Citigroup (NYSE:C) posted a mixed fourth quarter, with earnings beating expectations but revenue missing estimates on Wednesday.

The bank reported fourth-quarter revenue (net of interest expense) of $19.87 billion, up 2% year over year but below the analyst consensus of $20.53 billion. Excluding divestiture-related impacts tied to the planned sale of AO Citibank in Russia, revenue increased 8%.

Net income declined 13% year over year to $2.5 billion, reflecting a $1.1 billion after-tax loss related to the Russia exit. Adjusted net income totaled $3.6 billion, while adjusted earnings per share came in at $1.81, exceeding expectations of $1.68.

Citigroup CFO Mark Mason said the bank is closely monitoring current market reactions and emphasized that Citi has minimal exposure to the situation in focus, noting that its operations in Venezuela were sold in 2021, including both corporate and retail businesses. While Citi is tracking developments, Mason declined to comment on any future business plans involving the country.

Citigroup shares rose 4.1% to trade $117.00 on Thursday.

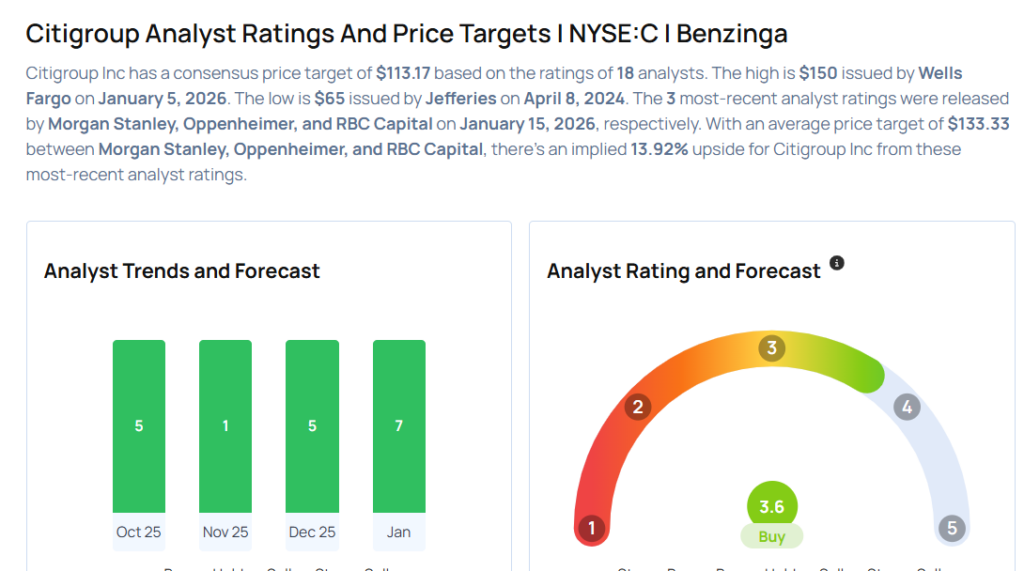

These analysts made changes to their price targets on Citigroup following earnings announcement.

- Oppenheimer analyst Chris Kotowski maintained Citigroup with an Outperform rating and raised the price target from $141 to $144.

- Morgan Stanley analyst Betsy Graseck maintained the stock with an Overweight rating and raised the price target from $134 to $135.

Considering buying C stock? Here’s what analysts think:

Photo via Shutterstock

Recent Comments