CoreWeave Inc (NASDAQ:CRWV) shares are down on Tuesday, pulling back following Monday’s strength, as the company’s CEO, Michael Intrator, recently dismissed allegations of “circular financing” with Nvidia. Here’s what investors need to know.

- CoreWeave stock is trending lower. Why is CRWV stock retreating?

Does Intrator’s Defense Change The Narrative?

Intrator characterized the narrative surrounding Nvidia’s minority stake in CoreWeave as “ridiculous,” emphasizing that Nvidia’s $300 million investment is minimal compared to CoreWeave’s total capital of over $25 billion.

He defended the company’s aggressive use of debt, explaining that special purpose vehicles are utilized to effectively manage risk, ensuring that revenue from investment-grade contracts covers operating expenses before profits are released.

Intrator also dismissed concerns about the relationship as a distraction, likening it to a “fly on the back of an elephant.”

Technicals Paint A Mixed Picture

The stock is currently trading 13.7% above its 20-day SMA but is 14.6% below its 100-day SMA, demonstrating some short-term strength while indicating longer-term challenges. Over the past 12 months, shares have increased by 118%, and they are currently positioned closer to their 52-week highs than lows.

The RSI is at 59.03, which is considered neutral territory, while the MACD is above its signal line, indicating bullish momentum. The combination of neutral RSI and bullish MACD suggests mixed momentum.

- Key Resistance: $87.50

- Key Support: $70.50

Analyst Consensus & Recent Actions: The stock carries a Buy Rating with an average price target of $125.52. Recent analyst moves include:

- Barclays: Equal-Weight (Lowered Target to $90.00)

- Wells Fargo: Overweight (Lowered Target to $125.00)

- Truist Securities: Initiated with Hold (Target $84.00)

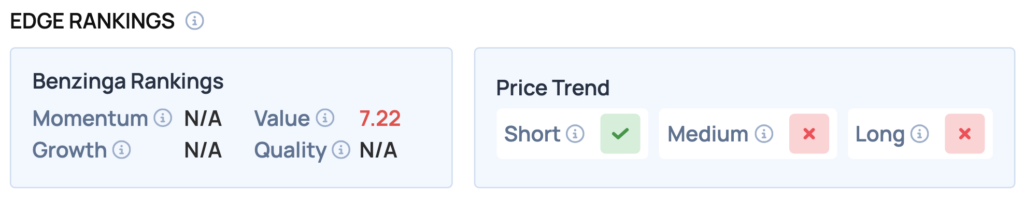

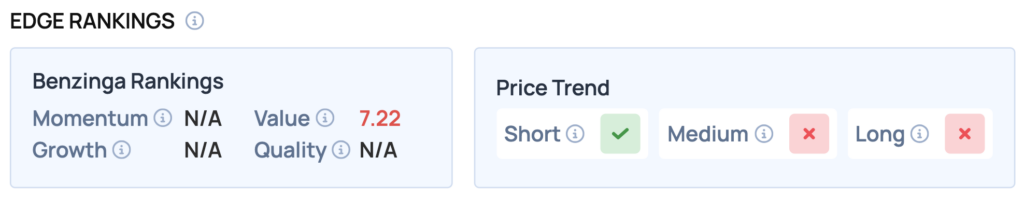

Benzinga Edge Rankings

Below is the Benzinga Edge scorecard for CoreWeave, Inc. Class A Common Stock (CRWV), highlighting its strengths and weaknesses compared to the broader market:

- Momentum: Bullish (Score: 83/100) — Stock is outperforming the broader market.

- Value: Risk (Score: 4/100) — Trading at a steep premium relative to peers.

The Verdict: CoreWeave’s Benzinga Edge signal reveals a classic “High-Flyer” setup. While the Momentum score (83) confirms the strong trend, the extremely low Value score (4) warns that the stock is priced for perfection—investors should ride the trend but use tight stop-losses.

Top ETF Exposure

- Tradr 2X Long CRWV Daily ETF (NASDAQ:CWVX): 118.53% Weight

- REX IncomeMax Option Strategy ETF (NASDAQ:ULTI): 5.05% Weight

Significance: Because CRWV carries such a heavy weight in these funds, any significant inflows or outflows for these ETFs will likely force automatic buying or selling of the stock.

CoreWeave Shares Dip

CRWV Price Action: CoreWeave shares were down 2.10% at $88.04 at the time of publication on Tuesday, according to Benzinga Pro data.

Image: Shutterstock

Recent Comments