Billionaire investor Jim Mellon said that Venezuela’s oil industry faces a long and difficult road to recovery, with meaningful production gains unlikely to materialize anytime soon.

Venezuela’s Oil Recovery A Long-Term Story

Speaking on the Master Investor podcast on Wednesday, Mellon cautioned that any meaningful recovery in Venezuela’s oil sector remains a long-term story. “It will take at least 5 to 10 years before they can get back up to what they had,” he said, which is an output of 3 million barrels of crude oil per day.

While that level of output would represent a meaningful rebound for Venezuela, he noted that “in the context of over 100 million barrels a day,” which is the current global daily output, it is just “enough to change things at the margin.”

Mellon also said that Venezuela’s output, which predominantly consists of heavy crude, uniquely positions U.S. refiners to benefit first from any eventual recovery.

“We also know that it’s very heavy oil,” he said, adding that the U.S. has “lots of spare capacity for heavy oil,” with the country now at “peak shale,” and not buying as much oil from Canada, which is known for its similarly heavy output.

With that backdrop, Mellon said he continues to recommend investors increase exposure to the sector. “I’d suggest loading up on oil and gas.”

US Refiners Rally On Venezuela’s Political Shift

American energy giants with sophisticated refineries, capable of handling heavy crude oil inputs, have seen significant gains since U.S. forces captured Venezuelan President Nicolás Maduro over the weekend.

| Stocks | 1 Week Performance |

| Valero Energy Corp. (NYSE:VLO) | +17.20% |

| Chevron Corp. (NYSE:CVX) | +4.67% |

| Phillips 66 (NYSE:PSX) | +11.80% |

| PBF Energy Inc. (NYSE:PBF) | +17.64% |

| VanEck Oil Refiners ETF (NYSE:CRAK) | +3.27% |

Even as experts caution about the long timelines involved in turning around the nation’s oil out, President Donald Trump claimed on Tuesday that the Latin American nation will be “turning over” 30 to 50 million barrels of “high quality, sanctioned oil” to the U.S.

This oil, Trump said, will be sold at market prices, with the proceeds being used to “benefit the people of Venezuela and the United States.”

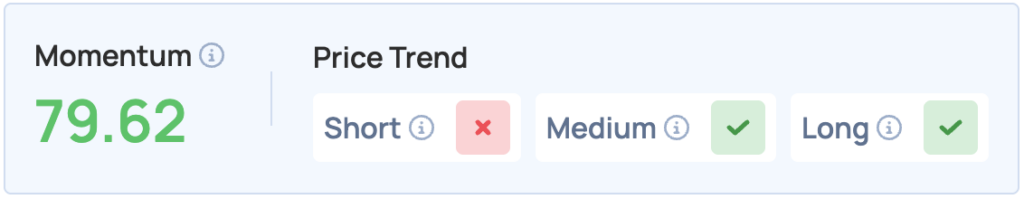

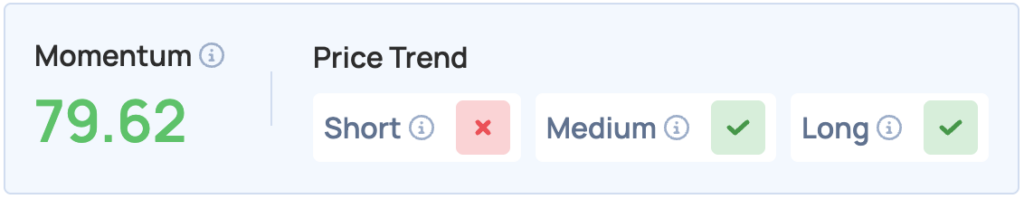

The VanEck Oil Refiners ETF tracks energy stocks with a significant portion of their revenue coming from refining and marketing. The fund scores high on Momentum in Benzinga’s Edge Stock Rankings, with a favorable price trend in the Medium and Long terms. Click here for deeper insights into the fund, its constituents, and more.

Image via Shutterstock

Recent Comments