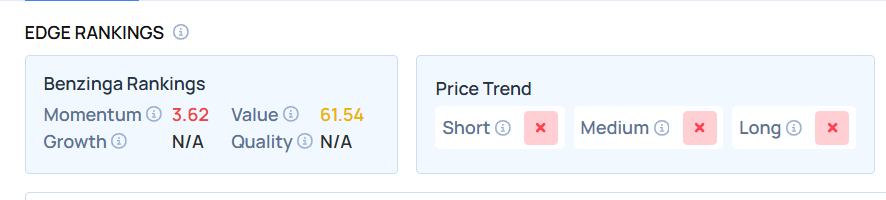

- Edge Stock Ratings: 91.92 Momentum score with Value at 93.51.

PMGC Holdings Inc (NASDAQ:ELAB)

- On Jan. 6, the company announced a 1-for-4 reverse split and an investment in non-controlling shares of Nuclea Energy Inc, which closed on Nov. 6. The company’s stock fell around 73% over the past month and has a 52-week low of $3.54.

- RSI Value: 16.2

- ELAB Price Action: Shares of PMGC Holdings dipped 11.4% to close at $3.56 on Wednesday.

- Benzinga Pro’s charting tool helped identify the trend in ELAB stock.

Zevia Pbc (NYSE:ZVIA)

- On Jan. 14, Telsey Advisory Group analyst Sarang Vora maintained Zevia with an Outperform rating and maintained a $6 price target. The company’s stock fell around 33% over the past month and has a 52-week low of $1.66.

- RSI Value: 26

- ZVIA Price Action: Shares of Zevia fell 3.5% to close at $1.68 on Wednesday.

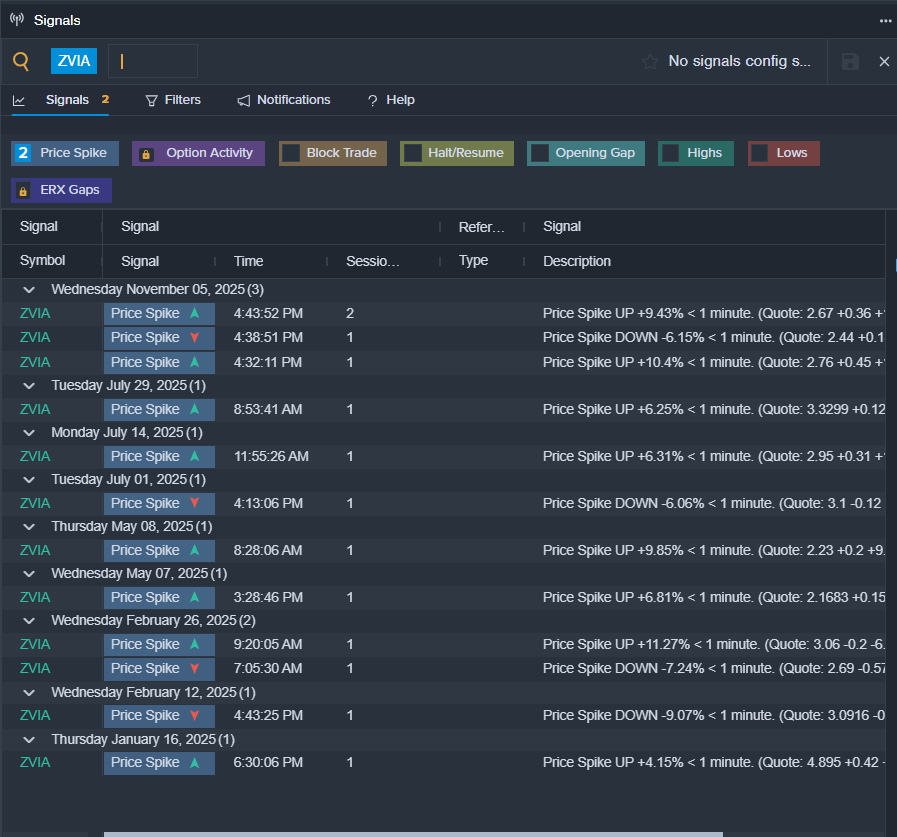

- Benzinga Pro’s signals feature notified of a potential breakout in ZVIA shares.

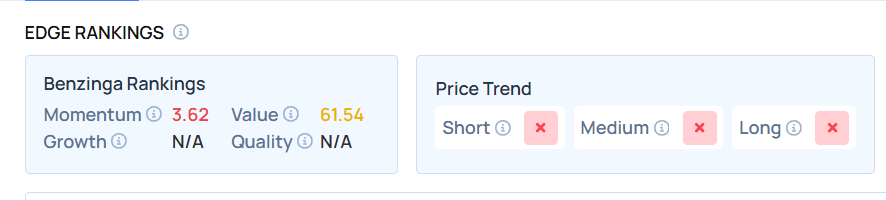

Learn more about BZ Edge Rankings—click to see scores for other stocks in the sector and see how they compare.

Photo via Shutterstock

Recent Comments