Meta Platforms Inc. (NASDAQ:META) is reportedly planning to cut about 10% or more jobs in its Reality Labs division, which includes the metaverse, to focus more on next-generation AI initiatives.

The Reality Labs division, which currently employs around 15,000 people is responsible for virtual reality headsets and a VR-based social network. The layoffs could be announced as early as Tuesday, according to The New York Times.

Meta did not immediately respond to Benzinga‘s request for comment.

According to the report, the company plans to shift funding from virtual reality to expand its wearables budget, including smart glasses and wrist-based devices

Meta’s chief technology officer Andrew Bosworth has called for a meeting on Wednesday, urging staff to attend in person. The purpose of the meeting has been described as the “most important” of the year, although no further details have been provided, the report said.

Meta Cuts Jobs, Budgets Across VR And AI

The tech giant’s layoff decisions come amid increasing competition from OpenAI, Alphabet‘s Google (NASDAQ:GOOG) (NASDAQ:GOOGL), and Microsoft Corporation (NASDAQ:MSFT). In April, the company laid off an unspecified number of employees from its Reality Labs division, primarily affecting the Oculus Studios unit, which develops VR and AR games and content for Meta’s Quest VR headsets.

Later, in December, Meta’s stock soared after the company announced job cuts and budget reductions of around 30% for its metaverse group. The report suggested that Meta executives are considering up to 30% budget cuts in 2026 for the metaverse division, which includes Horizon Worlds and the Quest VR unit, despite CEO Mark Zuckerberg previously positioning the metaverse as central to the company’s future and rebranding Facebook around it.

Not just the metaverse division, in October, Meta said it would cut about 600 jobs from its AI division as part of a restructuring aimed at streamlining operations and improving agility, according to an internal memo from Chief AI Officer Alexandr Wang, who joined after Meta’s $14.3 billion investment in Scale AI.

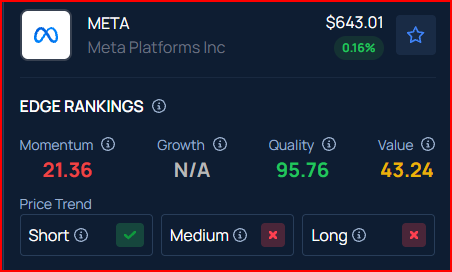

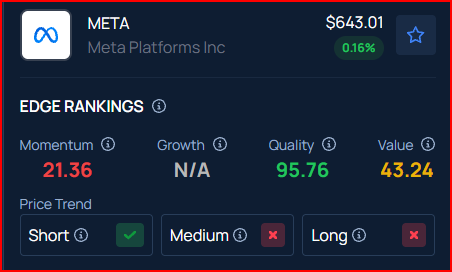

Meta holds a momentum rating of 21.36% and a quality rating of 95.76%, according to Benzinga’s Proprietary Edge Rankings. Click here to see how it compares to other leading tech companies.

Price Action: Over the past year, Meta stock climbed 5.53%, as per data from Benzinga Pro. On Monday, it fell 1.70% to close at $641.97.

Image via Shutterstock

Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors.

Recent Comments