U.S. stock futures declined on Monday after a positive close on Friday. Futures of major benchmark indices were trading lower.

Tensions flared up at the Federal Reserve after the Chair Jerome Powell said on Sunday that the Department of Justice had threatened the central bank with “criminal indictment” over his testimony before Congress, relating to its building renovation costs. This marks a major escalation in tensions between President Donald Trump and the central bank.

On Friday, nonfarm payrolls increased by 50,000 in December, mostly unchanged from November’s downwardly revised 56,000 gain and slightly below expectations for 60,000, according to the Bureau of Labor Statistics on Friday.

The U.S. Supreme Court did not issue a ruling Friday on President Trump’s sweeping global tariffs, as traders price in a 75% chance that the Supreme Court ultimately rules in favor of Trump’s tariffs.

Meanwhile, the 10-year Treasury bond yielded 4.19%, and the two-year bond was at 3.53%. The CME Group’s FedWatch tool‘s projections show markets pricing a 95% likelihood of the Federal Reserve leaving the current interest rates unchanged in January.

| Index | Performance (+/-) |

| Dow Jones | -0.78% |

| S&P 500 | -0.76% |

| Nasdaq 100 | -1.04% |

| Russell 2000 | -0.57% |

The SPDR S&P 500 ETF Trust (NYSE:SPY) and Invesco QQQ Trust ETF (NASDAQ:QQQ), which track the S&P 500 index and Nasdaq 100 index, respectively, were lower in premarket on Monday. The SPY was down 0.69% at $689.25, while the QQQ declined 0.95% to $620.77, according to Benzinga Pro data.

Stocks In Focus

Vistra

- Vistra Corp. (NYSE:VST) was 0.69% higher in premarket on Monday after it signed a 20-year nuclear power deal with Meta Platforms Inc. (NASDAQ:META).

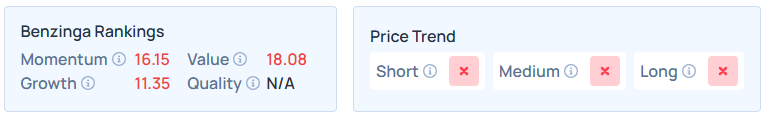

- Benzinga’s Edge Stock Rankings shows that VST maintains a weaker price trend over the short, medium, and long term, with a poor growth ranking. Additional information is available here.

Alibaba Group Holding

- Alibaba Group Holding Ltd. (NYSE:BABA) rose 4.44% after its Cloud’s flagship Qwen series became the world’s most widely used open-source AI system, surpassing 700 million downloads on the Hugging Face platform as of January.

- It maintains a stronger price trend over the long term but a weak trend in the short and medium terms, with a solid value ranking. Additional performance details, as per Benzinga’s Edge Stock Rankings, are available here.

Tempus AI

- Tempus AI Inc. (NASDAQ:TEM) jumped 8.12% after it reported a record $1.1 billion in total contract value and approximately 126% net revenue retention for 2025, driven by expanded data agreements with over 70 pharmaceutical and biotech clients.

- TEM maintains a stronger price trend over the long term but a weak trend in the short and medium terms. Additional performance details, as per Benzinga’s Edge Stock Rankings, are available here.

Xpeng

- Xpeng Inc. (NYSE:XPEV) gained 2.75% after unveiling its global 2026 P7+ flagship and new VLA2.0 autonomous driving AI while reporting 126% delivery growth in 2025, underscoring its rapid international expansion and technological scale.

- Benzinga’s Edge Stock Rankings indicate that XPEV maintains a weaker price trend over the short, medium and long terms. Additional performance details are available here.

Boot Barn Holdings

- Boot Barn Holdings Inc. (NYSE:BOOT) shares were down 0.37% despite reporting preliminary third-quarter net sales of $705.6 million, representing growth of 16.0% over the prior year.

- BOOT maintains a stronger price trend over the short, medium, and long terms, with a strong quality ranking. Additional performance details, as per Benzinga’s Edge Stock Rankings, are available here.

Cues From Last Session

Materials, utilities, and consumer discretionary stocks posted the largest gains on Friday, while health care and financial shares bucked the trend to close lower.

