President Donald Trump’s proposal to purchase $200 billion in mortgage-backed securities is drawing sharp criticism from economists, with warnings that the plan could worsen housing affordability in the long run despite temporarily lowering mortgage rates.

‘People’s QE’ Mortgage Stimulus

According to economist Mohamed El-Erian, by tapping funds held by government‑sponsored enterprises Fannie Mae (OTC:FNMA) and Freddie Mac (OTC:FMCC) under powers granted during their 2008 conservatorship, Trump is reviving long‑standing concerns over political intrusion into monetary policy.

“This should serve as a reminder of two things that markets haven’t yet fully internalized,” El-Erian said, first that political pressure on the Federal Reserve can extend beyond “lowering interest rates,” to include even “asset purchases,” which he likened to “People’s QE,” or the use of quantitative easing to fund public spending.

Second, that growing public anxiety over affordability issues and the political pressure resulting from the same will trigger more aggressive policy responses, he said in a post on X.

Inflation, Treasury Yields Will Rise And ‘Affordability’ Will Get Worse

Economist Peter Schiff slammed Trump’s proposal, saying that $200 billion being used to buy mortgage bonds means that there’s “$200 billion less available to buy Treasuries,” in a series of posts on X.

While acknowledging the plan may temporarily bring down mortgage rates, Schiff warned of unintended consequences, such as the rise in “Treasury yields and inflation,” in the long run.

He also pointed out that the fundamental problem in the American housing market isn’t high mortgage rates, but high home prices themselves. “Trump wants to prevent home prices from falling by using the government to misdirect more credit into the mortgage market,” he said.

According to Schiff, the policy exacerbates the very problem that it seeks to solve by allowing buyers to stretch and “overpay” for homes, which he said worsens the crisis.

Historically Unusual Intervention

Nick Timiraos, the chief economics correspondent at The Wall Street Journal, pointed out the unusual nature of this intervention.

In a post on X, Timiraos noted that, unlike past Fed-driven quantitative easing cycles during the 2008 Financial Crisis and the COVID-19 pandemic, there’s no systemic risk prompting this move.

“What’s notable about this intervention is that it’s being done during a period of relatively solid economic activity and with no meaningful stresses in credit markets,” he said, making this a political move.

Timiraos also pointed out that when the Federal Reserve purchased mortgage-backed securities in the past, it did so without any “profit motive in mind,” and as a result, raked up “large losses on the Covid-era purchases.”

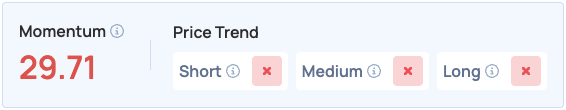

The fund has a poor Momentum score in Benzinga’s Edge Stock Rankings, with an unfavorable price trend in the short, medium and long terms. Click here for deeper insights into the fund and its constituents.

Photo: IAB Studio from Shutterstock

Recent Comments