The U.S. economy may be on track to post an exceptionally strong expansion in the fourth quarter of 2025, helped in large part by a sharp narrowing in the trade deficit following tariffs implemented under President Donald Trump.

The Atlanta Fed’s GDPNow model lifted its estimate of fourth-quarter real GDP growth to a blockbuster 5.4% annualized, on Jan. 8, up from a prior estimate of 2.7% earlier in the week. Outside the post-pandemic rebound, it would mark the strongest quarterly growth rate since 1984.

The upward growth revision was triggered by better-than-expected October trade figures, with net exports now adding nearly 2.0 percentage points to GDP growth after previously subtracting from the forecast, according to Atlanta Fed calculations.

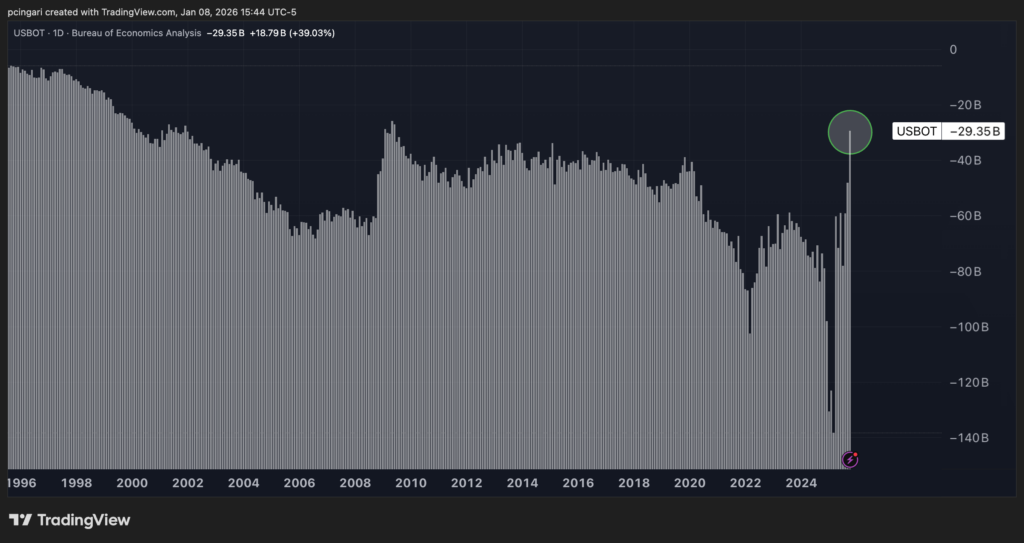

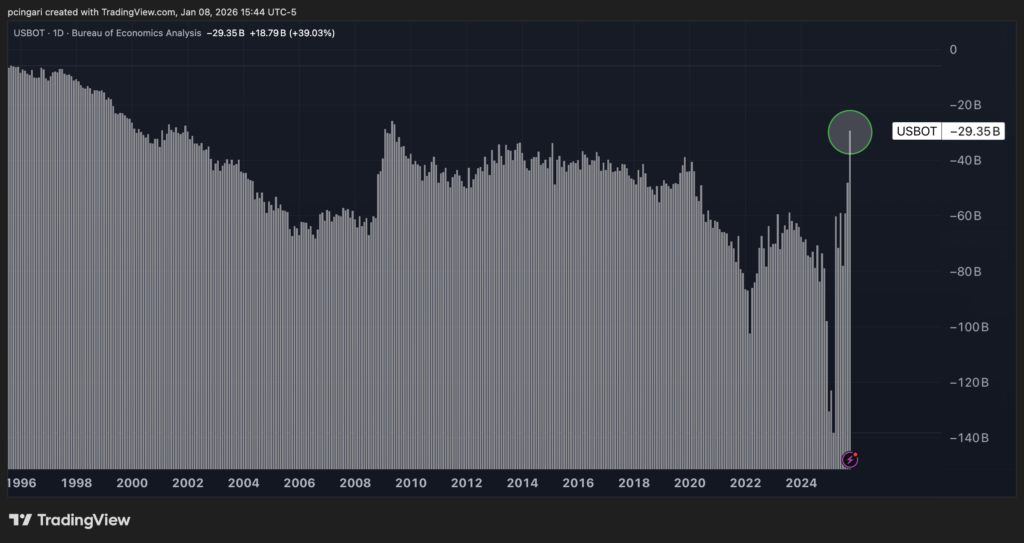

Trade data released Thursday by the U.S. Census Bureau and Bureau of Economic Analysis showed the goods and services trade deficit shrank to $29.35 billion in October 2025, a roughly 39% monthly drop and the lowest since mid-2009.

The outcome was well below the $58.1 billion consensus forecast. Exports rose by 2.6% to $302.0 billion, while imports fell 3.2% to $331.4 billion.

Almost all of the improvement came from goods trade. The goods deficit shrank by $19.2 billion to $59.1 billion, while the traditionally resilient services surplus edged slightly lower to $29.8 billion, reflecting softer government services exports.

Chart: US Trade Deficit Shrinks To June 2009 Levels

Why The US Trade Deficit Collapsed In October

The composition of exports reveals why economists are cautious about extrapolating October’s strength. Goods exports climbed $7.1 billion to $195.9 billion, led overwhelmingly by industrial supplies and materials, which surged $10.2 billion, and non-monetary gold, which jumped $6.8 billion.

By contrast, consumer goods and pharmaceutical exports declined.

On the import side, the contraction was both large and concentrated. Goods imports fell by $12.1 billion to $255.0 billion, with particularly sharp declines in pharmaceutical preparations ($14.3 billion) and consumer goods ($14.0 billion).

These declines more than offset the rise in capital goods inflows, including computers and telecommunications equipment.

In inflation-adjusted terms, the move was even more striking. The real goods deficit shrank nearly 20% in October, as real imports fell faster than real exports.

The U.S. posted sharply larger surpluses with the United Kingdom and Switzerland, while deficits widened with Taiwan and Vietnam, reflecting shifts in supply chains and technology imports.

Notably, the deficit with Ireland fell by $15.1 billion in a single month due to a plunge in pharmaceutical imports.

Despite October’s dramatic improvement, year-to-date figures paint a more restrained picture. The overall goods and services deficit remains 7.7% higher than in 2024, as imports have risen faster than exports over the course of the year.

All eyes on Friday’s Supreme Court decision

The U.S. Supreme Court is scheduled to issue a decision Friday on the legality of tariffs imposed under emergency executive authority.

The ruling will determine whether the administration exceeded its statutory powers in levying broad import duties.

According to Polymarket, there is only a 23% chance the Court rules in favor of Trump’s tariffs.

Photo: Shutterstock

Recent Comments