Pharmaceuticals giant Merck & Co. Inc. (NYSE:MRK) is reportedly in talks to acquire cancer drug-maker Revolution Medicines Inc. (NASDAQ:RVMD) in a deal potentially valued at between $28 and $32 billion.

Shares of Revolution Medicines were up 4.56% on Thursday, before soaring 15.14% overnight after the news broke out, now trading at $123.65 per share.

Merck On A Buying Spree

The deal is yet to be finalized and any potential tie-ups are weeks away, according to a report by the Financial Times citing sources familiar with the matter.

If it goes through, the deal is set to become the largest transaction in the biotech space since Pfizer Inc.’s (NYSE:PFE) acquisition of Seagen in 2023 for $43 billion, adding momentum to the booming M&A cycle in the biotech space, with deal volumes touching $135 billion in 2025, doubling since 2024, according to S&P Capital IQ Data.

This comes amid a looming patent cliff for the industry, with several blockbuster drugs set to lose their protections in the coming years, which includes Merck’s popular cancer treatment, Keytruda, in 2028.

The company’s been on an acquisition spree in recent months, with this deal coming just months after its $9.2 billion acquisition of Cidara Therapeutics Inc. (NASDAQ:CDTX) for its flu protection drugs, and $10 billion buyout of Verona Pharma plc early last year.

Neither Merck nor Revolution Medicines immediately responded to Benzinga’s request for a comment. This story will be updated as soon as we receive a response.

Revolution Soars With Cancer Therapies In Focus

Revolution is running early-stage clinical trials for a targeted therapy designed to slow tumor growth in pancreatic cancer, one of the deadliest cancers with few effective treatment options.

Earlier this year, Revolution raised $2 billion by partnering with Royalty Pharma Plc. (NASDAQ:RPRX) to advance its global development and commercialization strategy.

There are reportedly other big pharmaceutical companies that are vying to make a bid for the California-based biotech, with rumors swirling about AbbVie Inc. (NYSE:ABBV) being in talks for the same on Thursday, which the company has since denied.

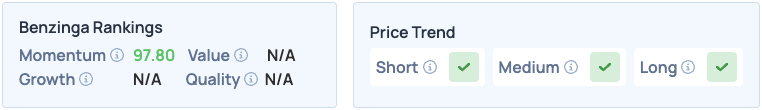

The stock scores high on Momentum in Benzinga’s Edge Stock Rankings, with a favorable price trend in the short, medium and long terms. Click here for deeper insights into the stock, its peers and competitors.

Photo Courtesy: Tada Images on Shutterstock.com

Recent Comments