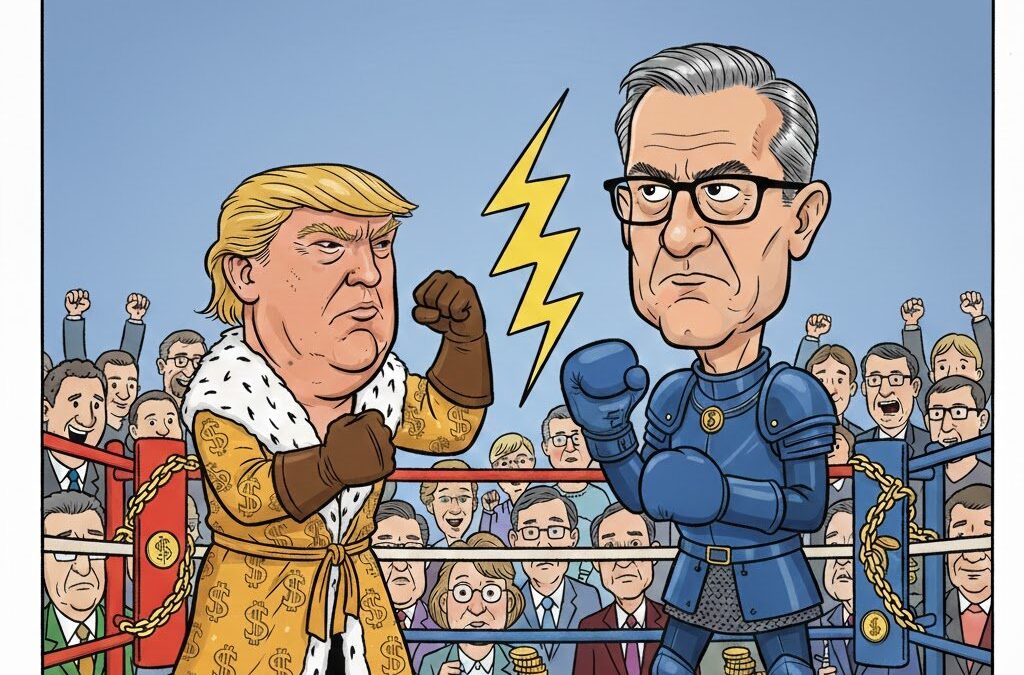

A fresh wave of political pressure on the Federal Reserve is rippling through financial markets, and cryptocurrencies are among the biggest beneficiaries. Bitcoin (CRYPTO: BTC) and major altcoins moved higher after President Donald Trump sharply criticized Federal Reserve Chair Jerome Powell, calling him a “jerk” and suggesting he “will be gone soon” during remarks at the Detroit Economic Club.

The comments, combined with reports of a potential Department of Justice probe into aspects of Federal Reserve leadership, have reignited speculation that the central bank could tilt more dovish in the months ahead. For crypto traders, the implications are familiar and powerful. Expectations of lower interest rates and easier monetary policy often translate into stronger demand for risk assets, including digital currencies.

Trump’s Renewed Attack on the Federal Reserve

President Trump has long clashed with the Federal Reserve over interest rate policy, and his latest remarks signal that the tension is far from over. Speaking to business leaders in Detroit, Trump criticized Powell’s leadership and suggested that change at the top of the central bank could be imminent.

While the White House does not have unilateral authority to remove a sitting Fed chair without cause, markets tend to react less to legal nuance and more to perceived political momentum. Trump’s comments reinforced the idea that Federal Reserve independence could face renewed pressure if political conditions shift in his favor.

The timing of the remarks amplified their impact. With investors already focused on the trajectory of interest rates and economic growth, the suggestion of leadership instability at the Fed added a new layer of uncertainty.

Reports of DOJ Scrutiny Add Fuel

Adding to market anxiety were reports that the Department of Justice may be examining aspects of Federal Reserve leadership and governance. While details remain limited and no formal charges or conclusions have been announced, the mere possibility of a probe was enough to move markets.

