Arm Holdings plc (NASDAQ:ARM) shares are moving lower on Tuesday following a downgrade from BofA. The company is also launching a new division focused on robotics and automotive technology. Here’s what investors need to know.

- Arm Holdings shares are showing limited movement. What’s the outlook for ARM shares?

BofA Securities downgraded Arm Holdings from Buy to Neutral and set a price target of $120. Even though the firm lowered its rating on the stock, BofA’s price target still calls for upside from current levels.

Other recent analyst changes include a downgrade from Goldman Sachs to Sell with a price target of $120 and a Buy rating from Loop Capital with a price target of $180.

Why Arm’s Strategic Shift Could Revolutionize Robotics

Arm Holdings last week announced the creation of a new business unit called Physical AI, aimed at expanding its presence in the robotics and automotive sectors. This strategic reorganization reflects the growing industry interest in AI systems that interact with the physical world, as the company now operates three core divisions: Cloud and AI, Edge and Physical AI.

The CES 2026 event highlighted the surge in robotics, with numerous companies showcasing humanoid robots capable of performing various tasks. Arm’s executives noted that both robots and vehicles share similar technical requirements, such as power efficiency and advanced sensor integration, making this new focus a natural fit for the company.

Is The Market Underestimating Arm’s Growth Potential?

The stock is currently trading 3.4% below its 20-day simple moving average (SMA) and 22.1% below its 100-day SMA, indicating a bearish trend in the short to medium term. Over the past 12 months, shares have decreased by 19.24% and are currently positioned closer to their 52-week lows than highs.

The RSI is at 29.15, suggesting the stock is in oversold territory, while the MACD is above its signal line, indicating bullish momentum. The combination of an oversold RSI and bullish MACD suggests mixed momentum for the stock.

- Key Resistance: $122.50

- Key Support: $108.50

Key Earnings Metrics That Demand Attention

Investors are looking ahead to the next earnings report on Feb. 4.

- EPS Estimate: 33 cents (Down from 39 cents YoY)

- Revenue Estimate: $1.23 billion (Up from $983.00 million YoY)

- Valuation: P/E of 142.5x (Indicates premium valuation)

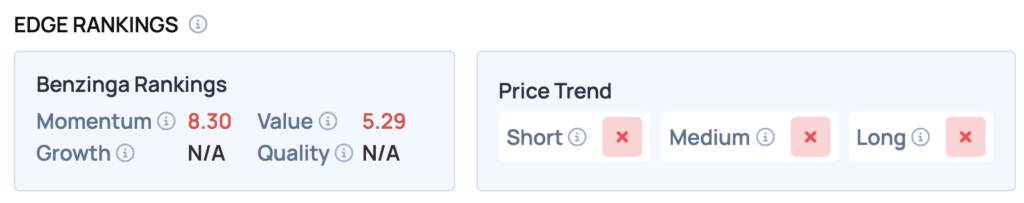

Benzinga Edge Rankings

Below is the Benzinga Edge scorecard for Arm Holdings, highlighting its strengths and weaknesses compared to the broader market:

- Momentum: Bullish (Score: 83/100) — Stock is outperforming the broader market.

- Value: Risk (Score: 5/100) — Trading at a steep premium relative to peers.

The Verdict: Arm Holdings’ Benzinga Edge signal reveals a classic ‘High-Flyer’ setup. While the Momentum (83) confirms the strong trend, the extremely low Value (5) score warns that the stock is priced for perfection—investors should ride the trend but use tight stop-losses.

Top ETF Exposure

- Themes Robotics & Automation ETF (NASDAQ:BOTT): 3.61% Weight

- Arm Holdings PLC ADRhedged (NYSE:ARMH): 95.29% Weight

- REX AI Equity Premium Income ETF (NASDAQ:AIPI): 4.60% Weight

Significance: Because ARM carries such a heavy weight in these funds, any significant inflows or outflows for these ETFs will likely force automatic buying or selling of the stock.

Price Action

ARM Price Action: ARM Holdings shares were down 3.93% at $106.75 at the time of publication on Tuesday, according to Benzinga Pro data.

Image: Shutterstock

Recent Comments