Infosys (NYSE:INFY) reported better-than-expected third-quarter earnings on Wednesday.

Infosys posted adjusted earnings of 21 cents per share, versus market estimates of 20 cents per share. The company’s sales came in at $5.099 billion up from $4.939 billion in the year-ago period.

“Infosys delivered a strong Q3 performance demonstrating how our differentiated value propositions in enterprise AI, through Infosys Topaz, are consistently driving higher market share. Clients increasingly view Infosys as their AI partner with demonstrated expertise, innovation capabilities and strong delivery credentials. This has helped them unlock business potential and enhanced value realization,” said Salil Parekh, CEO and MD. “Central to this journey is our commitment to reskill, transform and empower our dedicated human resource pool to drive success in an AI augmented world,” he added.

Infosys said it sees FY26 revenue growth of 3% to 3.5% in constant currency.

Infosys shares fell 3.9% to trade $18.58 on Thursday.

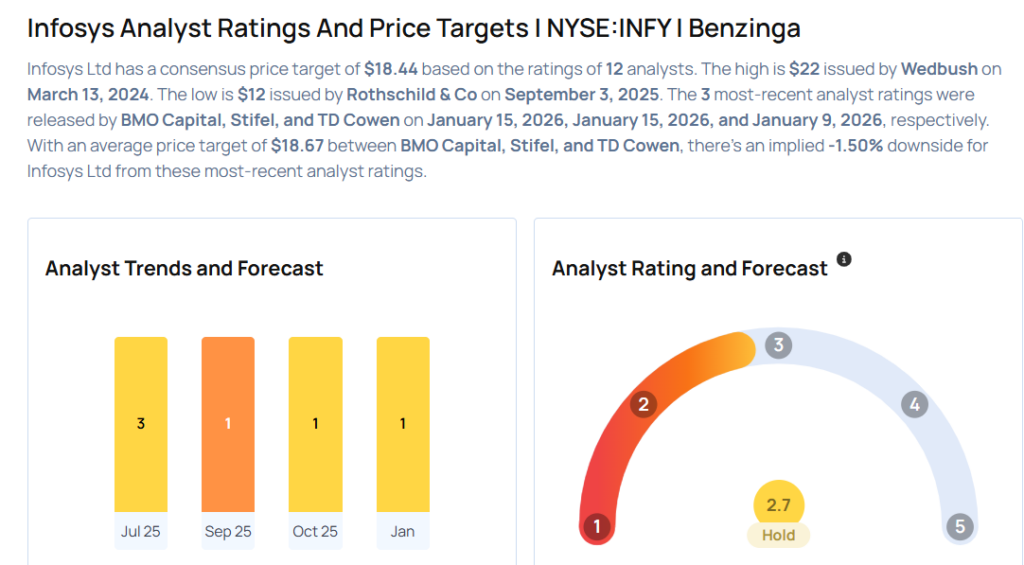

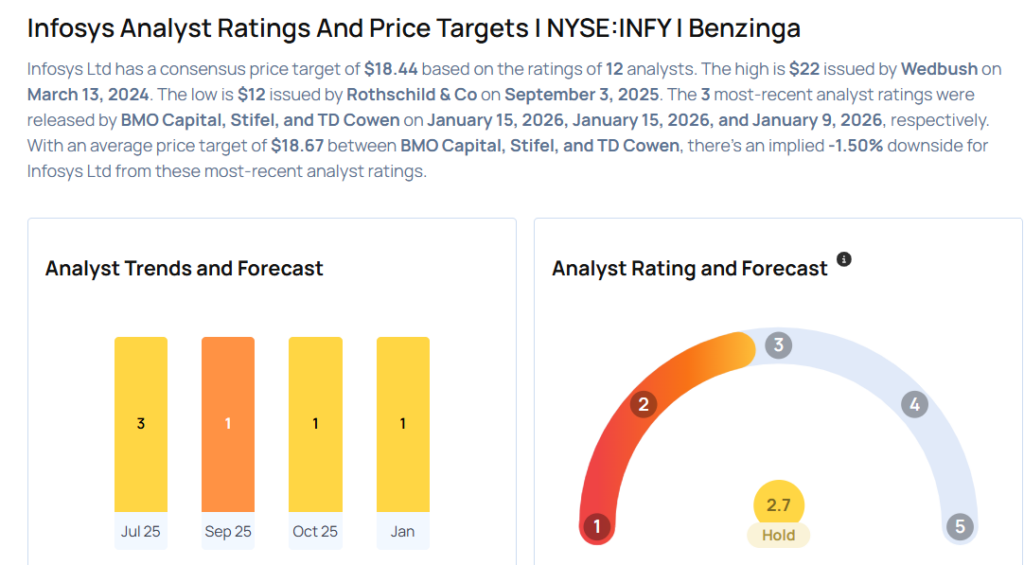

These analysts made changes to their price targets on Infosys following earnings announcement.

- Stifel analyst David Grossman maintained the stock with a Hold and raised the price target from $16.5 to $19.

- BMO Capital analyst Keith Bachman maintained Infosys with a Market Perform and raised the price target from $18 to $20.

Considering buying INFY stock? Here’s what analysts think:

Photo via Shutterstock

Recent Comments