Wells Fargo & Company (NYSE:WFC) posted stronger-than-expected fourth-quarter earnings on Wednesday.

Wells Fargo reported fourth-quarter 2025 net income of $5.4 billion, or $1.62 per diluted share, up from $5.1 billion, or $1.43 per share, a year earlier.The bank reported fourth-quarter adjusted earnings of $1.76, beating the consensus of $1.67.

Revenue increased 4% year over year to $21.3 billion, supported by growth in both net interest and fee income. Analysts expected $21.65 billion.

Looking ahead to 2026, Wells Fargo expects net interest income excluding Markets to increase from 2025 levels, driven by balance-sheet growth, loan and deposit mix improvements, and continued fixed-rate asset repricing. The outlook assumes two to three Federal Reserve rate cuts during the year, with the 10-year Treasury yield remaining relatively stable.

Wells Fargo shares fell 0.3% to trade $88.95 on Thursday.

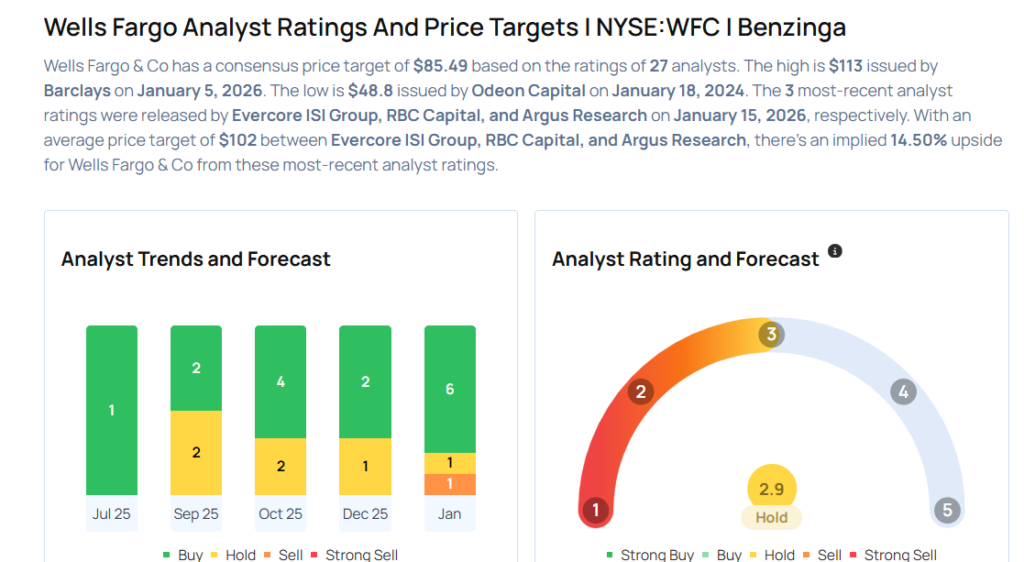

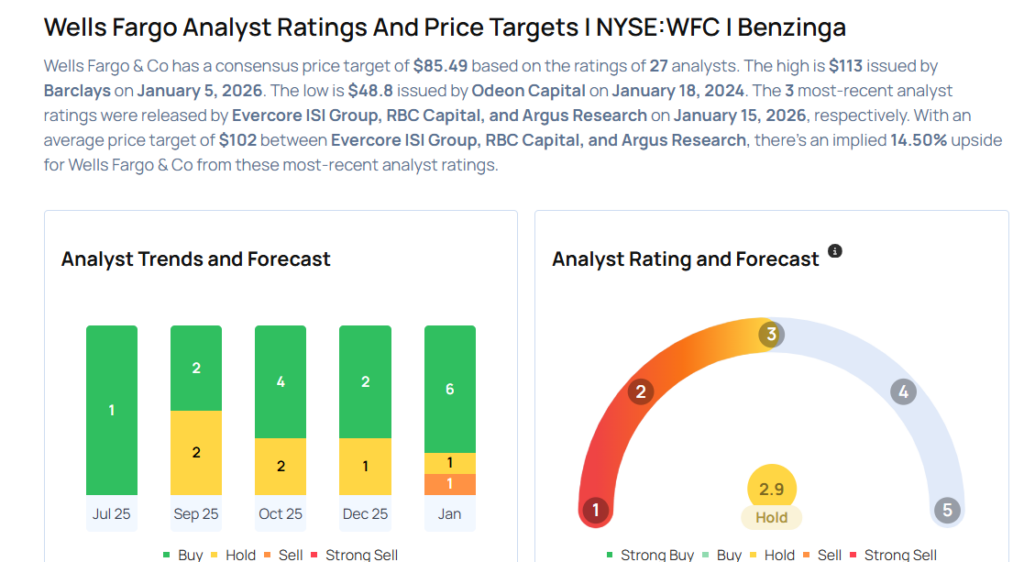

These analysts made changes to their price targets on Wells Fargo following earnings announcement.

- Truist Securities analyst John McDonald maintained Wells Fargo with a Buy and lowered the price target from $104 to $100.

- Argus Research analyst Stephen Biggar maintained the stock with a Buy and raised the price target from $94 to $101.

- Evercore ISI Group analyst John Pancari maintained Wells Fargo with an Outperform rating and lowered the price target from $110 to $105.

Considering buying WFC stock? Here’s what analysts think:

Photo via Shutterstock

Recent Comments