Chevron Corporation (NYSE:CVX) shares are up on Thursday as the company navigates complex geopolitical landscapes, particularly regarding potential investments in Venezuela. This movement comes as U.S. oil companies, including Chevron, are seeking serious guarantees from the administration before committing to significant investments in the region.

- Chevron stock is showing upward movement. Why are CVX shares climbing?

Why Chevron’s Caution Signals Deeper Risks

Chevron executives are reportedly cautious about investing in Venezuela due to the country’s unpredictable policymaking and infrastructure challenges.

The U.S. government has indicated it may ease sanctions, allowing American oilfield services firms to operate there, but companies like Chevron are demanding strong legal and financial protections before proceeding.

In related discussions, Energy Secretary Chris Wright has summoned top energy executives to the White House, where they are expected to outline their requirements for investment. Lawmakers are also questioning the administration’s plans, with concerns raised about transparency and the implications of U.S. involvement in Venezuela’s oil industry.

The broader market is experiencing mixed movements, with the S&P 500 slightly down by 0.06% while the State Street Energy Select Sector SPDR ETF (NASDAQ:XLE) is gaining 1.22%.

Are Sanctions About To Shift Investment Dynamics?

Chevron is currently trading 3.8% above its 20-day simple moving average and 2% above its 100-day SMA, indicating a bullish short-term trend. Over the past 12 months, shares have increased by 4.60% and are positioned closer to their 52-week highs than lows, reflecting a strong longer-term performance.

The RSI stands at 54.65, which is considered neutral territory, suggesting that the stock is neither overbought nor oversold. Meanwhile, the MACD is above its signal line, indicating bullish momentum.

The combination of neutral RSI and bullish MACD suggests mixed momentum, which could provide traders with opportunities for both short-term and long-term strategies.

- Key Resistance: $158.50

- Key Support: $147.50

Are Analysts Underestimating Chevron’s Potential?

Investors are looking ahead to the next earnings report on January 30.

- EPS Estimate: $1.53 (Down from $2.06 YoY)

- Revenue Estimate: $50.65 billion (Down from $52.23 billion YoY)

- Valuation: P/E of 21.8x (Indicates fair valuation)

Analyst Consensus & Recent Actions: The stock carries a Buy Rating with an average price target of $172.26. Recent analyst moves include:

- Piper Sandler: Overweight (Lowered Target to $174.00)

- Freedom Capital Markets: Upgraded to Sell (Target $165.00)

- Citigroup: Buy (Lowered Target to $179.00)

Valuation Insight: While the stock trades at a fair P/E multiple, the strong consensus and 26% expected earnings decline suggest analysts view this growth as justification for the 9% upside to analyst targets.

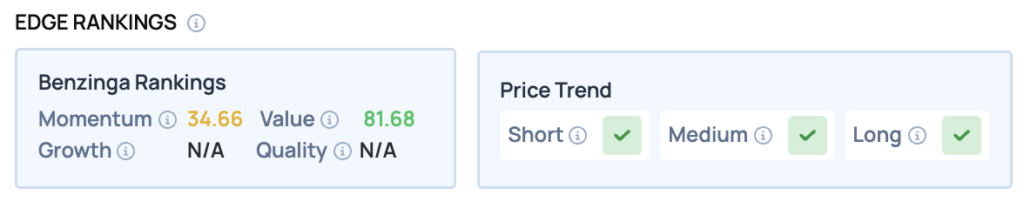

Benzinga Edge Rankings

Below is the Benzinga Edge scorecard for Chevron, highlighting its strengths and weaknesses compared to the broader market:

- Momentum: Bullish (Score: 34.66/100) — Stock is underperforming the broader market.

- Value: Strong (Score: 81.68/100) — Trading at a fair valuation relative to peers.

The Verdict: Chevron Corporation’s Benzinga Edge signal reveals a classic ‘Value’ setup. While the Value score indicates fair pricing, the low Momentum score suggests that the stock may be struggling to gain traction in the current market environment.

Top ETF Exposure

- iShares Core High Dividend ETF (NYSE:HDV): 6.22% Weight

- First Trust Morningstar Dividend Leaders Index Fund (NYSE:FDL): 8.12% Weight

- Invesco BuyBack Achievers ETF (NASDAQ:PKW): 4.87% Weight

Significance: Because CVX carries such a heavy weight in these funds, any significant inflows or outflows for these ETFs will likely force automatic buying or selling of the stock.

Price Action

CVX Price Action: Chevron shares were up 2.32% at $158.76 at the time of publication on Thursday, according to Benzinga Pro data.

Read Next: Why Venezuela’s Vast Oil Reserves Could Reshape US Energy Winners And Losers — Three Stocks To Watch

Image: Shutterstock

Recent Comments