Tyler Winklevoss, co-founder of Gemini Space Station, Inc. (NASDAQ:GEMI), slammed the state of California and Governor Gavin Newsom on Wednesday for approving a bill that lets authorities take control of unclaimed cryptocurrency.

Winklevoss Targets Newsom

In an X post, Winklevoss alleged that the “failed state” of California wants to “steal” the Bitcoin (CRYPTO: BTC) that people had held for long periods.

The cryptocurrency mogul said that the state administration is trying to feed its “money pit grift machine” with the move.

Notably, Tyler and his twin brother Cameron are primarily based in New York City, where Gemini and their venture capital firm, Winklevoss Capital Management, are also headquartered.

Newsom’s office didn’t immediately return Benzinga’s request for a statement.

Do the Allegations Have Merit?

The bill, which was signed into law last year, states that “intangible property” held in a cryptocurrency account will become state property if the holder fails to complete an “act of ownership interest” within three years.

These acts include making a transaction, i.e, buying, selling, depositing or withdrawing, and accessing the account electronically, among others.

Maaria Bajwa, an angel investor from Los Angeles, argued that the move is akin to custodial escheat rather than forfeiture, as many alleged.

She highlighted how the bill requires custodians to notify owners of such assets 6-12 months before they are transferred to the state. This bill also allows the state to liquidate the assets into fiat after 18-20 months if they aren’t claimed.

Furthermore, anyone who makes a “valid claim” for assets taken by the state is entitled to receive them back or receive the proceeds if they have already been sold.

Notably, Dennis Porter, co-founder of Bitcoin advocacy group Satoshi Action Fund, also dismissed the “forfeiture” interpretations as inaccurate earlier.

Price Action: Gemini shares rose 0.91% in after-hours trading after closing 6.62% lower at $11.00 during Wednesday’s regular trading session. Over the last year, the stock has plummeted over 65%.

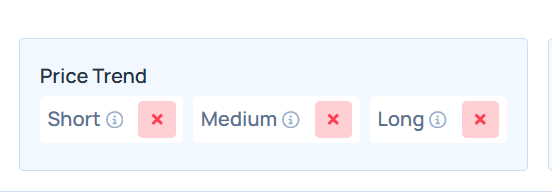

Benzinga’s Edge Stock Rankings indicate that GEMI maintains a weaker price trend over the short, medium and long terms. How does it compare with Coinbase Global Inc. (NASDAQ:COIN) and other cryptocurrency-linked stocks? Find out everything here.

Photo Courtesy: Sheila Fitzgerald on Shutterstock.com

Recent Comments