Critical Metals Corp (NASDAQ:CRML) shares are trading lower on Thursday, pulling back after Wednesday’s surge following the release of strong assay results from its drilling campaign at the Tanbreez rare earths project in Greenland. Here’s what investors need to know.

- Critical Metals stock is among today’s weakest performers. What’s behind CRML decline?

How Do New Findings Change Resource Estimates?

The latest drilling results revealed intervals grading between 0.40% and 0.47% total rare earth oxides, with heavy rare earths comprising about 26% to 27% of the mix across multiple holes.

Management indicated that these findings are expected to contribute to a revised mineral resource estimate and optimization studies, which are seen as crucial steps toward project financing and construction.

Additionally, the program confirmed economically significant levels of by-products, including gallium and hafnium, enhancing Tanbreez’s profile as a multi-commodity deposit. This evidence suggests a larger and more mineable resource than previously modeled, likely prompting traders to reassess CRML’s long-term cash flow potential.

Unpacking The Mixed Momentum Signals

Critical Metals is currently trading 76.9% above its 20-day simple moving average (SMA) and 79.8% above its 100-day SMA, reflecting significant strength over the longer term. Shares have increased 125.54% over the past 12 months and are positioned closer to their 52-week highs than lows.

The RSI is at 76.21, indicating that the stock is in overbought territory, which may suggest a potential pullback. Meanwhile, the MACD is above its signal line, signaling bullish momentum for the stock.

The combination of an overbought RSI and bullish MACD suggests mixed momentum, indicating that while the stock has performed well, caution may be warranted due to the overbought condition.

- Key Resistance: $17.50

- Key Support: $15.00

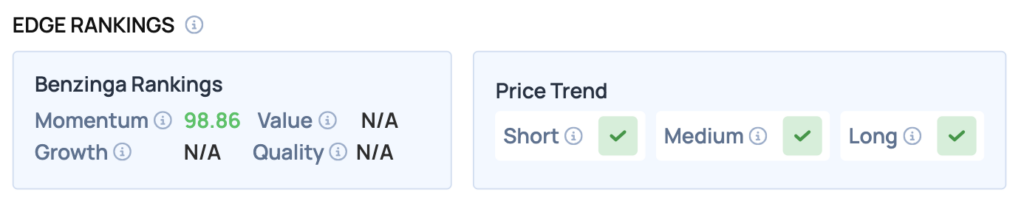

Benzinga Edge Rankings

Below is the Benzinga Edge scorecard for Critical Metals, highlighting its strengths and weaknesses compared to the broader market:

- Momentum: Bullish (Score: 98.86) — Stock is outperforming the broader market.

The Verdict: Critical Metals’ Benzinga Edge signal reveals a strong momentum setup. While the high momentum score confirms the stock’s upward trend, investors should remain cautious given the overbought conditions indicated by the RSI.

Price Action

CRML Price Action: Critical Metals shares were down 4.13% at $17.17 at the time of publication on Thursday, according to Benzinga Pro data.

Recent Comments