Wedbush Securities analyst Dan Ives unveiled his bullish roadmap for tech giant Apple Inc. (NASDAQ:AAPL), highlighting key catalysts that can drive the stock higher in 2026, even as the Street remains skeptical of the company’s role in the AI race.

‘Cupertino’ Finally Ready For The AI Race

On Sunday, in a post on X, Ives said, “We are very bullish on Apple for 2026,” as he outlined four key “strategic and financial goals” that he said are critical for the stock to reach his $350 price target, implying a potential upside of nearly 35% from current levels.

The first on Ives’ list is a potential partnership with Google’s Gemini platform. “We believe Google Gemini will be the exclusive partner for Apple’s AI strategy,” he said.

According to Ives, the “elephant in the room” remains Apple’s lack of a visible AI roadmap, despite commanding what he called the “biggest consumer installed base in the world of 2.4 billion iOS devices and 1.5 billion iPhones,” hinting that a partnership is likely the company’s preferred path forward.

Second, Ives expects the rollout of a revamped Siri in early 2026, which he said would be “Apple’s answer to ChatGPT and Perplexity.”

Third, on the hardware front, he said Apple “has potential to see iPhone unit sales in 2026 that will handily exceed current Street estimates,” highlighting strength in China and the expected introduction of a foldable phone during the iPhone 18 cycle.

Finally, Ives dismissed speculations regarding Apple CEO Tim Cook’s departure. “We disagree with this narrative,” adding that he expects Cook to remain as CEO at least through the end of 2027, while calling it “an integral period for Cupertino to design and execute on its broader AI Revolution strategy.”

Apple Plans AI Smart Glasses, Camera-Equipped AirPods

According to recent reports, Apple is working to expand its AI plays beyond the iPhone, the iPad and MacBooks, with plans to launch AI-powered wearables, such as smartglasses and AirPods, in 2026.

The company is also working on AirPods with an in-built infrared camera to support functions such as spatial recognition and visual interaction.

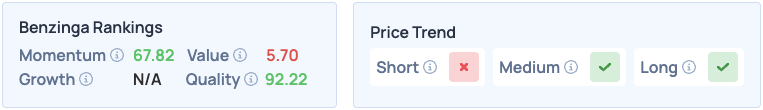

Shares of Apple were up 0.13% on Friday, closing at $259.37. The stock scores high on Momentum in and Quality in Benzinga’s Edge Stock Rankings, with a favorable price trend in the Medium and Long Terms. Click here for deeper insights into the stock, its peers and competitors.

Photo Courtesy: Thanon Charoenkitviwat on Shutterstock.com

Recent Comments