For traders, the story is less about the outcome of any investigation and more about what it signals. Increased scrutiny raises the odds of change, whether through leadership turnover or policy recalibration. In the context of monetary policy, change is often interpreted as an opening for a softer stance.

Crypto markets are particularly sensitive to shifts in policy expectations. The perception that the Federal Reserve could become more accommodating has historically coincided with periods of strength in Bitcoin and other digital assets.

Why Crypto Responds to Dovish Signals

The relationship between interest rates and cryptocurrencies has become clearer over time. When rates are high, capital tends to favor yield bearing assets such as bonds and money market instruments. When rates are expected to fall, investors often rotate toward growth oriented and speculative assets.

Bitcoin has increasingly traded as a macro sensitive asset, responding to liquidity conditions and expectations around monetary easing. Lower rates reduce the opportunity cost of holding non yielding assets, which can make Bitcoin more attractive to both retail and institutional investors.

Altcoins often amplify this dynamic. Ethereum (CRYPTO: ETH), Solana (CRYPTO: SOL), and other major tokens tend to outperform during periods of rising risk appetite, as traders seek higher beta exposure once confidence improves.

Market Reaction and Price Action

Following Trump’s remarks and the DOJ related reports, crypto prices moved higher across the board. Bitcoin pushed upward as traders positioned for a potential shift in the interest rate narrative. Several large cap altcoins posted stronger percentage gains, reflecting renewed speculative interest.

The rally was not driven by a single technical breakout, but rather by a shift in sentiment. Trading volumes increased, and derivatives markets showed signs of rising bullish positioning without immediately reaching extreme levels.

This type of move often reflects anticipation rather than confirmation. Traders are pricing in what could happen if political pressure translates into policy change, rather than reacting to an actual decision by the Federal Reserve.

What a Leadership Change Could Mean

Speculation about Jerome Powell’s future raises broader questions about the direction of US monetary policy. A new Fed chair, particularly one perceived as more politically aligned with growth priorities, could signal a willingness to cut rates sooner or tolerate higher inflation.

For crypto markets, such a scenario would likely be viewed as supportive. Easier financial conditions tend to boost liquidity, which has historically flowed into digital assets during periods of monetary expansion.

However, uncertainty cuts both ways. A politicized Federal Reserve could introduce volatility, especially if markets begin to question the credibility of inflation fighting efforts. While short term rallies may benefit from dovish expectations, longer term confidence depends on policy stability.

Risks and Counterarguments

Not all analysts are convinced that political pressure will meaningfully alter Federal Reserve policy. The Fed’s institutional structure and legal protections make abrupt leadership changes difficult. Powell’s term and the central bank’s mandate provide a degree of insulation from political rhetoric.

There is also the risk that expectations move too far ahead of reality. If rate cuts fail to materialize or inflation remains sticky, markets could reverse quickly. Crypto rallies driven by policy speculation have historically been vulnerable to sharp pullbacks when narratives change.

Additionally, regulatory uncertainty remains a factor for digital assets. Even in a more dovish monetary environment, shifts in enforcement or legislation could influence market dynamics independently of interest rates.

What Traders Are Watching Next

In the near term, crypto traders will be closely monitoring signals from the Federal Reserve, including speeches, meeting minutes, and economic data that influence rate expectations. Any indication that policymakers are leaning toward easing could reinforce the current rally.

Political developments will also remain in focus. Further comments from Trump or updates related to the reported DOJ scrutiny could add volatility to both traditional and digital markets.

For now, the clash between Trump and Powell has injected fresh momentum into crypto trading. Whether that momentum evolves into a sustained trend will depend on how much of today’s speculation turns into tomorrow’s policy reality.

As expectations around interest rates shift, Bitcoin and the broader crypto market are once again reminding investors that politics, policy, and digital assets are increasingly intertwined.

Benzinga Disclaimer: This article is from an unpaid external contributor. It does not represent Benzinga’s reporting and has not been edited for content or accuracy.

Recent Comments