Chewy Inc (NYSE:CHWY) shares are up on Monday following a recent increase in hedge fund activity. The stock’s rise comes as Viking Global Investors, led by Andreas Halvorsen, sharply increased its position in Chewy, suggesting a strong conviction in the company’s long-term potential as it navigates recent challenges.

- Chewy stock is among today’s top performers. What’s fueling CHWY momentum?

Viking’s Bold Move Signals Uncertain Recovery

Viking Global Investors boosted its stake in Chewy by nearly 147% on Dec. 18, 2025, adding over 8 million shares and bringing total ownership to approximately 13.5 million shares, valued at around $437 million.

This significant increase indicates that Viking sees a disconnect between Chewy’s current stock price and the durability of its core business model, particularly its subscription-heavy revenue stream.

The accumulation by Viking signals rising confidence that Chewy’s downside may be limited at current levels, despite the stock’s struggles over the past year. The firm’s average buy price sits above current levels, reinforcing the idea that this is a multi-quarter bet on the company’s fundamentals stabilizing and sentiment improving.

The broader market is experiencing mixed performance today, with the Russell 2000 up 0.21% and the S&P 500 gaining 0.08%. Chewy’s stock is moving higher while the State Street Consumer Discretionary Select Sector SPDR ETF (AMEX:XLY) is also up 0.4%, indicating that it is aligning with broader market trends.

Can Chewy Overcome Its Technical Challenges?

Chewy is currently trading 5% above its 20-day simple moving average (SMA) but is 4.7% below its 100-day SMA, suggesting a mixed technical picture. Over the past 12 months, shares have decreased approximately 4.53% and are currently positioned closer to their 52-week lows than highs.

The RSI is at 44.51, indicating neutral territory, while the MACD is below its signal line, suggesting bearish pressure on the stock. The combination of neutral RSI and bearish MACD suggests mixed momentum.

- Key Resistance: $35.00

- Key Support: $31.50

Analysts Split On Chewy’s Upcoming Earnings Potential

Investors are looking ahead to the company’s next earnings report in March, with analysts expecting earnings per share of 20 cents, down from 28 cents in the same quarter last year, and revenue of $3.26 billion, up from $3.25 billion in the previous year.

Chewy has a consensus Buy rating among analysts with an average price target of $45.62, suggesting the stock may be trading at a premium.

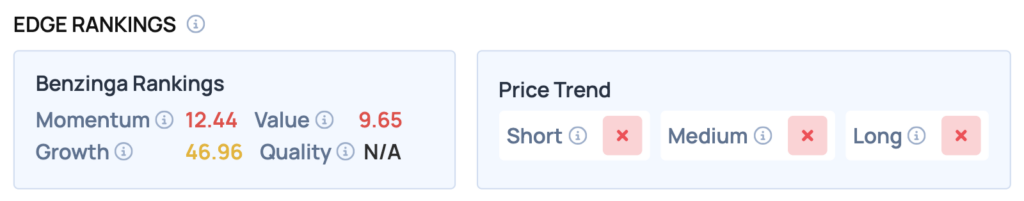

Benzinga Edge Rankings

Below is the Benzinga Edge scorecard for Chewy, highlighting its strengths and weaknesses compared to the broader market:

- Value: Risk (Score: 9.65/100) — Trading at a steep premium relative to peers.

- Growth: Moderate (Score: 46.96/100) — Growth potential exists but is tempered by current challenges.

- Momentum: Weak (Score: 12.44/100) — The stock is underperforming relative to the market.

The Verdict: Chewy’s Benzinga Edge signal reveals a classic ‘High-Flyer’ setup. While the Growth score indicates potential, the low Value and Momentum scores suggest that caution is warranted as the stock navigates its current challenges.

Top ETF Exposure

- SPDR S&P Retail ETF (NYSE:XRT): 1.53% Weight

- Amplify Online Retail ETF (NYSE:IBUY): 2.50% Weight

- ProShares Online Retail ETF (NYSE:ONLN): 4.41% Weight

Significance: Because CHWY carries significant weight in these funds, any significant inflows or outflows for these ETFs will likely force automatic buying or selling of the stock.

Chewy Shares Bounce

CHWY Price Action: Chewy shares were up 5.94% at $34.07 at the time of publication on Monday, according to Benzinga Pro data.

Image: Shutterstock

Recent Comments