Mass media conglomerate Warner Bros Discovery Inc.’s (NASDAQ:WBD) Chairman Samuel DiPiazza reaffirmed the company’s commitment to its merger agreement with Netflix Inc. (NASDAQ:NFLX), brushing aside recent efforts by Paramount Skydance Corp. (NASDAQ:PSKY), despite Larry Ellison’s personal guarantee backing the rival bid.

Netflix Offers ‘Compelling Value,’ Shareholder Protections

DiPiazza said that the Warner Bros management was sticking with Netflix because they have a “signed merger agreement” with the streaming giant, while appearing on CNBC’s “Squawk Box” on Wednesday.

Besides this, he said that the deal offers “compelling value,” a clear path to closing, and significant protections for shareholders “if something stops the close, whatever that might be.”

While acknowledging Ellison’s increased involvement in the deal, he said, “Yes, Larry Ellison stepped up to the table and the board recognizes what he did,” but DiPiazza maintained that the Paramount offer lacked key elements, including a higher price.

“Ultimately, he didn’t raise the price,” he said, adding that from the management’s perspective, “Netflix continues to be the superior offer.”

Critics of the Netflix deal have argued that regulatory headwinds, particularly in Europe, could stall or sink the merger, to which DiPiazza responded, saying, “We continue to believe that both of these deals have a path to be approved.”

He also emphasized the longer-term financial risks associated with a leveraged buyout structure like Skydance’s. “The entire sector is under stress,” he said, highlighting potential difficulties in debt refinancing and future market conditions 15 to 18 months down the line.

“We’ve got a signed deal with an investment-grade $400 billion company,” he said, along with a “$5.8 billion break fee that, frankly, has no challenge against it,” which refers to the amount that Netflix has to pay Warner if the deal fails to go through for any reason.

Deal Faces Significant Antitrust Roadblocks

The deal with Netflix is set to face significant regulatory hurdles, with antimonopolists such as Matt Stoller of the American Economic Liberties Project pushing back, while calling it a “disaster for America,” and one that would effectively “hold a noose around the theatrical marketplace” if approved.

U.S. lawmakers, as well as Hollywood unions, have raised concerns, with the multi-billion-dollar proposed transaction facing bipartisan pushback.

Even President Donald Trump has said that he will be playing a more direct role in reviewing the deal, saying, “I’ll be involved in that decision,” while noting that the combined entities would command a “very big market share,” which he said “could be a problem.”

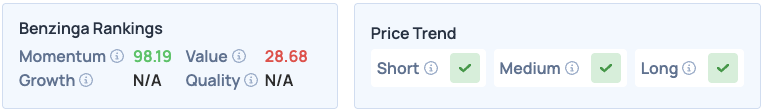

Warner Bros Discovery Shares were up 0.30% on Wednesday, closing at $28.56, but declining 0.73% overnight. The stock does well on Momentum on Benzinga’s Edge Stock Rankings and has a favorable price trend in the short, medium and long terms. Click here to see how the stock compares with Netflix and Paramount Skydance.

Photo courtesy: Shutterstock

Recent Comments