During times of turbulence and uncertainty in the markets, many investors turn to dividend-yielding stocks. These are often companies that have high free cash flows and reward shareholders with a high dividend payout.

Benzinga readers can review the latest analyst takes on their favorite stocks by visiting Analyst Stock Ratings page. Traders can sort through Benzinga’s extensive database of analyst ratings, including by analyst accuracy.

Below are the ratings of the most accurate analysts for three high-yielding stocks in the consumer discretionary sector.

Vail Resorts Inc (NYSE:MTN)

- Dividend Yield: 6.44%

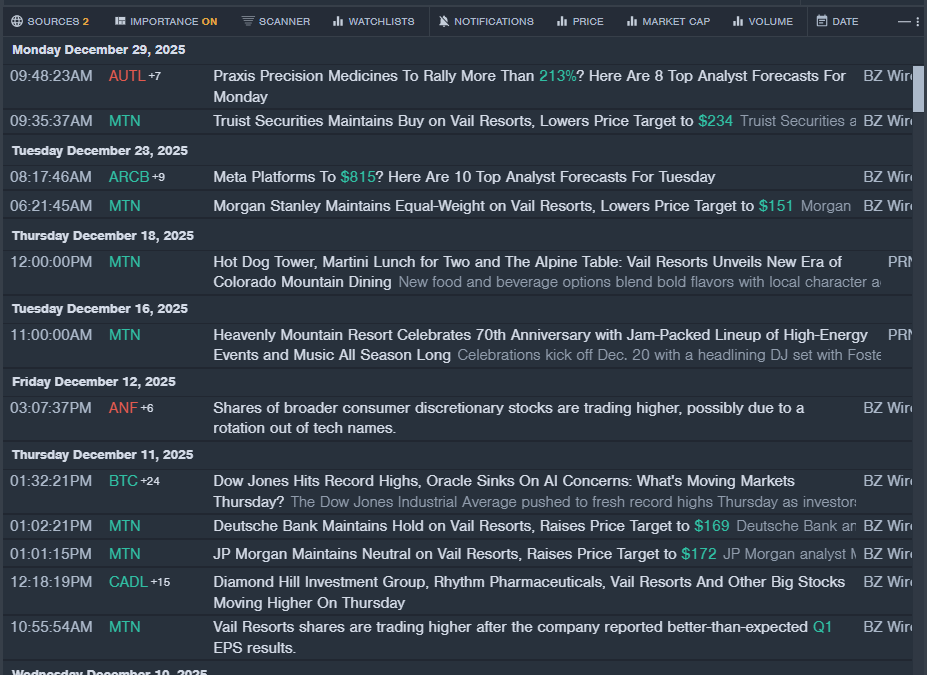

- Truist Securities analyst Patrick Scholes maintained a Buy rating and slashed the price target from $237 to $234 on Dec. 29, 2025. This analyst has an accuracy rate of 66%.

- Morgan Stanley analyst Stephen Grambling maintained an Equal-Weight rating and cut the price target from $153 to $151 on Dec. 23, 2025. This analyst has an accuracy rate of 66%

- Recent News: On Dec. 11, Vail Resorts reported better-than-expected first-quarter EPS results.

- Benzinga Pro’s real-time newsfeed alerted to latest MTN news.

Newell Brands Inc (NASDAQ:NWL)

- Dividend Yield: 6.65%

- Citigroup analyst Filippo Falorni maintained a Neutral rating and raised the price target from $3.5 to $3.75 on Dec. 17, 2025. This analyst has an accuracy rate of 53%.

- UBS analyst Peter Grom maintained a Neutral rating and cut the price target from $5.5 to $4 on Dec. 2, 2025. This analyst has an accuracy rate of 54%

- Recent News: Newell Brands said it will release its fourth quarter earnings results before the opening bell on Friday, Feb. 6, 2026.

- Benzinga Pro’s real-time newsfeed alerted to latest NWL news

Oxford Industries Inc (NYSE:OXM)

- Dividend Yield: 7.66%

- UBS analyst Mauricio Serna maintained a Neutral rating and raised the price target from $35 to $36 on Jan. 8, 2026. This analyst has an accuracy rate of 52%.

- Citigroup analyst Paul Lejuez maintained a Neutral rating and cut the price target from $35 to $33 on Dec. 12, 2025. This analyst has an accuracy rate of 66%.

- Recent News: On Dec. 10, Oxford Industries reported upbeat third-quarter financial results and issued fourth-quarter guidance below estimates.

- Benzinga Pro’s real-time newsfeed alerted to latest OXM news

Read More:

Photo via Shutterstock

Recent Comments