U.S. stock futures pared earlier losses to advance on Friday after a mixed Thursday. Futures of major benchmark indices were trading higher.

Rising unrest in Iran gripped investor sentiment as WTI Crude futures rose, gold remained largely flat, and the silver spot was inching higher.

With the Iranian government initiating a nationwide internet blackout to quell dissent, traders were parsing the risk on global markets and the economy.

The U.S Supreme Court is set to announce its ruling on tariffs imposed on other countries by President Donald Trump later today. Meanwhile, investors also await the December jobs reports, slated to be released on Friday.

The 10-year Treasury bond yielded 4.18%, and the two-year bond was at 3.50%. The CME Group’s FedWatch tool‘s projections show markets pricing an 86.2% likelihood of the Federal Reserve leaving the current interest rates unchanged in January.

| Futures | Change (+/-) |

| Dow Jones | 0.05% |

| S&P 500 | 0.08% |

| Nasdaq 100 | 0.15% |

| Russell 2000 | 0.11% |

The SPDR S&P 500 ETF Trust (NYSE:SPY) and Invesco QQQ Trust ETF (NASDAQ:QQQ), which track the S&P 500 index and Nasdaq 100 index, respectively, were higher in premarket on Friday. The SPY was up 0.067% at $689.97, while the QQQ advanced 0.084% to $620.99, according to Benzinga Pro data.

Stocks In Focus

General Motors

- General Motors Co. (NYSE:GM) was 0.63% lower in premarket on Friday after it faced a $7.1 billion loss from electric vehicle investments.

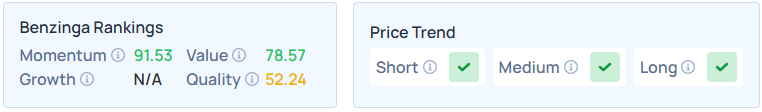

- Benzinga’s Edge Stock Rankings shows that GM maintains a stronger price trend over the short, medium, and long term, with a moderate quality ranking. Additional information is available here.

Rio Tinto

- Rio Tinto PLC ADR (NYSE:RIO) dropped 2.46% after it confirmed talks on a possible merger with Glencore.

- It maintains a stronger price trend over the short, medium, and long terms, with a strong value ranking. Additional performance details, as per Benzinga’s Edge Stock Rankings, are available here.

Tilray Brands

- Tilray Brands Inc. (NASDAQ:TLRY) jumped 8.32% after the company released its second-quarter earnings report, beating expectations on the top and bottom lines.

- TLRY maintains a stronger price trend over the long term but a weaker trend in the short and medium terms. Additional performance details, as per Benzinga’s Edge Stock Rankings, are available here.

Offerpad Solutions

- Offerpad Solutions Inc. (NYSE:OPAD) surged by 38.82% following a new proposal by President Trump, with big implications for the nation’s housing market.

- Benzinga’s Edge Stock Rankings indicate that OPAD maintains a stronger price trend over the short and long terms but a weaker trend in the medium term. Additional performance details are available here.

Kalvista Pharmaceuticals

- Kalvista Pharmaceuticals Inc. (NASDAQ:KALV) shares were 13.65% after the company reported preliminary global net product revenue results for the fourth quarter. The company said it sees preliminary global net product revenue of EKTERLY of $35 million to $49 million for the quarter.

- KALV maintains a stronger price trend over the short, medium, and long terms. Additional performance details, as per Benzinga’s Edge Stock Rankings, are available here.

Cues From Last Session

U.S. markets saw broad gains across most industries, led by the Energy and Consumer Staples sectors, while Information Technology and Health Care were the only sectors to post losses.

| Index | Performance (+/-) | Value |

| Nasdaq Composite | -0.44% | 23,480.02 |

| S&P 500 | 0.0077% | 6,921.46 |

| Dow Jones | 0.55% | 49,266.11 |

| Russell 2000 | 1.11% | 2,603.90 |

Insights From Analysts

Scott Wren of the Wells Fargo Investment Institute advises investors to look past “headline fatigue” and focus on the “economic and policy trends that should drive the economy and capital markets.”

Wren identifies four critical pillars for the year: resilient AI capital spending, significant tax benefits, continued Federal Reserve rate cuts, and deregulation.

He argues that “productivity is a buzzword we expect to hear even more of in 2026,” as companies use automation to navigate a tight labor supply.

While Technology and Communication Services were top performers in 2025, Wren believes “the tentacles of the AI revolution are reaching well beyond” those sectors.

Consequently, he sees opportunities in Industrials and Utilities—sectors essential for building and powering data centers.

He also highlights potential in Midstream Energy and Industrial Metals like copper to support this infrastructure build-out. Wren concludes that success in 2026 relies on following these innovation-driven trends rather than reacting to daily news.

Upcoming Economic Data

Here’s what investors will be keeping an eye on Friday.

- December’s U.S. employment report will be out by 8:30 a.m. Additionally, December’s U.S. unemployment rate, hourly wages, October’s housing starts, and January’s UMich consumer sentiment will be released by 9:45 a.m. Lastly, Richmond Fed President Tom Barkin will speak at 1:35 p.m. ET.

Commodities, Gold, Crypto, And Global Equity Markets

Crude oil futures were trading higher in the early New York session by 0.28% to hover around $57.92 per barrel.

Gold Spot US Dollar fell 0.13% to hover around $4,471.65 per ounce. Its last record high stood at $4,550.11 per ounce. The U.S. Dollar Index spot was 0.13% higher at the 99.0620 level.

Meanwhile, Bitcoin (CRYPTO: BTC) was trading 0.51% higher at $90,195.78 per coin.

Asian markets closed mixed on Friday, as India’s Nifty 50 and Australia’s ASX 200 indices fell. China’s CSI 300, Japan’s Nikkei 225, Hong Kong’s Hang Seng, and South Korea’s Kospi indices rose. European markets were mixed in early trade.

Read Next:

Image via Shutterstock

Recent Comments