In the ever-changing and fiercely competitive business landscape, conducting thorough company analysis is crucial for investors and industry experts. In this article, we will undertake a comprehensive industry comparison, evaluating Netflix (NASDAQ:NFLX) and its primary competitors in the Entertainment industry. By closely examining key financial metrics, market position, and growth prospects, our aim is to provide valuable insights for investors and shed light on company’s performance within the industry.

Netflix Background

Netflix’s relatively simple business model involves only one business, its streaming service. It has the biggest television entertainment subscriber base in both the United States and the collective international market, with more than 300 million subscribers globally. Netflix has exposure to nearly the entire global population outside of China. The firm has traditionally avoided a regular slate of live programming or sports content, instead focusing on on-demand access to episodic television, movies, and documentaries. The firm introduced ad-supported subscription plans in 2022, giving the firm exposure to the advertising market in addition to the subscription fees that have historically accounted for nearly all its revenue.

| Company | P/E | P/B | P/S | ROE | EBITDA (in billions) | Gross Profit (in billions) | Revenue Growth |

|---|---|---|---|---|---|---|---|

| Netflix Inc | 36.99 | 14.47 | 8.90 | 10.01% | $7.37 | $5.35 | 17.16% |

| The Walt Disney Co | 16.57 | 1.84 | 2.18 | 1.2% | $3.85 | $8.45 | -0.49% |

| Spotify Technology SA | 67.91 | 12.02 | 5.66 | 12.48% | $0.86 | $1.35 | 7.12% |

| Warner Bros. Discovery Inc | 150.68 | 1.97 | 1.89 | -0.41% | $4.28 | $4.48 | -6.01% |

| Live Nation Entertainment Inc | 106.36 | 65.38 | 1.41 | 38.94% | $0.98 | $2.06 | 11.08% |

| Tencent Music Entertainment Group | 17.56 | 2.27 | 5.97 | 2.58% | $2.72 | $3.68 | 20.64% |

| TKO Group Holdings Inc | 79.38 | 4.30 | 20.91 | 1.01% | $0.31 | $0.68 | -27.31% |

| Warner Music Group Corp | 45.32 | 25.25 | 2.43 | 17.64% | $0.34 | $0.83 | 14.6% |

| Cinemark Holdings Inc | 21.89 | 5.09 | 1.10 | 6.32% | $0.12 | $0.55 | -6.98% |

| iQIYI Inc | 201.38 | 1.02 | 0.49 | -1.85% | $0.01 | $1.22 | -7.77% |

| Imax Corp | 49.39 | 5.40 | 5.11 | 6.17% | $0.05 | $0.07 | 16.62% |

| Average | 75.64 | 12.45 | 4.71 | 8.41% | $1.35 | $2.34 | 2.15% |

Upon closer analysis of Netflix, the following trends become apparent:

-

The Price to Earnings ratio of 36.99 is 0.49x lower than the industry average, indicating potential undervaluation for the stock.

-

With a Price to Book ratio of 14.47, which is 1.16x the industry average, Netflix might be considered overvalued in terms of its book value, as it is trading at a higher multiple compared to its industry peers.

-

The Price to Sales ratio of 8.9, which is 1.89x the industry average, suggests the stock could potentially be overvalued in relation to its sales performance compared to its peers.

-

With a Return on Equity (ROE) of 10.01% that is 1.6% above the industry average, it appears that the company exhibits efficient use of equity to generate profits.

-

With higher Earnings Before Interest, Taxes, Depreciation, and Amortization (EBITDA) of $7.37 Billion, which is 5.46x above the industry average, the company demonstrates stronger profitability and robust cash flow generation.

-

The company has higher gross profit of $5.35 Billion, which indicates 2.29x above the industry average, indicating stronger profitability and higher earnings from its core operations.

-

The company’s revenue growth of 17.16% exceeds the industry average of 2.15%, indicating strong sales performance and market outperformance.

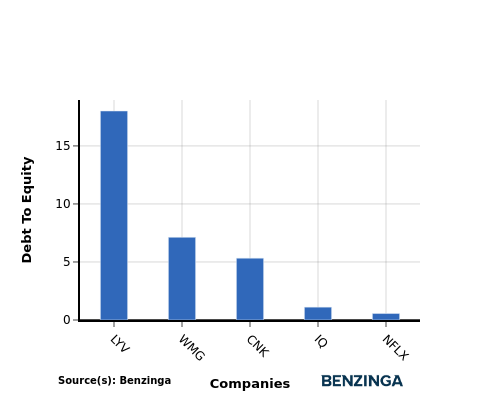

Debt To Equity Ratio

The debt-to-equity (D/E) ratio is a financial metric that helps determine the level of financial risk associated with a company’s capital structure.

Considering the debt-to-equity ratio in industry comparisons allows for a concise evaluation of a company’s financial health and risk profile, aiding in informed decision-making.

In terms of the Debt-to-Equity ratio, Netflix stands in comparison with its top 4 peers, leading to the following comparisons:

-

Netflix has a stronger financial position compared to its top 4 peers, as evidenced by its lower debt-to-equity ratio of 0.56.

-

This suggests that the company has a more favorable balance between debt and equity, which can be perceived as a positive indicator by investors.

Key Takeaways

For Netflix, the PE ratio is low compared to peers, indicating potential undervaluation. The high PB and PS ratios suggest strong market sentiment and revenue multiples. In terms of ROE, EBITDA, gross profit, and revenue growth, Netflix demonstrates high performance relative to industry peers, reflecting strong profitability and growth potential in the Entertainment sector.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

Recent Comments