Rocket Companies Inc (NYSE:RKT) traded sharply higher in Thursday’s after-hours session after President Donald Trump posted on Truth Social to outline a sweeping plan aimed at lowering U.S. mortgage rates.

Here’s what investors need to know.

- Rocket Companies shares are climbing with conviction. Why is RKT stock up today?

Trump Floats $200 Billion Mortgage-Bond Purchase

In his message, Trump said that because his administration did not sell Fannie Mae and Freddie Mac, the government-sponsored enterprises now hold about $200 billion in cash.

He said he is instructing his representatives to buy $200 billion of mortgage bonds, asserting the move would drive mortgage rates lower, cut monthly payments and “make the cost of owning a home more affordable,” as part of what he called a broader push to restore housing affordability.

Why Rocket Shares Reacted

Rocket’s business is heavily tied to mortgage volumes. When rates fall, more homeowners refinance and more buyers qualify for loans, sending application and origination activity higher across Rocket’s largely fixed-cost, technology-driven platform.

A large new buyer of agency mortgage bonds would likely push mortgage-bond yields and, in turn, mortgage rates lower. Even the prospect of such a program suggests a potential rebound in loan demand and fee income for Rocket after a period of rate-driven weakness, prompting traders to bid the stock up in anticipation of improved earnings power.

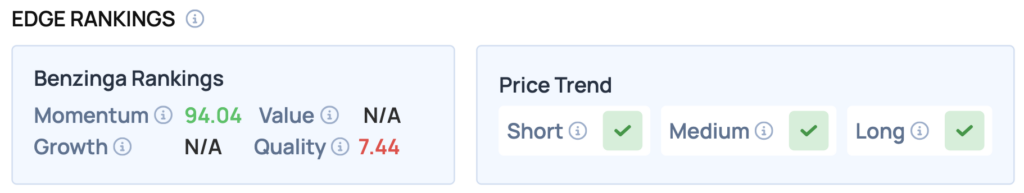

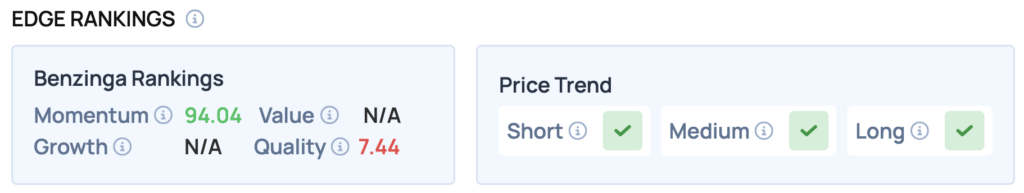

Benzinga Edge Rankings: Rocket currently carries a Momentum score of 94.04 in Benzinga Edge rankings, reflecting strong price performance.

Image: Shutterstock

Recent Comments