Despite confirmation from Nvidia Corp. (NASDAQ:NVDA) CFO Colette Kress that the company’s market opportunity has expanded beyond previous estimates of $500 billion, the stock’s muted reaction on Tuesday signals a lingering “reluctance” among investors to commit to the next phase of the AI trade, according to Deepwater Asset Management’s Managing Partner, Gene Munster.

Check out NVDA’s stock price here.

The Market Disconnect

Munster highlighted a stark disconnect between Nvidia’s fundamentals and its recent price action.

Following Kress’s appearance at the JPMorgan Fireside Chat—where she delivered highly bullish updates on the company’s product roadmap—Nvidia shares remained flat. According to Munster, the fact that the stock failed to rally on such positive news is “the latest evidence” that investors remain hesitant to buy into the 2026 AI hardware cycle.

He suggests the market is skeptical that the explosive growth seen in recent years can be sustained through the launches of the upcoming Blackwell and Vera Rubin platforms.

Forecasting 65% Growth

Contrary to the market’s caution, Munster reiterated his aggressive bullish stance on the chipmaker.

He added that while the Wall Street consensus currently models Nvidia’s revenue growth at 50% for the coming year, Munster expects the company to significantly outperform, projecting revenue growth of “65%+” for 2026.

Munster noted that Kress’s comments provided the specific upside confirmation he had initially expected from CEO Jensen Huang‘s keynote speech earlier, reinforcing his view that the fundamental demand story remains misunderstood by the broader market.

The Expanding $500 Billion Opportunity

The catalyst for Munster’s commentary was Kress’s update regarding the combined market opportunity for Nvidia’s Blackwell and Vera Rubin architectures.

Kress revisited the company’s previous estimate of a $500 billion opportunity through 2026, explicitly stating that demand has continued to surge and that the figure “has definitely gotten larger.”

The Nvidia CFO further outlined that the Vera Rubin platform has “taped out” and is scheduled to hit the market in the second half of the year, with a full volume ramp expected in the following calendar year. She described the platform not merely as a chip, but as a “co-designed data center infrastructure” capable of delivering 10x higher throughput than its predecessor.

NVDA Stock Gains Over 18% In 6 Months

Shares of NVDA have risen 18.33% over the last six months and 33.61% over the last year. On Tuesday, the shares fell 0.47% to $187.24 apiece and rose by 0.49% in after-hours.

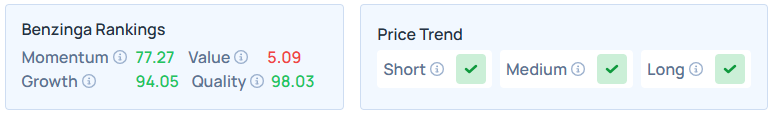

Benzinga’s Edge Stock Rankings indicate that NVDA maintains a stronger price trend over the short, medium, and long terms, with a poor value ranking. Additional performance details are available here.

Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors.

Photo courtesy: Shutterstock

Recent Comments