President Donald Trump has escalated his war on high interest rates, warning credit card companies that failure to cap rates at 10% by Jan. 20 will be treated as a “violation of the law” and met with “severe” repercussions.

Escalation To Legal Threats

In a forceful new statement delivered on Jan. 12, 2026, President Trump shifted from political pressure to explicit legal threats against the banking sector.

Moving beyond his initial call for a voluntary cap in a Truth Social post, Trump declared that maintaining current interest rates past next week’s deadline would constitute illegal activity.

“If credit card companies do not lower interest rates to 10% by January 20th, then they are in violation of the law, very severe things,” Trump stated while talking to the press. “They really abuse the public, I am not going to let it happen.”

Credit Card Issuers In Focus

This marks a significant intensification of rhetoric. While previous comments framed the rate cap as a policy goal, the President is now asserting that current pricing models are effectively unlawful.

His statement signals potential regulatory crackdowns or executive action if major issuers, such as Visa Inc. (NYSE:V), Mastercard Inc. (NYSE:MA), and major banks, do not comply immediately.

The ‘Affordability’ Mandate

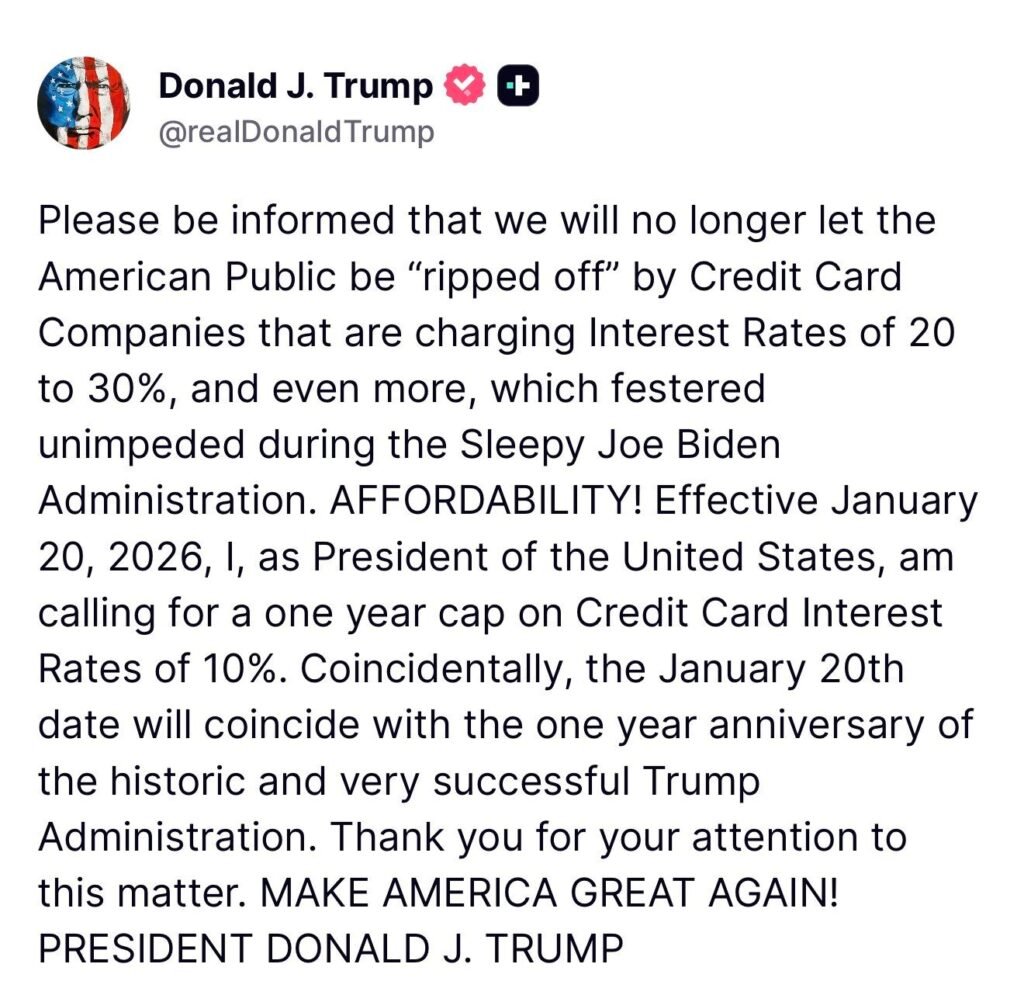

The ultimatum follows a formal policy announcement made on Truth Social two days prior, where Trump first proposed a “one-year cap” on credit card interest rates.

Citing “affordability” as a primary concern, the President blasted lenders for charging Americans “20 to 30%, and even more,” claiming these rates “festered unimpeded” during the Biden administration.

“We will no longer let the American Public be ‘ripped off’ by Credit Card Companies,” Trump wrote on Jan. 10. The proposed 10% cap represents a drastic reduction from current market averages, which often hover near 25% for many consumers.

Symbolic Deadline

The Jan. 20 deadline is strategically timed to coincide with the first anniversary of Trump’s inauguration.

The President has framed the date as a milestone for his administration’s economic agenda, turning the anniversary into a hard compliance deadline for the financial industry.

The recent press statement also follows Billionaire investor Bill Ackman raising concerns about credit card rewards programs on Saturday, arguing that the current structure unfairly forces low-income consumers to subsidize benefits for wealthy cardholders.

The SPDR S&P 500 ETF Trust (NYSE:SPY) and Invesco QQQ Trust ETF (NASDAQ:QQQ), which track the S&P 500 index and Nasdaq 100 index, respectively, closed higher on Friday. The SPY was up 0.66% at $694.07, while the QQQ advanced 1.00% to $626.70, according to Benzinga Pro data.

The futures of the S&P 500, Nasdaq 100, and Dow Jones indices were trading lower on Monday.

Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors.

Photo Courtesy: Joshua Sukoff on Shutterstock.com

Recent Comments