For the week, the S&P 500 rose 1%, while the Dow and Nasdaq surged 2.3% and 1.9%, respectively.

| Index | Performance (+/-) | Value |

| Dow Jones | 0.48% | 49,504.07 |

| S&P 500 | 0.65% | 6,966.28 |

| Nasdaq Composite | 0.81% | 23,671.35 |

| Russell 2000 | 0.78% | 2,624.22 |

Insights From Analysts

Mohamed El-Erian expects the “frantic start to the year to continue” as 2026 begins with a sharp contrast between escalating geopolitical instability and remarkably resilient capital markets.

He observes that investors have “largely shrugged off” significant risks involving Venezuela and Iran, propelling the S&P 500 to new records and fueling the busiest start to a year for bond deals ever.

El-Erian emphasizes that the world is firmly in a “geo-economic” era where national security now exerts an “overwhelming influence” on economic outcomes. He highlights a confusing economic landscape where robust GDP growth—potentially exceeding a 5.4% pace—coexists with cooling job creation, illustrating a troubling “decoupling of employment from growth.”

Looking ahead, El-Erian anticipates a “flood of fresh data” that will test the market’s optimism. Key questions include whether inflation trends justify the Federal Reserve’s view that it is “well-positioned” to keep rates steady, and if economic momentum is “finally broadening beyond AI-related activities.”

While the service sector shows strength, he warns that political and security spillover effects are becoming just as critical as commercial fundamentals.

Upcoming Economic Data

Here’s what investors will be keeping an eye on this week.

- On Monday, Richmond Fed President Tom Barkin will speak at 8:00 a.m., Atlanta Fed President Raphael Bostic will speak at 12:30 p.m., and New York Fed President John Williams will speak at 6:00 p.m. ET.

- On Tuesday, December’s NFIB optimism index data will be out by 6:00 a.m., December’s headline and core U.S. CPI data will be released by 8:30 a.m., and October’s U.S. new home sales data will be released at 10:00 a.m. ET.

- St. Louis Fed President Alberto Musalem will speak at 10:00 a.m., December’s U.S. budget deficit will be out by 2:00 p.m., and Richmond Fed President Tom Barkin will speak at 4:00 p.m. ET.

- On Wednesday, November’s delayed report of the U.S. retail sales and producer price index will be released by 8:30 a.m., October’s delayed U.S. Business inventories, and December’s existing home sales will be out by 10:00 a.m. ET.

- Atlanta Fed President Raphael Bostic will speak at 12:00 p.m., Fed Governor Stephen Miran will speak at 12:30 p.m., Minneapolis Fed President Neel Kashkari will speak at 11:00 a.m., and New York Fed President John Williams will speak at 2:10 p.m. Also, the Federal Reserve’s Beige Book will be released at 2:00 p.m. ET.

- On Thursday, the initial jobless claims data for the week ending Jan. 10 will be out by 8:30 a.m. ET, along with November’s delayed U.S. import prices data, January’s Empire State manufacturing survey, and the Philadelphia Fed’s manufacturing survey.

- Fed Governor Michael Barr will speak at 9:15 a.m., Richmond Fed President Tom Barkin will speak at 12:40 p.m., and Kansas City Fed President Jeff Schmid will speak at 1:30 p.m. ET.

- On Friday, December’s industrial production and capacity utilization data will be released by 9:15 a.m., Richmond Fed President Tom Barkin will speak at 11:00 a.m., and Federal Reserve Vice Chair Philip Jefferson will speak at 3:30 p.m. ET.

Commodities, Gold, Crypto, And Global Equity Markets

Crude oil futures were trading lower in the early New York session by 0.15% to hover around $58.85 per barrel.

Gold Spot US Dollar rose 1.90% to hover around $4,596.15 per ounce. Its last record high stood at $4,601.17 per ounce. The U.S. Dollar Index spot was 0.41% lower at the 98.7230 level.

Meanwhile, Bitcoin (CRYPTO: BTC) was trading 0.16% higher at $90,758.51 per coin.

Asian markets closed higher on Monday, as India’s Nifty 50, Australia’s ASX 200, China’s CSI 300, Japan’s Nikkei 225, Hong Kong’s Hang Seng, and South Korea’s Kospi indices rose. European markets were mixed in early trade.

Photo: Shutterstock

Recent Comments