Plug Power Inc (NASDAQ:PLUG) shares are trading higher Monday afternoon. The stock’s activity comes in the wake of a recent announcement of a strategic partnership with Walmart and a downgrade from TD Cowen. Here’s what investors need to know.

- Plug Power stock is showing exceptional strength. What’s behind PLUG gains?

How Walmart Partnership Could Transform Plug Power

Plug Power saw its shares trading lower last Friday, following a surge on Thursday. The fluctuation came after the company announced a strategic partnership with Walmart and a subsequent downgrade by TD Cowen from Buy to Hold and a price target cut from $4 to $2.

The partnership with Walmart, outlined in a recent SEC filing, provides the retail giant with a limited-use license for certain GenKey System-related materials. This move could potentially enhance Plug Power’s market position by helping Walmart identify and qualify alternative stack suppliers.

In addition to the Walmart deal, Plug Power has been taking steps to refinance its debt. The company successfully replaced high-interest obligations with a convertible note offering exceeding $430 million. This move, combined with progress on projects in France and Namibia, signals a strategic shift towards more sustainable growth for Plug Power.

Also Read: Oil Companies Rush To Secure Tankers For Venezuelan Crude Exports: Report

Are Analysts Underestimating Plug Power’s Potential?

Analysts have a Hold consensus rating on Plug Power, with a price target of $2. On Jan. 9, TD Cowen maintained a Hold rating with a $2 price target. On Dec. 31, Clear Street maintained a Buy rating with a $3 price target. On Nov. 20, Canaccord Genuity maintained a Hold rating with a $3 price target.

The consensus Hold rating indicates a cautious sentiment among analysts regarding Plug Power’s near-term prospects. While Clear Street’s Buy rating suggests some optimism, the overall sentiment is tempered by TD Cowen and Canaccord Genuity’s Hold ratings, which reflect a more neutral stance on the stock.

The price targets ranging from $2 to $3 suggest that analysts have a relatively limited outlook for Plug Power’s stock, with the highest target from Clear Street indicating only modest upside potential.

The recent downgrade from TD Cowen, combined with the mixed ratings from other analysts, highlights a cautious approach to the stock’s future performance, suggesting that investors should remain vigilant as developments unfold.

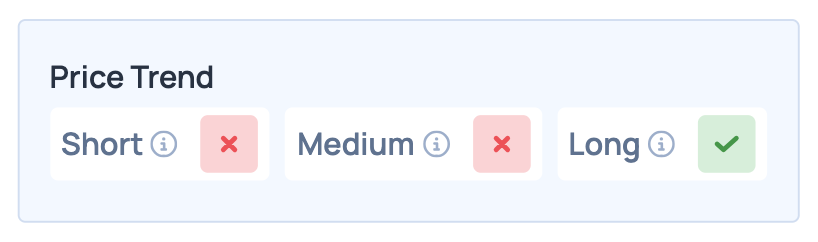

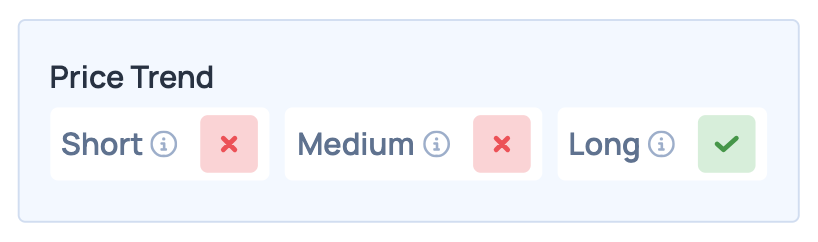

Benzinga Edge Rankings: Per Benzinga Edge rankings, Plug Power shows a positive long-term price trend, while both its short- and medium-term price trends are rated negative, signaling strength only over a longer horizon.

PLUG Price Action: Plug Power shares were up 4.11% at $2.28 at the time of publication on Monday, according to Benzinga Pro data.

Image: Shutterstock

Recent Comments