San Francisco-based Wells Fargo & Co. (NYSE:WFC) will report fourth-quarter earnings Wednesday morning, in what investors see as the first full-scale test of the bank’s post-asset-cap strategy.

Start Of Real Growth Story

In June 2025, the Federal Reserve removed the asset-cap provision that had been in place on the bank since 2018, owing to a string of scandals tied to improper customer practices.

The cap had effectively frozen Wells Fargo’s balance sheet at $1.95 trillion, and following its removal, the company can finally resume growth by growing its deposits and expanding its loan books, which were frozen in place over the past couple of years.

While this is the second quarter since the company rid itself of heightened regulatory constraints, it marks the first real test for the company, as investors wait to see if the company fulfils its post-cap objectives.

During its third-quarter results three months ago, management had guided aggressive growth in its return on tangible common equity, or ROTCE, at 17% to 18%, compared to 15.2% during the third quarter.

The bank also introduced a new common equity tier 1, or CET1 target of 10.0% to 10.5%, down from 11%, signaling a more assertive capital deployment strategy as it begins leveraging its expanded balance sheet, all while aiming to preserve the cost discipline and credit quality that defined its multi-year turnaround.

“We are now beginning to use this increased capacity and [have] started to grow our balance sheet,” the bank’s CEO Charles Scharf said during the earnings call, noting that its total assets at the end of the third quarter were already at $2 trillion, “for the first time in the company’s history.”

Long-Term Turnaround

Bank of America Securities analyst Ebrahim Poonawala reiterated a “Buy” rating on the stock recently, while increasing its Price Target to $107 from $100, representing an upside of 14.36% from current levels.

According to Poonawala, Wells Fargo remains a long-term turnaround story supported by several catalysts, including an ROTCE in the high-teens, while forecasting earnings per share of $7.07 for fiscal 2026 and $8.21 for fiscal 2027, implying earnings growth 15% year-over-year.

Wells Fargo currently trades at just 13.59 times forward earnings, compared to the S&P 500, tracked by the SPDR S&P 500 ETF Trust (NYSE:SPY) at 28.09 and the State Street Financial Select Sector SPDR ETF (NYSE:XLF), which tracks the financial services sector at 18.66.

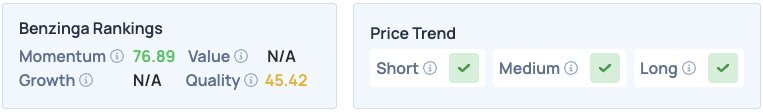

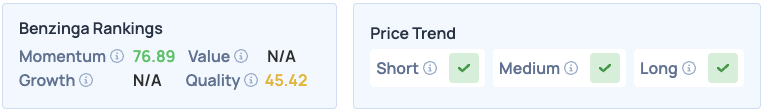

Shares of Wells Fargo were down 1.47% on Tuesday, closing at $93.56 and are down 0.01% overnight. The stock scores high on Momentum in Benzinga’s Edge Stock Rankings, with a favorable price trend in the short, medium and long terms. Click here for deeper insights into the stock, its peers and competitors.

Photo courtesy: Rob Wilson / Shutterstock.com

Recent Comments