On Wednesday, Tesla Inc. (NASDAQ:TSLA) CEO Elon Musk leaned into battlefield rhetoric after prediction market Kalshi showed rising odds for his victory in a looming legal fight against OpenAI, its CEO Sam Altman and key partner Microsoft Corp (NASDAQ:MSFT).

Trial Date Set For Musk–OpenAI Legal Clash

A federal judge has scheduled an April 27 trial in the lawsuit brought by Musk against OpenAI, Altman and other defendants, including Microsoft.

Musk has alleged that OpenAI abandoned its founding nonprofit, public-benefit mission and misled him while transforming the organization into a for-profit enterprise closely tied to Microsoft.

Musk was an original co-founder of OpenAI in 2015 and its largest early backer, contributing tens of millions of dollars before leaving the organization in 2018.

OpenAI later released ChatGPT in 2022, while Musk went on to launch rival artificial intelligence startup xAI.

Microsoft, which first invested in OpenAI in 2019, has since poured billions into the company and emerged as its largest stakeholder following a restructuring last year.

Kalshi Odds Shift After Musk Weighs In

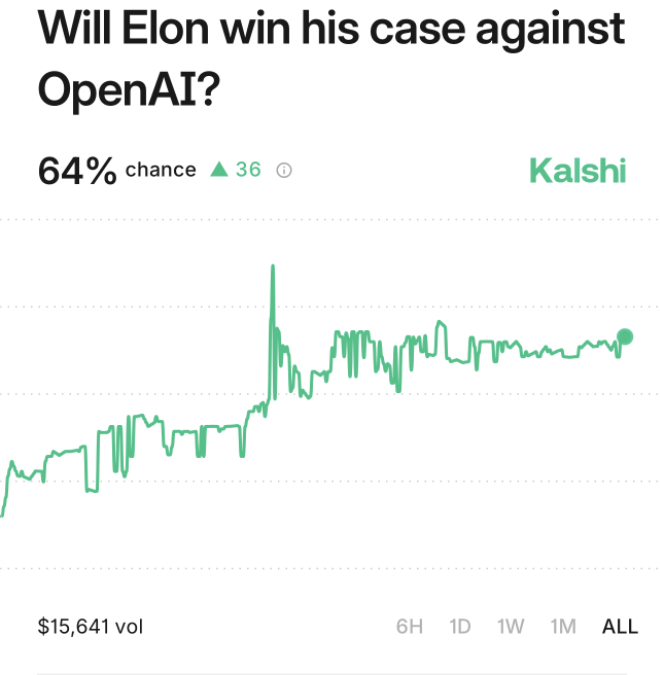

Following news of the trial date, Musk responded on X to a post from prediction market exchange Kalshi, asking, “What are the odds looking like?”

Kalshi initially replied that the market placed Musk’s chances of winning at 36%. Hours later, the exchange posted an update showing the odds had climbed to 41%.

Sharing the revised screenshot, Musk wrote, “I’ve lost a few battles over the years, but I’ve never lost a war.”

Market Sentiment Meets Courtroom Reality

At the time of writing, Kalshi’s market showed bettors assigning Musk a roughly 64% chance of prevailing.

While prediction markets reflect sentiment rather than legal outcomes, the shifting odds underscore growing attention around a case that could reshape the governance and commercialization of artificial intelligence.

Price Action: On Wednesday, Microsoft shares slipped 2.40% during the regular session and gained 0.081% in after-hours trading, according to Benzinga Pro.

Benzinga’s Edge Stock Rankings rank Microsoft in the 82nd percentile for Quality. While its short and medium-term price trends are negative, the long-term outlook remains positive. Click here to compare it with peers and competitors.

Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors.

Photo Courtesy: Shutterstock.com

Recent Comments