General Motors Co. (NYSE:GM) has announced it took a $7.1 billion charge related to EVs amid a pivot away from EV efforts. GM had earlier announced a $1.6 billion EV charge.

Capacity Changes, Contract Cancellations

The automaker announced it took a $6 billion charge related to EVs, comprising capacity changes and more, an SEC filing showed on Thursday. Of the $6 billion, over $4.2 billion is related to supplier commercial settlements, as well as contract cancellation fees, the automaker said. The other $1.8 billion comes from “non-cash impairments,” GM said in the filing.

“We expect to recognize additional material cash and non-cash charges in 2026 related to continued commercial negotiations with our supply base,” the company said, adding that it expects these charges to be “significantly less” than 2025’s EV-related charges.

GM also shared that it expects impairments in its Emissions Credits amid recent regulatory changes, but reaffirmed that the charges and the policy changes would not affect the automaker’s model lineup.

“We also expect to record additional non-EV related charges of approximately $1.1 billion for the three months ended December 31, 2025,” GM said, adding that the charges would have an “approximately $0.5 billion cash impact when paid.” The charges stem from its venture with China’s state-owned automaker SAIC Motor Corp. Ltd.

GM’s Scaled-Back EV Efforts

The news comes as GM has been scaling back on EVs, with the company announcing an end to the BrightDrop commercial van’s production, as well as laying off over 3,400 workers from its EV-related production facilities in Ohio and Michigan.

However, CEO Mary Barra has reiterated the company’s commitment to all-electric mobility, sharing that EVs remain the automaker’s “north star.” GM also recently unveiled its most affordable EV, the Chevrolet Bolt EV, priced at $29,000.

Ford’s $19 Billion Charge

GM’s fellow Michigander automaker, Ford Motor Co. (NYSE:F), announced last month that it recorded a $19.5 billion charge related to the company’s EV business changes.

Investor Gene Munster of Deepwater Asset Management shared that the charge could be beneficial to the likes of Tesla Inc. (NASDAQ:TSLA) as it would signify a scaling back of efforts in the EV sector from legacy automakers. Munster also shared that Ford could risk being left behind in the autonomous vehicle sector.

It’s worth noting that Ford recently announced its plans to introduce “eyes-off” driving technology at the Consumer Electronics Show (CES) 2026. The company said that it is targeting a 2028 rollout for the technology with its $30,000 EV based on the Universal EV Platform.

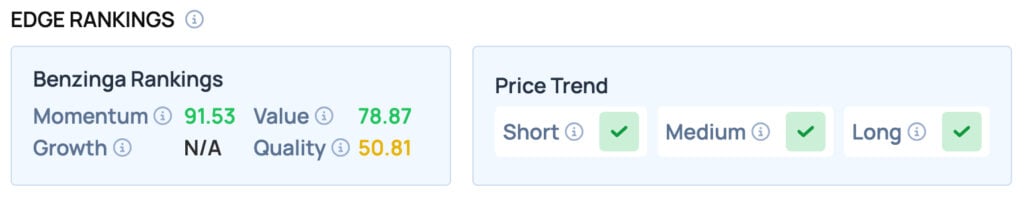

GM offers good Momentum and Value and scores satisfactorily on the Quality metric. GM also offers a favorable price trend in the Medium and Long term. For more such insights, sign up for Benzinga Edge Stock Rankings today!

Price Action: GM declined 1.46% to $83.89 during the after-hours trading session, according to Benzinga Pro data.

Photo courtesy: Jonathan Weiss / Shutterstock.com

Check out more of Benzinga’s Future Of Mobility coverage by following this link.

Recent Comments