Dell Technologies Inc (NYSE:DELL) shares were trading higher on Thursday afternoon after Barclays upgraded the stock to Overweight from Equal-Weight, pointing to rising momentum in the company’s AI strategy.

Here’s what investors need to know.

- Dell Technologies stock is moving in positive territory. Why is DELL stock trading higher?

Dell Stock Rises On Operational Revamp, Analyst Upgrade

An internal memo, reported by Business Insider, says Dell COO Jeff Clarke outlined “One Dell Way,” a major operational transformation. The initiative will replace multiple applications and databases with a single enterprise platform launching May 3, standardizing processes, unifying data and reducing complexity across the business.

Clarke said simplifying Dell’s infrastructure is critical to unlocking AI’s potential. A streamlined, automated system is expected to make it easier for customers to deploy AI workloads and for Dell to operate as a single, integrated organization.

The revamp follows Dell’s $120 million acquisition of Israeli AI startup Dataloop AI, bolstering its end-to-end AI infrastructure offerings. Despite mixed third-quarter results, Dell reported strong AI-driven revenue, including record AI server demand of $12.3 billion and $30 billion in total orders.

Why The News Is Lifting Dell Stock

Investors often reward companies that combine cost-saving changes with clear growth drivers. Dell’s plan to modernize systems, deepen AI capabilities and capitalize on AI server demand, reinforced by Barclays’ upgrade, signals stronger earnings potential and lower execution risk, helping lift Dell shares Thursday afternoon.

Short-Term Weakness Signals Caution Ahead

Dell Technologies is currently trading 3.7% below its 20-day simple moving average (SMA) and 11.5% below its 100-day SMA, suggesting some short-term weakness. Over the past 12 months, shares have increased by 10.17% and are positioned closer to their 52-week highs than lows.

The RSI is at 33.67, which is considered neutral territory, while the MACD is below its signal line, indicating bearish pressure on the stock. The combination of neutral RSI and bearish MACD suggests mixed momentum.

- Key Resistance: $131.50

- Key Support: $116.50

Record Earnings Forecast

Investors are looking ahead to the next earnings report on Feb. 26.

- EPS Estimate: $3.42 (Up from $2.68 year-over-year)

- Revenue Estimate: $31.60 billion (Up from $23.93 billion YoY)

- Valuation: P/E of 15.9x (Indicates fair valuation)

Analyst Consensus & Recent Actions: The stock carries a Buy Rating with an average price target of $165.64. Recent analyst moves include:

- Barclays: Upgraded to Overweight (Target $148 on Jan. 15)

- Goldman Sachs: Buy (Lowered Target to $165 on Jan. 14)

- Mizuho: Outperform (Raised Target to $175 on Nov. 26, 2025)

Valuation Insight: While the stock trades at a fair P/E multiple, the strong consensus and 28% expected earnings growth suggest analysts view this growth as justification for the 38% upside to analyst targets.

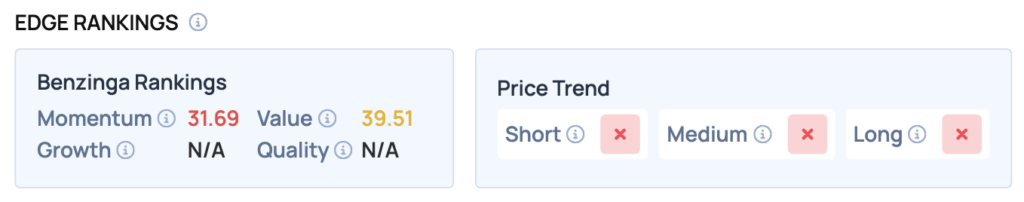

Benzinga Edge Rankings

Below is the Benzinga Edge scorecard for Dell Technologies, highlighting its strengths and weaknesses compared to the broader market:

- Momentum: Neutral (Score: 31.69/100) — The stock is currently underperforming relative to the market.

- Value: Risk (Score: 39.51/100) — The stock is trading at a moderate premium relative to peers.

The Verdict: Dell Technologies’s Benzinga Edge signal reveals a mixed outlook as the stock struggles with momentum but maintains a fair valuation. Investors should monitor upcoming earnings closely, as the company’s strategic moves in AI could significantly impact future performance.

Top ETF Exposure

- American Customer Satisfaction ETF (BATS:ACSI): 4.09% Weight

- Alpha Dog ETF (NYSE:RUFF): 1.61% Weight

- Tortoise AI Infrastructure ETF (NYSE:TCAI): 4.38% Weight

Significance: Because Dell carries significant weight in these funds, any significant inflows or outflows for these ETFs will likely force automatic buying or selling of the stock.

Dell Shares Gain on Thursday

DELL Price Action: Dell Technologies shares were up 0.80% at $119.67 at the time of publication on Thursday, according to Benzinga Pro data.

Image: Shutterstock

Recent Comments